The G7 “Double Down” Stock Market (And Sentiment Results)

Einstein once said, “The definition of insanity is doing the same thing over and over and expecting different results.” That’s exactly what the G7 decided to do when they published their communique on Tuesday and drove the Dow down ~500 points and energy prices UP.

This G7 has been compared to the meeting in 1979 that took place in Japan – under the Jimmy Carter era – when there was also a global food and energy crisis. While in 1979 the G7 tried to limit imports from the Middle East – which failed immediately – this time, they want to restrict imports from Russia. They intend to do this with a “price cap” (i.e. quota). The proposed alternative solution is to go hat in hand to Saudi Arabia and beg for more production. This is an embarrassment considering – under a different energy policy – The United States became the world’s top crude oil producer in 2018 and maintained the lead position through 2020. Then policy changed…

As Milton Friedman once cleverly said, “If you want to create a shortage of tomatoes, for example, just pass a law that retailers can’t sell tomatoes for more than two cents per pound. Instantly you’ll have a tomato shortage. It’s the same with oil or gas.”

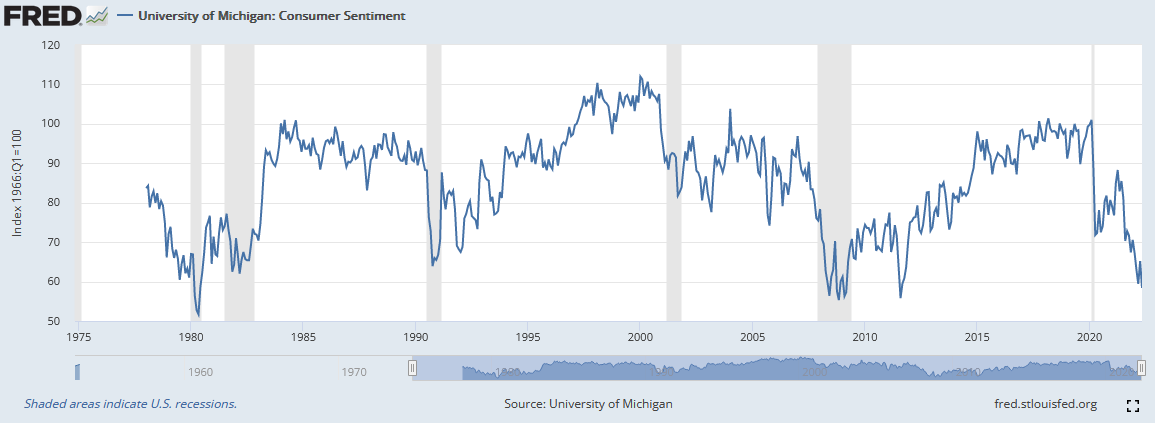

With consumer confidence at all-time lows, the stock market in a bear market, the economy on the verge of recession, tightening financial conditions, layoffs ticking up, and MASS POLITICAL DISAPPROVAL across the developed world, you would think they would tread lightly. Instead, they ignored the acute pain (at the gas pump and supermarket) and dissatisfaction from their constituents and DOUBLED DOWN on the same policies that created it. LET THEM EAT CAKE!!!

(Click on image to enlarge)

Why would oil go up when they “doubled down” on failed energy policies? Because the natural reaction to oppression is hoarding (i.e. why invest to produce more in a hostile political environment when you could simply pay out all of the cash to yourself and the other owners in the form of dividends and buybacks?).

Those who don’t study history are doomed to repeat it. When it’s the seven most important leaders in the developed world – who collectively don’t understand history and basic economics – it’s not only sad, it’s a bit scary.

Some key quotes from the Communique:

“We commit to a highly decarbonised road sector by 2030 including by, in this decade, significantly increasing the sales, share and uptake of zero emission light duty vehicles, including zero emission public transport and public vehicle fleets.”

“We commit to reduce emissions of hydrofluorocarbons (HFC) throughout the life cycle and welcome international efforts and knowledge sharing initiatives in this regard.”

“We stress that fossil fuel subsidies are inconsistent with the goals of the Paris Agreement and reaffirm our commitment to the elimination of inefficient fossil fuel subsidies by 2025.”

“We are concerned about the burden of energy price increases and energy market instability, which aggravate inequalities nationally and internationally and threaten our shared prosperity.In coordination with the IEA, we will explore additional measures to reduce price surges and prevent further impacts on our economies and societies, in the G7 and globally.”

“While taking immediate action to secure energy supply and stop the increases in energy prices driven by extraordinary market conditions, we will not compromise our climate and biodiversity goals including the energy transition nor on our commitments to phase out our dependency on Russian energy, including by phasing out or banning the import of Russian coal and oil.”

The INTENT is lofty. The IMPLEMENTATION is irresponsible. Transition will take time, and there is no proper acknowledgement of this fact (or a sensible timeline) by global leadership.

