The Growth Prospects For Conoco Phillips & Phillips 66 In 2021

The S&P 500 Energy Select SPDR (XLE) holds shares in the leading US energy-related companies. Since crude oil and oil products dominate the energy sector, many of the top holdings are oil companies. The XLE’s top holdings are Chevron Corporation (CVX) and Exxon Mobile Corporation (XOM). Together, the two giants account for over 44% of the XLE ETF product’s net assets.

Energy shares and the XLE hit highs in 2014. Over the past six years, the energy companies have made lower highs and lower lows, even as the stock market moved to record highs.

Conoco Phillips (COP - Get Rating) and Phillips 66 (PSX - Get Rating) are two of the top seven holdings of the XLE. The ETF and all oil-related shares reached lows in March 2020 as NYMEX crude oil was on its way to a negative price on April 20. Since then, crude oil and energy-related shares have made higher lows. As we move into 2021, COP and PSX are trading well above the March lows. However, any continued appreciation could depend on adapting to a new era in energy production and consumption.

The two Phillips are XLE holdings

XLE is a bellwether ETF for US oil-related companies. As of December 24, the ETF had net assets of $12.12 billion at $38.09 per share. The XLE trades an average of almost 34 million shares each day and charges a 0.13% expense ratio. The top holdings include:

Source: Yahoo Finance

While the XLE has over 44% of its net assets invested in oil giants CVX and XOM, the ETF has parked 8.83% in the two Phillips; COP and PSX.

A rebound in COP- Subpar earnings

At $39.49 per share, COP has a $42.176 billion market cap. The company pays shareholders a $1.72 or 4.4% dividend. As with all oil companies, 2020 has been a challenging year.

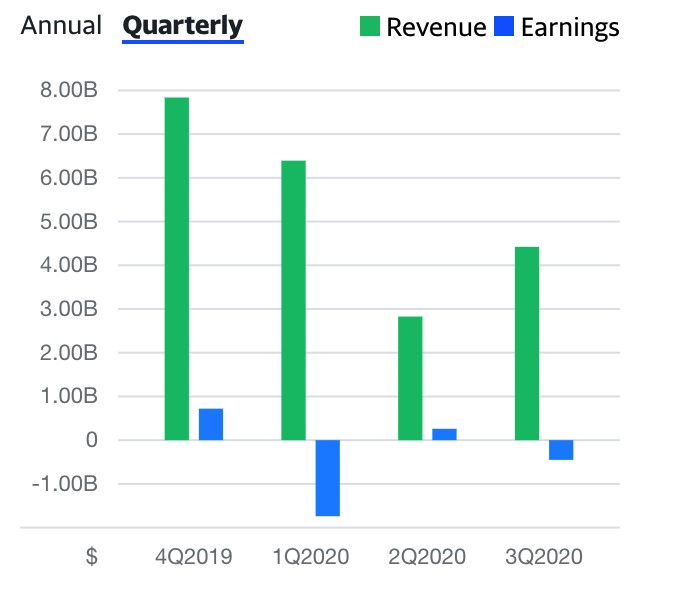

Source: Yahoo Finance

The chart shows the quarterly volatility in revenues and earnings/losses over the past four quarters.

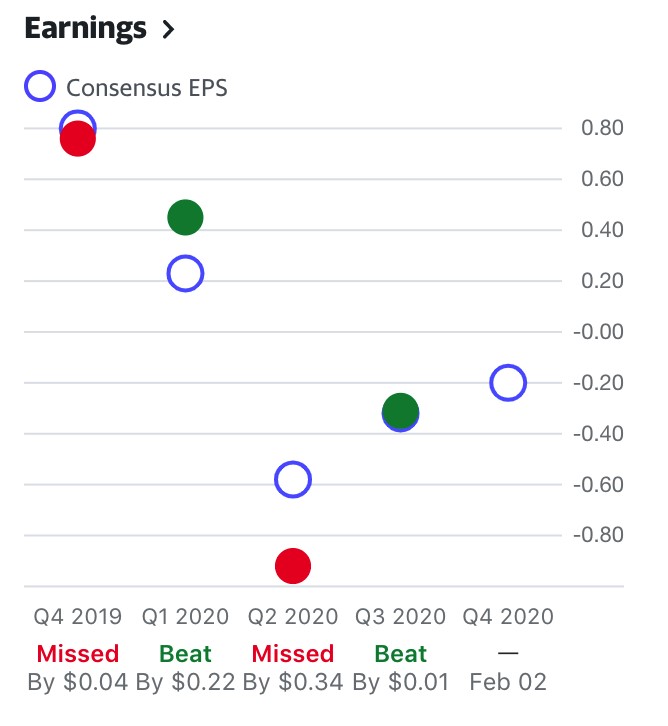

Source: Yahoo Finance

COP turned in earnings in Q4 2019 and Q1 2020, but they turned to losses in Q2 and Q3 this year. The consensus EPS projections are for a loss of 20 cents in Q4. Meanwhile, a survey of twenty-one analysts on Yahoo Finance has a price target of $48.52 for COP shares, with targets ranging from $36 to $58. Many Wall Street companies currently rate COP as a buy or overweight for portfolios.

