The Flaw In The Bull Case

(Click on image to enlarge)

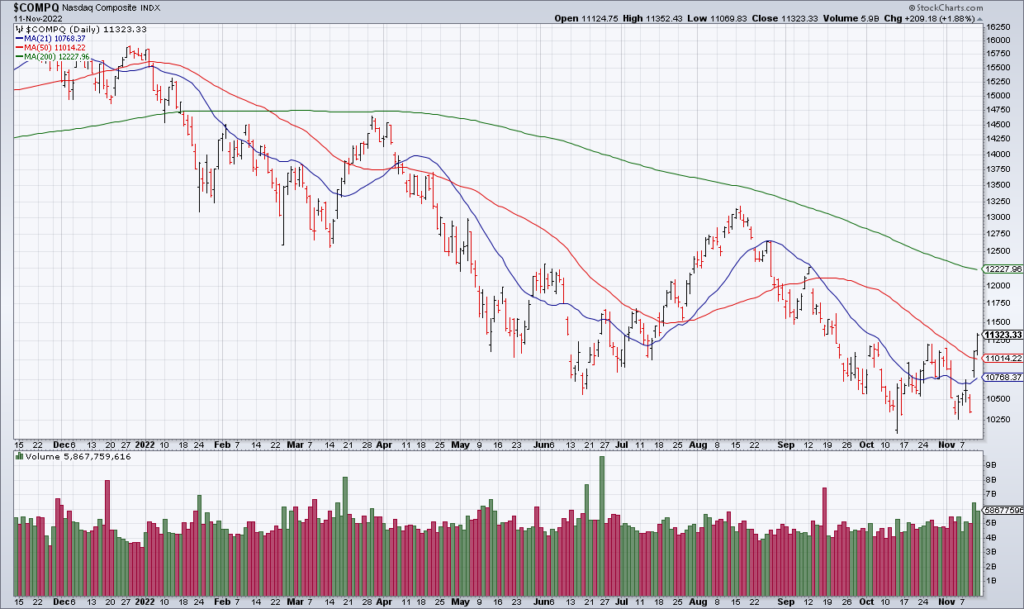

The stock market had a terrific relief rally at the end of last week in the wake of the cooler-than-expected October CPI Report. Since inflation has been the main driver of the bear market some bulls have concluded that cooling inflation means stocks have found a bottom. The argument here is that cooling inflation will allow the Fed to slow its pace of rate hikes and lower its terminal rate. While the argument is sound as far as it goes it ignores something crucial.

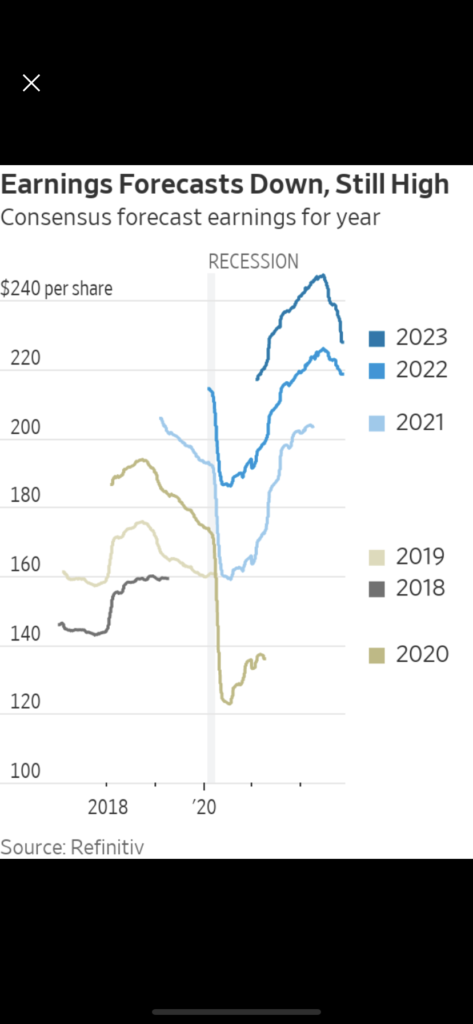

What it ignores is that all the Fed tightening up to this point is still working its way through the system and will show up in corporate earnings in a big way next year. Earnings estimates are still way too high and as earnings disappoint amid a recession stocks will take another leg down.

The October CPI Report has provided a welcome reprieve from the relentless selling but that’s all it is. The bear market is by no means over.

More By This Author:

Things Are Starting To BreakSpeculating On The October CPI

PLTR: From Universally Loved To Universally Hated