The Last Time This Happened Was The Day The Dot-Com Bubble Burst

The last few weeks have seen something 'odd' happening.

VIX has been 'rising' as stocks soared to record highs.

(Click on image to enlarge)

Source: Bloomberg

Normally, this is a warning sign since it typically suggests that professionals are buying macro overlays (protection) to lock-in gains or protect against downside for an over-valued stock market.

However, in this case, there's another reason for the surge (which might be even more concerning) - call-buyers have gone crazy. Not satisfied with simply buying stocks, retail traders are now getting levered long in a hurry and that demand for calls has bid up volatility and lifted VIX...

(Click on image to enlarge)

Source: Bloomberg

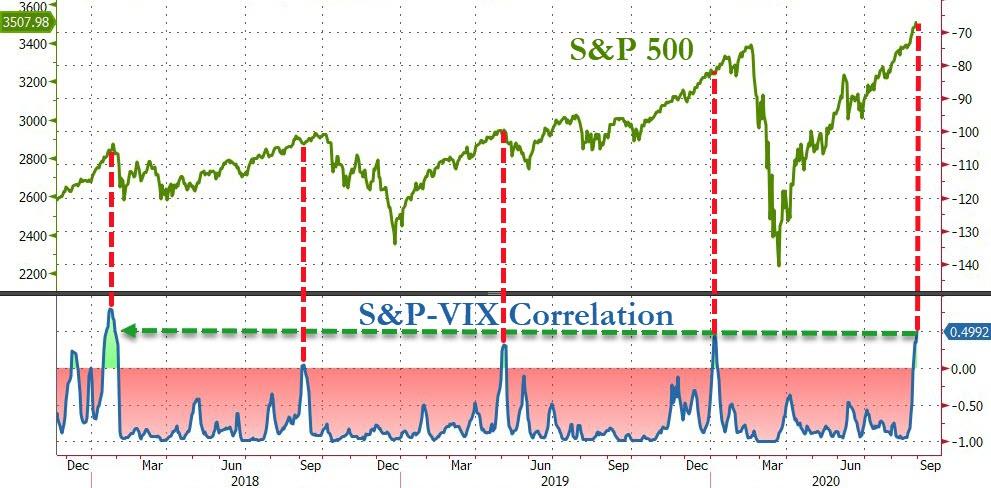

Breaking with its typical trading pattern, the last two weeks have seen stocks and VIX rising almost in lockstep as retail specs move the risk dial to '11'...

(Click on image to enlarge)

Source: Bloomberg

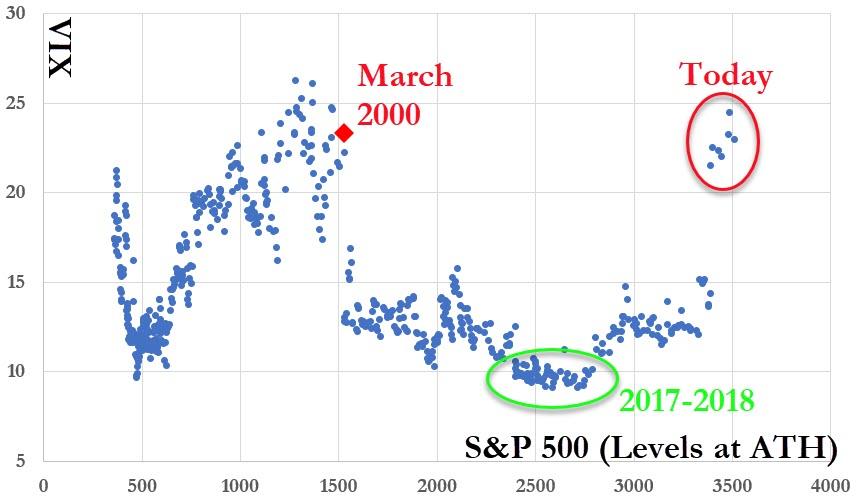

We have seen this pattern before... in March of 2000...

(Click on image to enlarge)

Source: Bloomberg

In fact, as the S&P hits an all-time-highs, this is a level of VIX that has not been seen since those heady days of extreme speculation and retail day-trading muppetry. This is a very different regime of 'walls of worry' that we saw during the 2017/2018 all-time-highs...

(Click on image to enlarge)

Source: Bloomberg

This level of co-movement between VIX and stocks is highly unusual - and has typically not ended well for stocks. Except this time is even more extreme, as the correlation between stocks and vol is at its highest since the collapse of XIV and Volmageddon 2018...

(Click on image to enlarge)

Source: Bloomberg

Oh, and one more thing, valuations - no matter how you desperately adjust for hockey-sticks in the future - have never been so high...

(Click on image to enlarge)

Source: Bloomberg

Or against the country's earnings...

(Click on image to enlarge)

Source: Bloomberg

So, to sum up:

1) Valuations have never been this extreme... ever,

2) VIX Correlation to stocks is at its highest since Volmageddon 2018, and

3) VIX and Stocks are showing similar patterns of extreme speculation as occurred right at the peak of the dotcom bubble.

Trade accordingly.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more