The Biggest Dividend Hikes In 2021

Dividend growth investors are likely familiar with the Dividend Aristocrats, a group of 65 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases. While the Dividend Aristocrats are a great source of dividend growth stocks, they are not likely to be among the highest dividend growth stocks in any given year.

Dividend Aristocrats typically increase their dividends at a modest rate, usually below 10% each year. But each year, there are several lesser-known stocks that raise their dividends by truly impressive amounts. This article will discuss the stocks with the 5 biggest dividend hikes in 2021.

#1: Cigna Corporation (CI)

- 2021 Dividend Hike: 9,900%.

Cigna is a leading provider of insurance products and services. The company’s products include dental, medical, disability, and life insurance that it provides through employer–sponsored, government–sponsored, and individual coverage plans.

Cigna operates four business segments, including Evernorth, which provides pharmacy services and benefit management, U.S. Medical, which provides commercial and government health insurance, International Markets, and Group Disability. Evernorth contributes 70% of annual revenues while U.S. Medical accounts for 24%. Cigna has annual revenues of $170 billion.

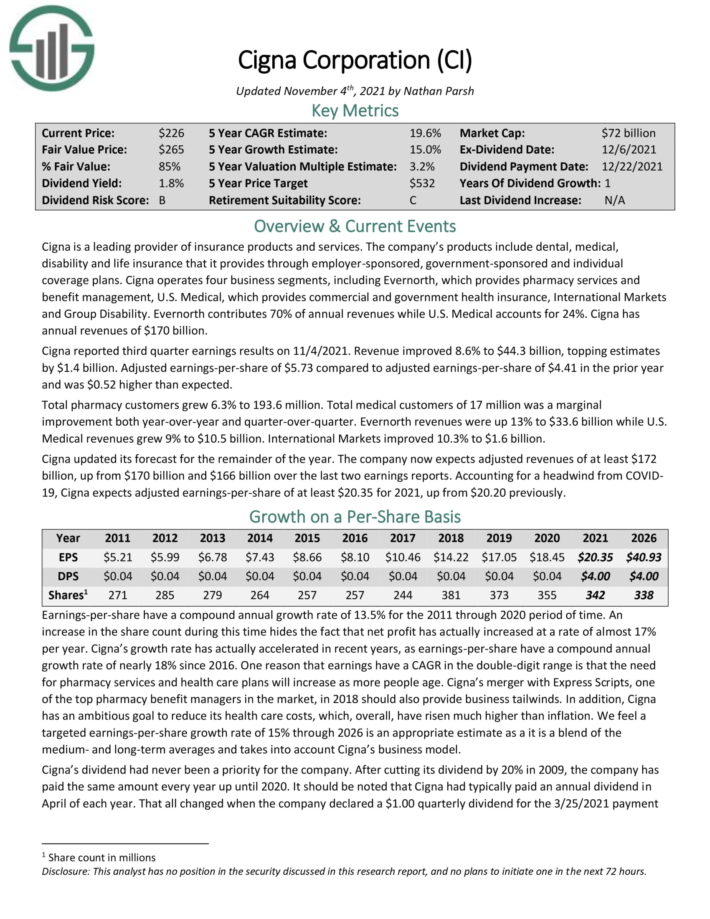

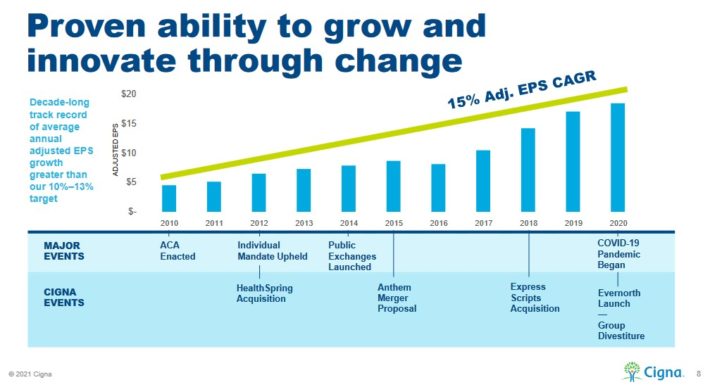

The company has generated strong growth over the past decade.

Source: Investor Presentation

Cigna reported third quarter earnings results on Nov. 4, 2021. Revenue improved 8.6% to $44.3 billion, topping estimates by $1.4 billion. Adjusted earnings–per–share of $5.73 compared to adjusted earnings–per–share of $4.41 in the prior year. The company raised its quarterly dividend 25-fold in 2021, from $0.04 per share to $1.00 per share. Shares currently yield around 1.7%.

#2: Harley-Davidson, Inc. (HOG)

-

2021 Dividend Hike: 650%.

Since 1903, Harley Davidson has been making American–style motorcycles. Harley Davidson also makes and sells parts, accessories, merchandise, and maintenance/repair services.

