The Home Depot Inc: Is It A Buy?

Image Source: Unsplash

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals.

One of the cheapest stocks in our Stock Screeners is:

The Home Depot Inc (HD)

Home Depot is the world’s largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the US, Canada, and Mexico. Its stores offer numerous building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals. The acquisition of Interline Brands in 2015 allowed Home Depot to enter the MRO business, which has been expanded through the tie-up with HD Supply (2020). The additions of the Company Store brought textiles to the lineup, and Redi Carpet added multifamily flooring, while the recent tie-up with SRS will help grow professional demand.

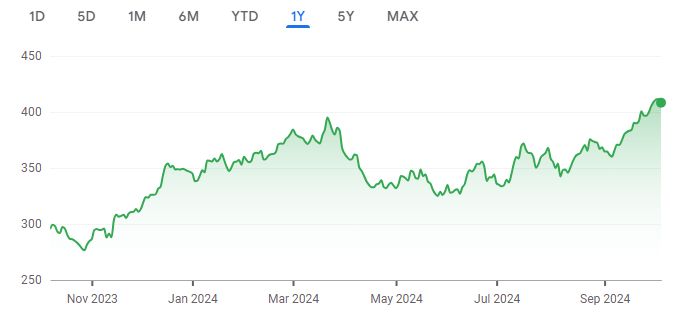

A quick look at the share price history (below) over the past twelve months shows that the price is up 38.26%. Here’s why the company is undervalued.

Source: Google Finance

Key Stats

Market Cap: $405.50 Billion

Enterprise Value: $468.50 Billion

Operating Earnings

Operating Earnings: $21.16 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 22.10

Free Cash Flow (TTM)

Free Cash Flow: $16.78 Billion

FCF/MC Yield %:

FCF/MC Yield: 4.14

Shareholder Yield %:

Shareholder Yield: 2.90

Other Indicators

Piotroski F Score: 5.00

Div Yield %: 2.10

ROA (5 Year Avge%): 22

More By This Author:

Large-Cap Stocks In Trouble - Saturday, Oct. 19

Visa Inc. DCF Valuation: Is The Stock Undervalued?

Large-Cap Stocks In Trouble - Sunday, Oct. 13