The Fed’s Tough Decision, ORCL & KR Earnings Preview

Technicals: The S&P closed last week at 5,408 – just above 5,400 which is an important level because the S&P has spent so little time below it in the last three months. In other words, below that level almost everyone who has bought in the last three months is underwater and may be looking for a spot to get out and limit their losses.

(Click on image to enlarge)

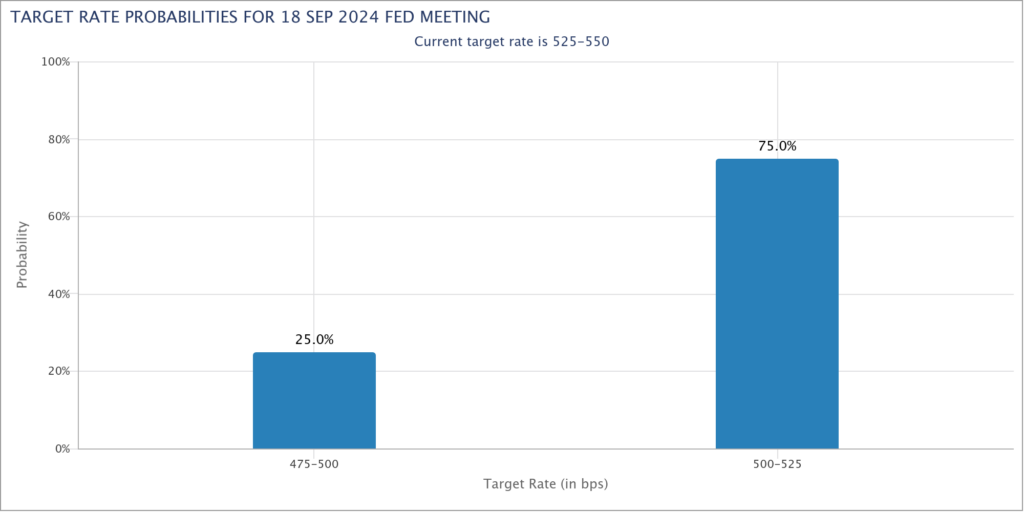

Macro: The big macro event coming up is the Fed Decision next Wednesday (Sept 18). The question is whether they will cut 50 or 25 basis points. Fed Futures are currently pricing in a 75% chance of 25. But it will be a live meeting with both options on the table.

Earnings: Oracle (ORCL) reports earnings after the close Monday. As you can see in the chart above, the stock has been extremely strong over the last year. ORCL continues to be an interesting value play on the cloud but I think the stock is too extended in the short term. While I have no position, I’m leaning slightly bearish heading into this afternoon’s report.

I continue to like the nation’s leading grocer Kroger (KR) heading into earnings Thursday morning. Comps have been lukewarm over the last year but the stock is cheap and obviously groceries are a quintessential defensive play if you are leaning bearish as I am.

Also take note that KR is currently in court versus the DOJ in an antitrust case regarding its proposed merger with Albertson’s (ACI). After college I spent two years working for an Industrial Organization Economics consulting firm in West LA called Economic Analysis LLC (subsequently acquired by LECG). The firm provided expert testimony for industrial organization litigation from some of the leading economists in the field. What I learned is that antitrust cases come down to how the market is defined.

In this case, if the market is traditional grocery stores, then the acquisition of ACI would result in KR having a monopoly like market share. But if the grocery market also includes non-traditional players like Walmart, Costco, Target, etc… then the acquisition would not result in a monopoly like market share. As a KR (and ACI) long I’d like to see the merger go through to help the companies compete with Walmart, Costco and other tough competitors but I have no insight into how the case will be decided.

(Click on image to enlarge)

More By This Author:

Buffett And The Missing Link In Value InvestingThe Implications Of The Reaction To NVDA Earnings

Why I’m Short The One You’re Long And Long The One You Don’t Care About