The Best Small-Cap Stocks To Buy Now - Sunday, Oct. 19

Image Source: Unsplash

Small-cap stocks too often make the headlines for the wrong reasons, including massive price swings, fraudulent activity, and accounting scandals. Most investors prefer large-cap and mega-cap stocks, such as those in the Magnificent Seven. Yet small-cap stocks offer the best growth potential of any cap size stocks. Should you consider adding some underdogs to your portfolio?

While there is no universal definition, small-cap stocks are publicly listed companies with market capitalizations between $250 million and $2 billion. The “cap” is short for market capitalization, which is the number of shares multiplied by the share price. For example:

- Company XY2 has 50 million shares, and each share trades at $10.

- Therefore, the market cap is $500,000,000 (50 million x $10).

The Russell 2000 equity index is the primary small-cap index. It covers 2,000 small caps with market values between $240 million and $6 billion. Some argue that a few components of the Russell 2000 are mid-cap stocks, as the equity bull market has technically lifted them out of small-cap territory. Other small-cap indices are the S&P SmallCap 600 and the MSCI USA Small-Cap Index.

The Financial Industry Regulatory Authority (FINRA) has the following definition of small-cap, medium-cap, and large-cap stocks:

- Small-cap stocks have a market cap from $250 million to $2 billion.

- Mid-cap stocks have a market cap above $2 billion but below $10 billion.

- Large-cap stocks have a market cap exceeding $10 billion.

Why Should You Consider Buying Small-Cap Stocks?

Small-cap stocks offer exciting stories, disruptive technologies and services, portfolio diversification, and can deliver above-average growth, but investors must accept higher risks. Here are a few things to consider when evaluating small-cap stocks:

- Look for companies with a product or service in a high-growth sector with a disruptive advantage.

- Favor small-caps with annualized EPS growth of 25% or more.

- Ensure the current price trades at a discount to the average analyst price target.

- Buy small-cap stocks in a separate portfolio and do not mix them with other investments.

What are the Downsides of Small-Cap Stocks?

Investing in small-cap stocks carries greater risks due to unknown factors, shaky balance sheets, and challenging business conditions. After all, there is a reason why small-caps are small-caps. Investors must also accept greater volatility.

Here is a shortlist of potential small-cap stocks to consider:

- DigitalBridge Group (DBRG)

- Teradata Corporation (TDC)

- Lithium Americas Corporation (LAC)

- Consolidated Water (CWCO)

- Evolv Technologies Holdings (EVLV)

- SES AI Corporation (SES)

- Innodata (INOD)

- Xunlei (XNET)

- Serve Robotics (SERV)

- X Financial (XYF)

Update on My Previous Best Small-Cap Stocks to Buy Now

In the previous installment, I highlighted the upside potential of DigitalBridge Group and Teradata Corporation.

- DigitalBridge Group: A long position taken in the stock between $9.06 and $9.84. DigitalBridge Group rallied over 33%, and I closed my position at $13.50. While price action corrected into its ascending 38.2% Fibonacci Retracement Level, I am not re-entering this trade.

- Teradata Corporation: A long position taken in the stock between $20.15 and $20.97. Teradata Corporation advanced over 13%, and my stop-loss closed it for a profit at $22.50, just shy of 10%. The correction has brought the price back into my previous buy zone, and I will go for round two.

Evolv Technologies Holdings Fundamental Analysis

Evolv Technologies Holdings provides AI-based, non-invasive, advanced security technologies and security screening solutions. It transforms physical security with advanced, extensible solutions designed for schools, stadiums, transit hubs, and corporate offices.

So, why am I bullish on Evolv after its price doubled since April?

The need for non-invasive AI-based security solutions remains in its infancy, but I expect demand to outstrip supply moving forward. The addressable market for Evolv Technologies Holdings is expanding, which should boost double-digit revenue growth. Evolv Technologies Holdings reported positive cash flow from operations, gross margins rank among the best in its industry, and the earnings-per-share growth is impressive.