Source: Barchart

The chart shows COP shares rose from a low of $20.84 in March 2020 to a high of $50.79 in early June but was trading at the $39.49 level at the end of last week. COP recovered, but the trend of lower highs in 2020 remains intact.

PSX looks similar- A better dividend

PSX has a market cap of $30.021 billion at $68.73 per share. PSX pays its shareholders a $3.60 or 5.2% dividend.

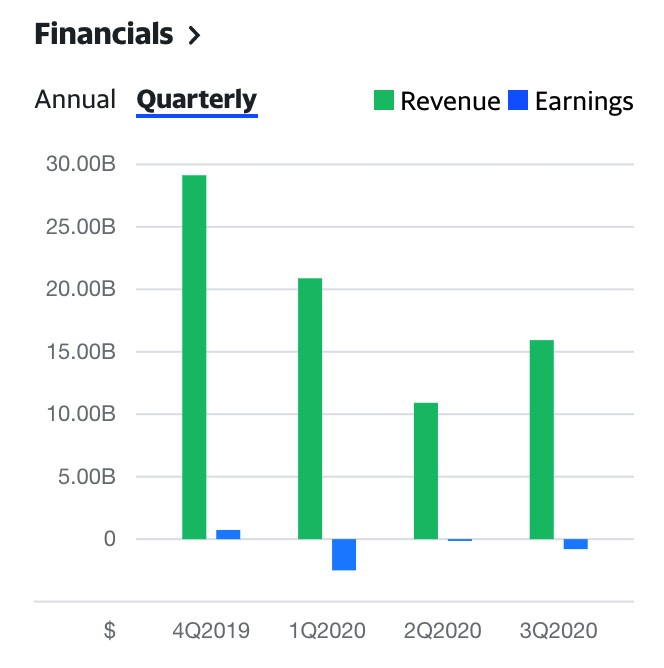

Source: Yahoo Finance

The quarterly revenue and earnings picture for PSX reflects the impact of the global pandemic in 2020.

Source: Yahoo Finance

While PSX recorded profits in Q4 2019 and Q1 2020, the company posted losses in Q2 and Q3 this year. However, PSX has beat consensus EPS projections over the past three quarters. The current average forecast for Q4 is for another loss of 32 cents per share.

Eighteen analysts on Yahoo Finance has an average target of $76.28 for PSX shares, with projections ranging from $63 to $86. Most Wall Street companies rate the company as an outperform or overweight for portfolios.

Source: Barchart

The chart illustrates that PSX fell to a low of $40.04 in March, rallied to a high of $89.79 in early June, and was trading at below $69 per share at the end of last week.

Traditional oil will continue to face headwinds in 2021

PSX has been in business since 1875. The company operates as an energy manufacturing and logistics business. The midstream segment transports crude oil and other feedstocks, delivers refined products, provides terminaling and storage services, and transports, stores, and markets natural gas liquids, among other services. PSX also operates a petrochemical and refining segment. The refineries produce gasoline, distillates, and aviation fuels produced at thirteen refineries in the US and Europe.

COP is a bit younger, as it has only been in business since 1917. The company explores for, produces, transports, and markets crude oil, bitumen, natural gas, and LNG. While most of COP’s business is in conventional and tight oil reservoirs, shale gas, heavy oil, LNG, oil sands, and other production operations, the portfolio includes some unconventional assets worldwide.

The two companies will face a substantial shift in US energy policy when Joe Biden becomes the forty-sixth President on January 20. The change could be even more dramatic if Democrats capture a majority in the Senate on January 5 in the pair of runoff elections in Georgia. The US will rejoin the Paris climate accords abandoned by the Trump administration. The regulatory environment for fossil fuels will tighten over the coming years.

Each of these companies has been in business for over a century. The managements realize they must adapt their business models to fit the future of US policy under the new regime. Conoco Philipps states it is “managing social and environmental concerns, including climate change.” Philipps 66 states, “Operating excellence leads to strong environmental performance.” Putting words into action will determine if the companies can survive and thrive as the US moves to address climate change and environmental concerns over the coming months.

A new energy era on the horizon- Can they adapt?

We are on the cusp of a new era in energy production in the United States. In March 2020, US crude oil production reached a record 13.1 million barrels per day. After decades of dependence on foreign petroleum, the US output moved above the other two leading producing nations, Saudi Arabia, and Russia.

Time will tell if the government adopts a gradual shift, giving companies like COP, PSX, and the other leading energy companies time to remake their business. A sudden slew of new regulations and limits or bans on extracting hydrocarbons from the earth’s crust could have a substantial impact on earnings and sustainability. A sudden pivot could also hand pricing power back to OPEC+ as the world continues to depend on crude oil as a primary energy source.

When it comes to markets, share prices tend to tell us all we need to know about a company’s future. As we move into 2021, COP and PSX shares are off the lows, analysts are mostly bullish, but the trends remain bearish. Adapting to the new environmental environment is critical for success in 2021 and beyond.

Disclaimer: Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ...

more