The Best Meme Stocks To Buy Now - Sunday, July 27

Image Source: Unsplash

A “meme stock” is a publicly listed company that is trending among retail traders on social media. Reddit and Telegram channels are among the favorite social media platforms for retail traders to engage in social trading, in-depth discussions, and short-term price speculation.

Trading in meme stocks is like a pump-and-dump scheme, which is illegal, but so far, regulators have tolerated the meme craze. Retail investors band together and agree to buy a beaten-down stock, often a well-known penny stock with high short interest by institutional traders. It has created massive market volatility and, sometimes, sparked a short squeeze.

The core characteristics of most meme stocks are:

- A well-known company that played a role in the life of traders, especially growing up (for example, Krispy Kreme, Avis, and GameStop).

- A depressed share price, often penny stocks trading below $5 per share.

- A high percentage of short interest by institutional traders who anticipate a drop in the company’s share price.

- A high interest by retail traders on social media.

What Should You Know Before Betting on Meme Stocks?

Meme stocks trade at depressed levels for a reason, and you must understand why the share price is where it is. Here are some aspects to consider before putting money into a meme stock trade:

- Meme stocks are high-risk, short-term gambles.

- Institutional traders heavily short them.

- Prepare for excessive volatility, sharp rallies, and sharper selloffs.

- Understand that you can suffer huge losses if you get the timing and volatility wrong.

- Follow popular social media channels and try to catch the first wave of buy orders.

- Ensure you place a stop-loss order when you enter a buy order.

- Only use capital that you can afford to lose.

Here is a shortlist of meme stocks that are trending now:

- AMC Entertainment (AMC)

- GameStop (GME)

- BlackBerry (BB)

- Krispy Kreme (DNUT)

- Avis (CAR)

- Kohl’s (KSS)

- GoPro (GPRO)

- OpenDoor (OPEN)

- Soundhound AI (SOUN)

- Rivian Automotive (RIVN)

Below are detailed analyses of these stocks: Krispy Kreme and Kohl.

Krispy Kreme Fundamental Analysis H2

Krispy Kreme (DNUT) is a doughnut company and coffeehouse chain. It is a component of the Russell 2000, and it has become the target of the recent meme mania.

So, why am I bullish on Krispy Kreme after its violent price spike?

The company launched a partnership with McDonald’s (MCD) to gradually introduce Krispy Kreme doughnuts to all US locations by 2026. Krispy Kreme has 1,400 locations globally, continues to divest underperforming businesses, and is an underappreciated coffeehouse chain.

The price-to-earning (P/E) ratio is unavailable for Krispy Kreme due to negative earnings, but it trades at a tremendous discount to its PB ratio. By comparison, the P/E ratio for the Russell 2000 is 17.61.

The average analyst price target for the stock is 5.23. It suggests excellent upside potential from recent levels.

Krispy Kreme Technical Analysis

(Click on image to enlarge)

Krispy Kreme Price Chart

- The Krispy Kreme D1 chart shows price action completing a breakout sequence above its descending Fibonacci Retracement Fan.

- It also shows the stock converting a horizontal resistance zone into support following a breakout.

- The Bull Bear Power Indicator turned bullish and has been improving since March.

My Call

I will take a long position in Krispy Kreme stock between 3.61 and 4.70. The PB ratio and the dividend yield make this a meme stock worth considering. Like most meme stocks, the balance sheet has problems, but the McDonald's partnership should slowly address those issues.

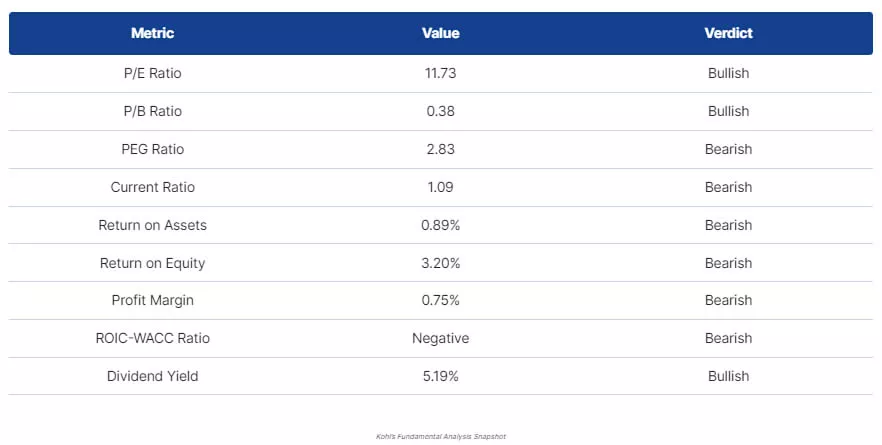

Kohl’s Fundamental Analysis

Kohl’s (KSS) is a department retail store chain with over 1,170 locations. It is a component of the S&P 600 and has experienced meme mania. So, why am I bullish on the stock after its massive price spike and volatility?

Kohl's continues to increase its home assortment section and has signed a partnership with Babies R US. It also sells diffusion lines from high-end designers, and dozens of celebrities sell their branded clothing exclusively through Kohl’s. Therefore, I think the unique characteristics warrant higher prices.

The price-to-earning (P/E) ratio of 11.73 makes Kohl's an inexpensive stock. By comparison, the P/E ratio for the S&P 600 is 15.61. The average analyst price target for Kohl's is 9.57. It suggests an overpriced stock following the meme mania price spike, but support levels could allow more upside.

Kohl’s Technical Analysis

(Click on image to enlarge)

Kohl's Price Chart

- The Kohl's D1 chart shows price action supported by its ascending 61.8% Fibonacci Retracement Fan.

- It also shows the stock above its horizontal support zone following a breakout.

- The Bull Bear Power Indicator is bullish, and the trendline has moved higher since March.

My Call

I am taking a long position in Kohl's stock between 12.52 and 14.06. Kohl’s trades at a discount to its book value and pays an excellent dividend yield. The balance sheet is healthier than many meme stocks, and I believe this stock has the ingredients to turn around its business.

Please remember the high-risk nature of trading meme stocks. They are highly volatile, face balance sheet and operational issues, and can generate major losses in a few seconds. Some meme stocks can swing 50% to 100% in short periods without corporate events.

More By This Author:

Weekly Forex Forecast - Sunday, July 27Forex Today: S&P 500 Index Powers To New All-Time High

Forex Today: Japan & USA Announce Big Trade Deal, 15% Tariff

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more