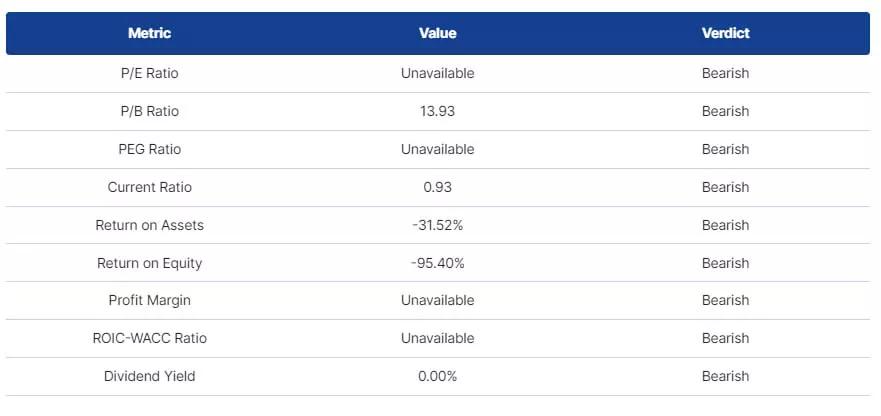

Evolv Technologies Holdings Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio for the stock is negative. By comparison, the P/E ratio for the S&P 500 Index is 29.79. The average analyst price target for Evolv Technologies Holdings is $9.50. This suggests excellent upside potential with manageable downside risks.

Evolv Technologies Holdings Technical Analysis

(Click on image to enlarge)

Evolv Technologies Holdings Price Chart

The Evolv Technologies D1 chart shows price action between its ascending 38.2% and 50.0% Fibonacci Retracement Fan levels. It also shows the stock inside a bullish price channel.

Meanwhile, the Bull Bear Power Indicator turned bearish, but near its ascending trendline.

My Call on Evolv Technologies Holdings

I am taking a long position in Evolv Technologies Holdings between $7.82 and $8.20. I expect to see the company secure more long-term contracts with hospitals and public school systems, while its ongoing advancements and updates should continue to boost client retention rates.

X Financial Fundamental Analysis

X Financial is a Chinese FinTech platform connecting borrowers on its platform with its institutional funding partners. Thanks to its big-data-driven technology, the company has established numerous strategic partnerships with financial institutions.

So, why am I bullish on X Financial despite its pullback?

I like how X Financial uses its technology to facilitate loans to prime borrowers while it deploys robust risk assessment and control systems. The top three shareholders hold 54% of X Financial, while its CEO holds a 43% stake, with limited institutional shareholdings. Therefore, buying this FinTech firm means buying the vision of its CEO, who has done a remarkable job to date, as confirmed by operational stats that rank at the top of its industry.

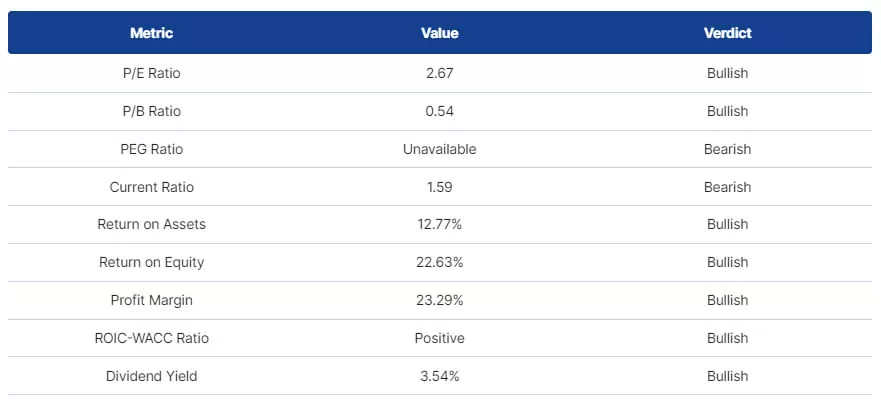

X Financial Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 2.67 makes X Financial an inexpensive stock. By comparison, the P/E ratio for the S&P 500 Index is 29.79. The average analyst price target for X Financial is $15.00. This suggests moderate upside potential with decreasing downside risks.

X Financial Technical Analysis

(Click on image to enlarge)

X Financial Price Chart

The X Financial D1 chart shows price action above its descending Fibonacci Retracement Fan. It also shows the stock entering a massive horizontal support zone.

Meanwhile, the Bull Bear Power Indicator is bearish, but it remains within its ascending support level.

My Call on X Financial

I am taking a long position in X Financial between $11.62 and $13.20. The stock has excellent operational statistics, a deep understanding of its market, creates shareholder value, and pays a good dividend yield, which is rare for a small-cap stock. X Financial is one of the most undervalued stocks I have researched this year.

More By This Author:

The Best Semiconductor Stocks To Buy NowWeekly Forex Forecast - Sunday, Oct. 19

Forex Today: Gold Make A New All-TIme High At $4,242

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more