The Battle Is On

Stocks technically finished lower last week (the S&P 500 fell -1.3%), but in reality, the market has been moving sideways for the past couple weeks or so. Some will call it a consolidation of the big bounce off the bottom. Others say the market is in search of an equilibrium point. And then there are those will call the sideways action a technical struggle as the S&P 500 has been flirting with its 50-day moving average recently as well as important overhead resistance.

But from my seat, I see a series of battles playing out. For example, the battle between expectations and reality. Stimulus versus sustainability. Growth versus slowdown. Price versus value. Bulls versus bears. And of course, science versus the virus.

To be sure, these are not the only battles being fought. But as I discussed last week in our review of the "war playbook," it is the status of these battles that will determine where stocks (and bonds, for that matter) go from here.

Expectations vs. Reality

Perhaps the biggest battle has to do with future expectations. Everybody knows we're in a recession. Everybody knows we did this to ourselves. Everybody knows the news is going to get worse. But the question is, when will things turn? When will the "new normal" begin and what will it look like?

On one hand, you've got the folks who suggest that stocks have now exceeded future economic reality. My favorite quote of the week was from Oaktree Capital's Howard Marks, who summed up this view fairly well. "We’re only down 15% from the all-time high of Feb. 19. It seems to me the world is more than 15% screwed up," Marks said.

Frankly, it's kinda hard to argue with Mr. Marks' point.

It would be different if we had some reasonable expectation of how long the "great cessation" will last and/or how bad it will be. It would help if we had some idea of how many jobs will be lost permanently. How many businesses will close forever? Or how much stimulus the Fed/Government will come up with to ensure we don't face an economic catastrophe.

Science vs Virus

The general thinking at this point in time is that we can't return to anything even remotely close to "normal" until there is a vaccine or a drug therapy to keep folks out of the hospital. This certainly makes sense.

And yes, the market will likely "sniff out" when we get close to either of these solutions. But until there is a line on something concrete - other than shooting Lysol into your veins, of course - the bulls are basically betting on hope here. The hope that science wins the battle over the virus - and soon.

About Those Earnings Reports

But in the meantime, stock market investors must deal with the expectations versus reality battle playing out in the current earnings parade.

Jonathan Golub, chief U.S. equity strategist at Credit Suisse offered his two cents opinion on the subject to CNBC on Saturday. The question posed was, how long will it take for earnings to return to new highs? "The most important earnings story is not what happens this quarter, it's how long does it take to get back to peak earnings again," Golub said. "My estimate is this is going to take three years to get back to peak profits." Three years? Yikes.

Markets Can Handle Anything, If...

I have often said that the stock market can handle anything, once it gets comfortable with the situation. And the general consensus is that stocks look six to nine months down the road. So, the argument can be made that stocks are expecting to have some good news on the virus front within that time frame. Makes sense, right?

The fly in the ointment with this scenario is that things can't get worse. You know, like bankruptcies in the oil patch and the second/third derivative players. Things like credit downgrades or bank problems.

In other words, the current battle, which the bulls appear to be winning from a big-picture perspective (a decline of 15% in an environment expected to be worse than the financial crisis should be considered a "win"), assumes that we've either seen or feel that we know what the worst will look like. The worst unemployment rates. The worst GDP numbers. The worst earnings assumptions. And the worst from the virus.

But, if the current battle starts to go the other way, then it is safe to say that the current assumptions, as well as current prices, may have to be adjusted. And with stocks currently positioned for upbeat expectations, well, we must recognize that if there any hiccups along the way, the bears might have another day or two in the sun.

From my seat, this is what the current sideways action is about. So, ask yourself, are the current assumptions and current prices appropriate? If you think science will win the battle and will have a line on a solution to the pandemic in the coming months, then stocks probably look cheap to you. Buy 'em!

But if you think this thing may stick around a while and cause more damage than is expected along the way, you may view the current levels with a raised eyebrow.

As the saying goes, this is what makes a market. Perhaps this is why stocks are moving sideways at the present time as we all try to get a grip on what to expect for the future.

Weekly Market Model Review

Each week we do a disciplined, deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay "in tune" with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

The Major Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

There are no changes to report on the Primary Cycle board this week. While the mood on Wall Street seems to be improving due to additional stimulus and states/countries moving toward re-opening, my "primary cycle" models suggest that some caution remains warranted at this time.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of the Fundamental Backdrop

Next, we review the market's fundamental factors in the areas of interest rates, the economy, inflation, and valuations.

There are no obvious changes to the Fundamental Factors board this week. However, if you look closely, you will see that the rating of our Economic Composite declined and is now close to going negative. Granted, most of the indicators are lagging at this point. However, the Fed is picking up the slack from an indicator standpoint with an eye-popping effort.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of the Trend

After looking at the big-picture models and the fundamental backdrop, I like to look at the state of the trend. This board of indicators is designed to tell us about the overall technical health of the current trend.

The Trend board tells a story here. From a shorter-term perspective, the price action has been excellent. However, the longer-term indicators still sport some damage. It is also worth noting that with the trading "regime" currently in "mean reverting" mode, our S.T. Channel System took profits last week and is currently waiting for further strength in order to flip back to a buy signal.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.The State of Internal Momentum

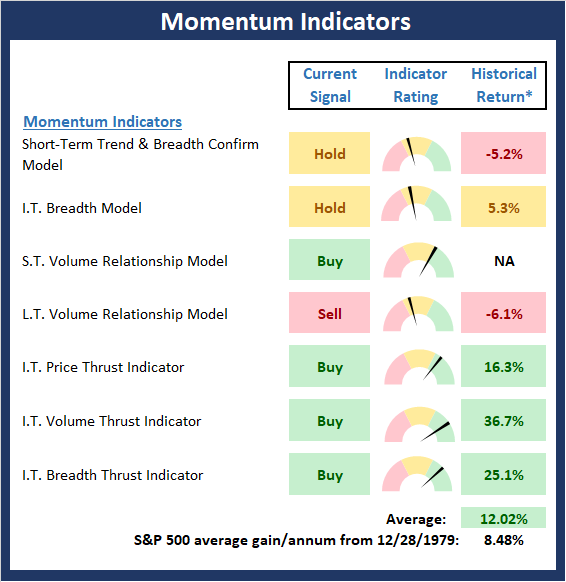

Next, we analyze the "oomph" behind the current trend via our group of market momentum indicators/models.

The Momentum Board saw some improvement again last week as our intermediate-term breadth model improved to neutral and our short-term volume relationship moved to positive. As such, the bulls appear to be in control of the board at this time.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Early Warning Signals

Once we have identified the current environment, the state of the trend, and the degree of momentum behind the move, we then review the potential for a counter-trend move to begin. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

The Early Warning board remains mixed here. From a short-term perspective, stocks continue to be overbought. And it is worth noting that the tailwinds from the extreme oversold/negative sentiment situation are starting to wane. As such, the picture remains mixed. But from a trading standpoint, we would not be surprised the bears attempt to get back in the game here at some point soon.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more

I believe things will get worse before they get better. and it will be a long time before things get better.

Most vaccines take 20 years to develop (the fastest ever still took 4 years). The World Health Organization said immunity may not be possible, experts say Covid-19 has mutated to be 30 unique strains and that the virus is here to stay. Next year we will have a flu season and a coronavirus season simultaneously.

I see little hope for optimism.

I fear you are correct :(