While the politicians are oblivious to effects of their misinformed policies, the market has a perfect and clear understanding. The #1 proxy for the “green movement” is Tesla (down ~48% off its recent highs) – while the energy sector is still the top performing group (even after the recent June correction).

So rather than complain about it, what is Warren Buffett doing? Doubling down on his Occidental Petroleum position. He is betting that continued restrictive policy will force small players out of production and only a handful of big producers will survive. In essence, a historic “commodity” business (of price takers) will soon become an “Oligopoly” business – with a multi-player moat and pricing power.

This is the unintended consequence of ALL POOR POLICY/REGULATION throughout the ages. If you think Facebook, Google, etc are powerful today, wait until they “regulate tech” and push all of the existing/emerging competitors out of business with an untenable barrage of unnavigable red tape.

China has already done it in the past year with their “regulatory tech crackdown.” We will see the effects in coming years as Alibaba BABA, Tencent TCEHY and JD take more and more market share while small/emerging players fall by the wayside.

We think Buffett is right. We also think there will be better levels from which to reload – as the masses who crowded into energy over the past four months just got a taste of the trap door opening as the Exploration and Production index dropped over 30% in less than 2 weeks.

(Click on image to enlarge)

1966?

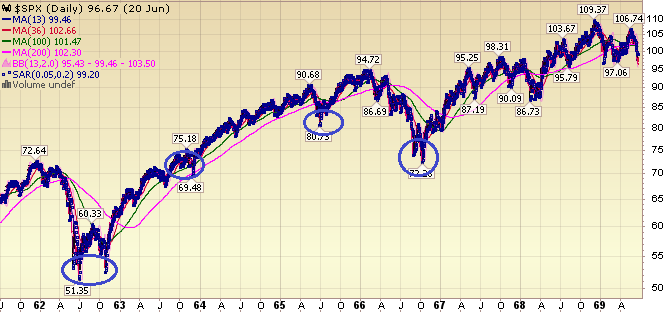

In our June 16th note we covered the market similarities to 1994. Yesterday, an analyst named Jim Bianco was quoted in MarketWatch comparing current conditions to 1966:

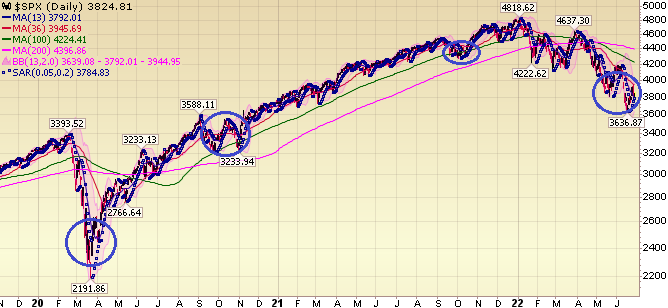

“I think the most comparable bear market we’ve experienced right now is 1966,” Bianco said at a media event Tuesday. While the Fed also was fighting inflation back in the ’60s, the S&P only fell 22% in the 1966 bear market, he said, calling the period “just slightly worse” than the 20.3% drop in the benchmark since its Jan. 3 closing peak at 4,796.56, according to Dow Jones Market Data.”

“Even if a small recession occurs late this year or early next year, which is becoming the consensus view,” according to Bianco, he doesn’t expect “a nasty credit” cycle to unfold. “I don’t think anybody wants to default on their mortgages right now. Their homes are still in-the-money relative to their debt levels, thanks to sensible reforms on lending,” he said. “We see every incentive for them to want to stay good on the loans they’ve taken, and keep the terms in place that they have.”

I looked back to compare the market price action and have posted my own annotated analogues below:

1966:

2022:

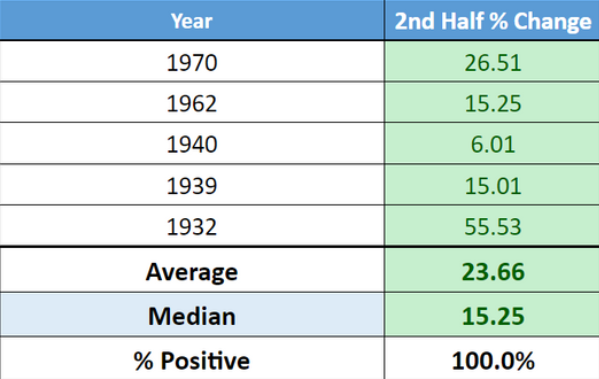

This type of rebound would also be consistent with what happens historically following a terrible first half of the year. The S&P 500 is on track to finish the first half at its worst ytd performance in 50 years.

MarketWatch: Data compiled by Dow Jones Market Data shows that the S&P 500 has bounced back after past first-half falls of 15% or more. The sample size, however, is small, with only five instances going back to 1932 (see table below).

