The Implications Of The Reaction To NVDA Earnings

(Click on image to enlarge)

Nvidia (NVDA) reported a terrific quarter after the close Wednesday – but its stock is currently -7% in the after hours. What does it mean?

Let’s start with the numbers. Revenue of $30 billion beat guidance and estimates as did 3Q guidance of $32.5 billion. In fact it’s hard to quibble with anything in what was an outstanding quarter. Then why is the stock down?

When a stock sells off on good news it frequently means that everybody who wants to be in at current prices is already in. At the end of the day the market is supply and demand so even though NVDA reported a terrific quarter the stock doesn’t necessarily have to go up. At 50x current year earnings – which may even be peak earnings – there simply may not be sufficient demand for shares at these prices.

(Click on image to enlarge)

(Click on image to enlarge)

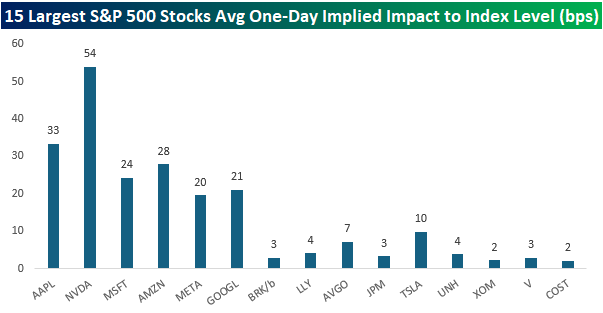

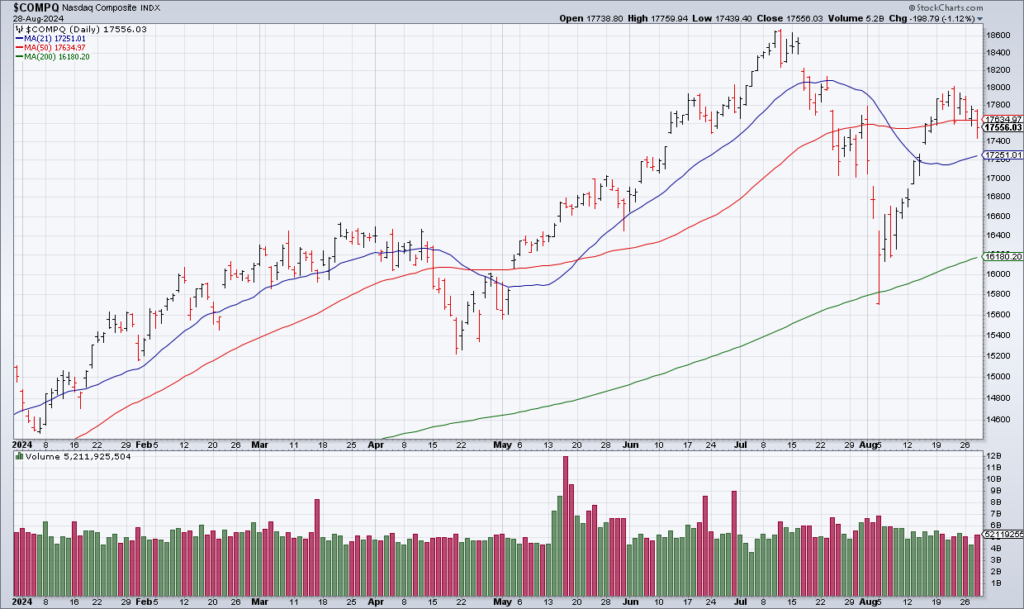

Beyond NVDA itself this reaction bodes poorly for the overall market. That’s because due to its size and volatility, the reaction to NVDA earnings has the most impact on the S&P 500 of any other stock by far. In other words, Thursday is likely to be a bad day for the overall market as well as for NVDA. Indeed, I am convinced that the rally that started on Monday August 5th is now confirmed as a bull trap and a new bear market began at the beginning of July.

(Click on image to enlarge)

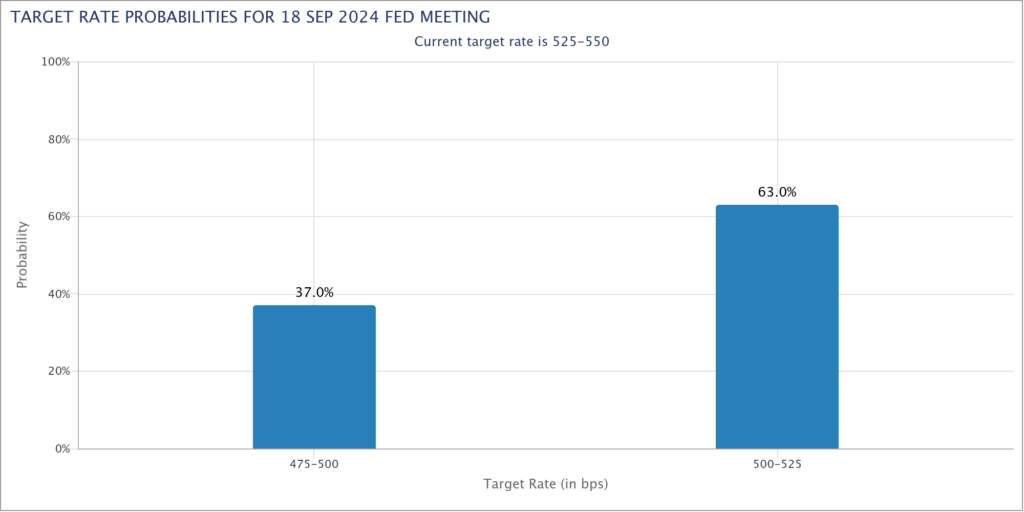

Of course the Fed can always reinflate the market by cutting interest rates and pumping money into it via Quantitative Easing (QE) – though such actions are not without risks and costs. Bulls are holding out hope for a 50 basis point cut in three weeks on September 18. But the Fed tends to move carefully and the Fed Futures are currently pricing in a 63% chance of a 25 basis point cut – though there are the August Jobs and CPI Reports to come before the Fed makes its decision.

More By This Author:

Why I’m Short The One You’re Long And Long The One You Don’t Care AboutThursday’s Big Reversal, A Preview Of Powell’s Jackson Hole Speech

Can ZM Pull A PYPL?