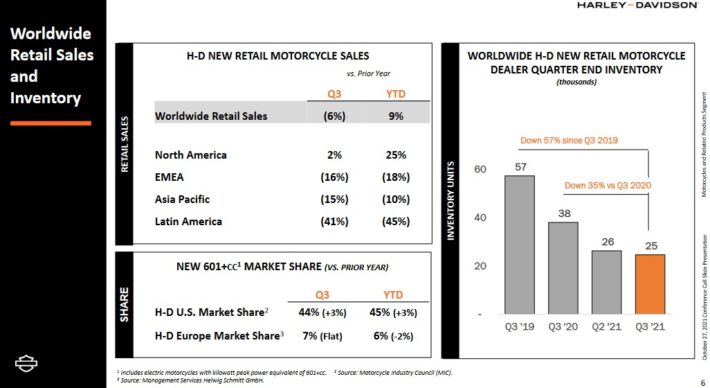

Harley–Davidson reported Q3 results on Oct. 27, 2021. GAAP EPS came in at $1.05. Revenue increased by 20.3% year–over–year to $1.16 billion. The company also reported shipments increased 12% to 47,900 units.

Source: Investor Presentation

For the full–year 2021, management expects financial services segment operating income growth of 95% to 105%, capital expenditures of $135 million to $150 million, and motorcycles segment revenue growth of 30% to 35%.

Like many of the companies on this list, Harley-Davidson’s impressive dividend increase in 2021 came off a low base. The company cut its dividend by 95% in 2020, to $0.02 per share quarterly. In 2021, Harley-Davidson raised its dividend to the current level of $0.15 per share. Shares currently yield around 1.6%.

#3: Capital One Financial (COF)

-

2021 Dividend Hike: 500%.

Capital One is on our financial stocks list. As a major financial institution, the company has a diversified lineup of banking and other financial services. It operates through three segments: Credit Card, Consumer Banking, and Commercial Banking.

The company offers traditional banking services such as checking accounts, money market deposits, savings deposits, and time deposits. It also makes typical loans such as auto and retail banking loans, and commercial and multi-family real estate loans. Capital One also offers credit and debit card products, as well as treasury management and depository services.

In the 2021 third quarter, earnings-per-share rose 34% to $6.78 year-over-year. Total revenue increased 6% to $7.8 billion. In 2020, Capital One cut its quarterly dividend by 75%, to $0.10 per share. The company’s financial recovery in 2021 led the way for multiple dividend hikes, leading to the current quarterly dividend of $0.60 per share.

#4: Camping World Holdings (CWH)

-

2021 Dividend Hike: 455.6%.

Camping World operates as a recreational vehicle and outdoor retailer. It operates through two segments, Good Sam Services and Plans; and RV and Outdoor Retail. It provides a variety of additional services including extended vehicle service contracts, roadside assistance plans, property and casualty insurance, travel protection plans, and more.

Prior to 2021, Camping World paid quarterly special dividends, in addition to a regular quarterly payout. The company’s recent quarterly payments have not included a special dividend. However, this has not been a negative for shareholders.

Quite the contrary, Camping World has simply accelerated growth of its regular quarterly dividend. For example, the regular quarterly dividend was increased from $0.09 per share to $0.50 per share over the course of 2021. With an annualized dividend payout of $2.00 per share, Camping World stock yields over 5%, making it the highest-yielding stock on this list.

#5: APA Corporation (APA)

-

2021 Dividend Hike: 400%.

APA explores and produces crude oil, natural gas, and natural gas liquids (NGLs) in the U.S., Egypt, and the North Sea. The company is extremely sensitive to the prevailing price of oil and natural gas; much more so than the well–known integrated oil majors like Exxon Mobil (XOM) and Chevron (CVX).

In early November, APA reported financial results for the third quarter of fiscal 2021. The company reduced its production –2% sequentially. However, its average realized prices of oil and gas grew 8% and 29%, respectively. As a result, adjusted earnings–per–share grew 40%, from $0.70 to $0.98.

APA cut its quarterly dividend by 90% in 2020 amid the pandemic. 2021 was a year of strong recovery, for the company’s financial results as well as its dividend payout. After cutting its quarterly dividend to $0.025 per share, APA raised its dividend in 2021 to its current level of $0.125 per share. The stock currently yields about 1.7%.

Final Thoughts

2021 was a record year for many dividend growth stocks. As the global economy recovered from the coronavirus pandemic, many stocks that had slashed their dividends in 2020 returned to growing their dividends.

To be sure, these 5 dividend stocks had low yields before their 2021 dividend hikes. With the exception of Camping World, the other stocks on this list yield less than 2%. Even after their aggressive hikes, four of the five top dividend growers from last year are still not appealing to income investors looking for high dividend stocks.

That said, many of the stocks on this list have strong competitive advantages, and long-term growth potential. Assuming their growth continues, their dividends could continue to rise, despite the massive dividend hikes in 2021.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more