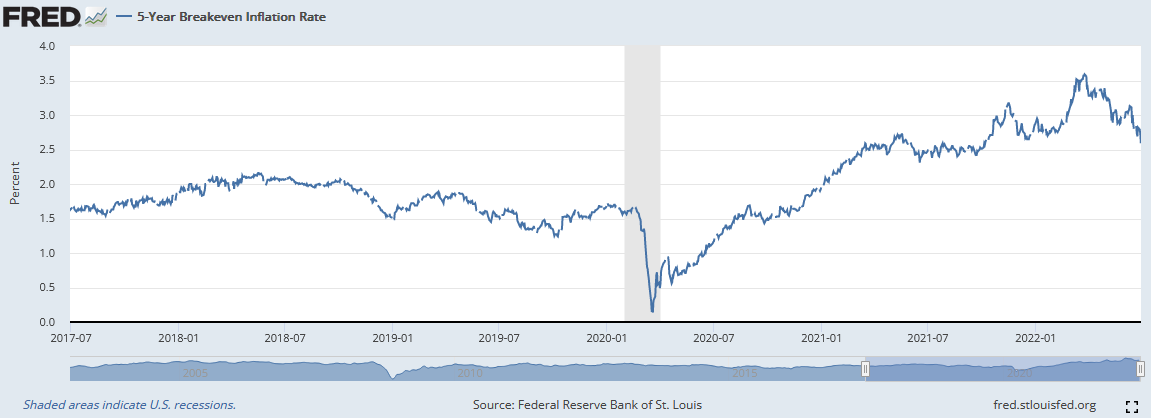

So long as inflation expectations continue to collapse (5yr breakevens have dropped a FULL 1% in the last three months – from 3.59% to 2.59%), the above-mentioned scenario remains within the realm of possibility (despite all of the policy errors). If inflation expectations ramp up again, then all bets are off…

(Click on image to enlarge)

Now onto the shorter term view for the General Market:

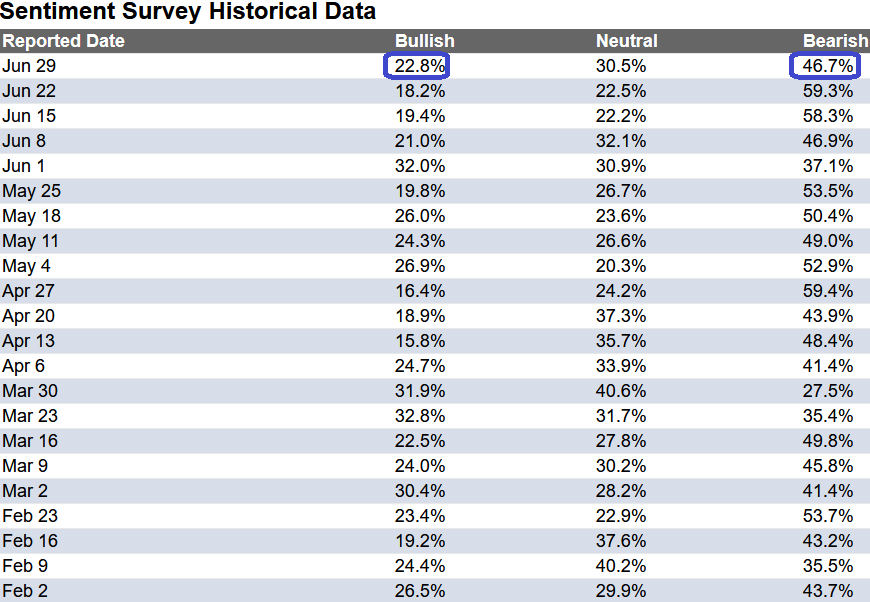

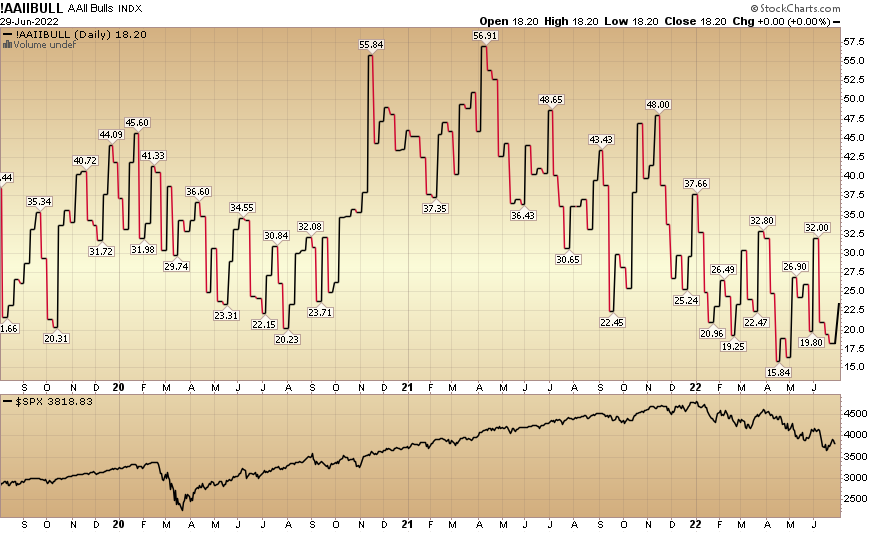

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 22.8% this week from 18.2% last week. Bearish Percent came down to 46.7% from 59.3%. Retail investors are still extremely fearful.

(Click on image to enlarge)

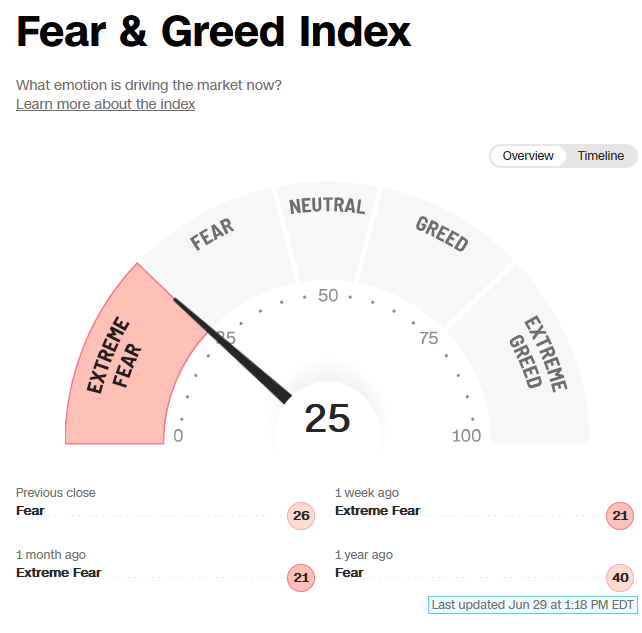

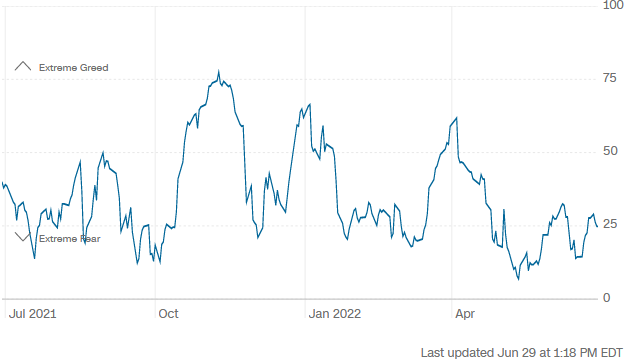

The CNN “Fear and Greed” ticked up from 22 last week to 25 this week. This still shows extreme fear. You can learn how this indicator is calculated and how it works here: (Video Explanation)

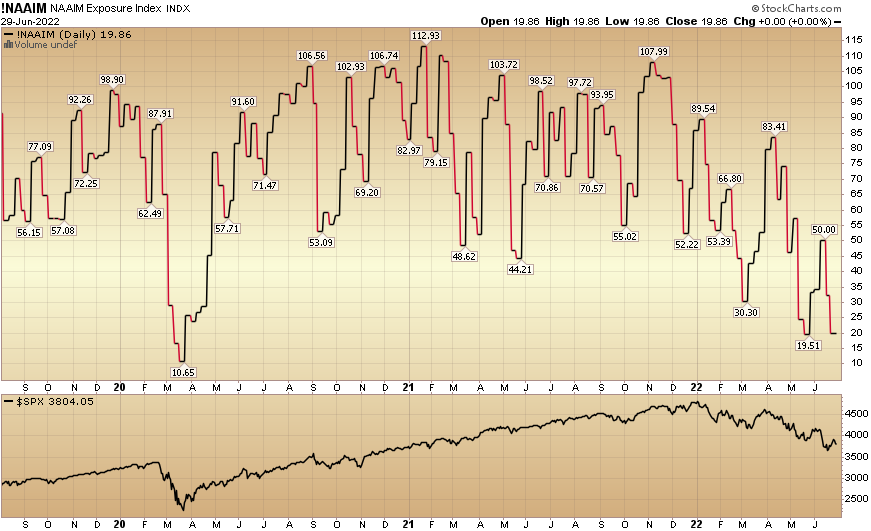

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 19.86% this week from 32.18% equity exposure last week. Based on positioning, we expect to see “panic buying” come in aggressively if Q2 earnings/guidance is not as bad as feared.

(Click on image to enlarge)

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.