The AI Bubble's Circle Of Life Trade Is Getting Desperate

Image Source: Unsplash

Broadcom (AVGO) just announced a deal with OpenAI for 10 gigawatts of AI infrastructure by 2029.

My response? You are full of crap.

I can't believe more people aren't willing to come out and say it out loud. This is an absolute facade at this point, and I'm getting infuriated watching supposedly smart money fall for it.

The Circle of Life Gets Ridiculous

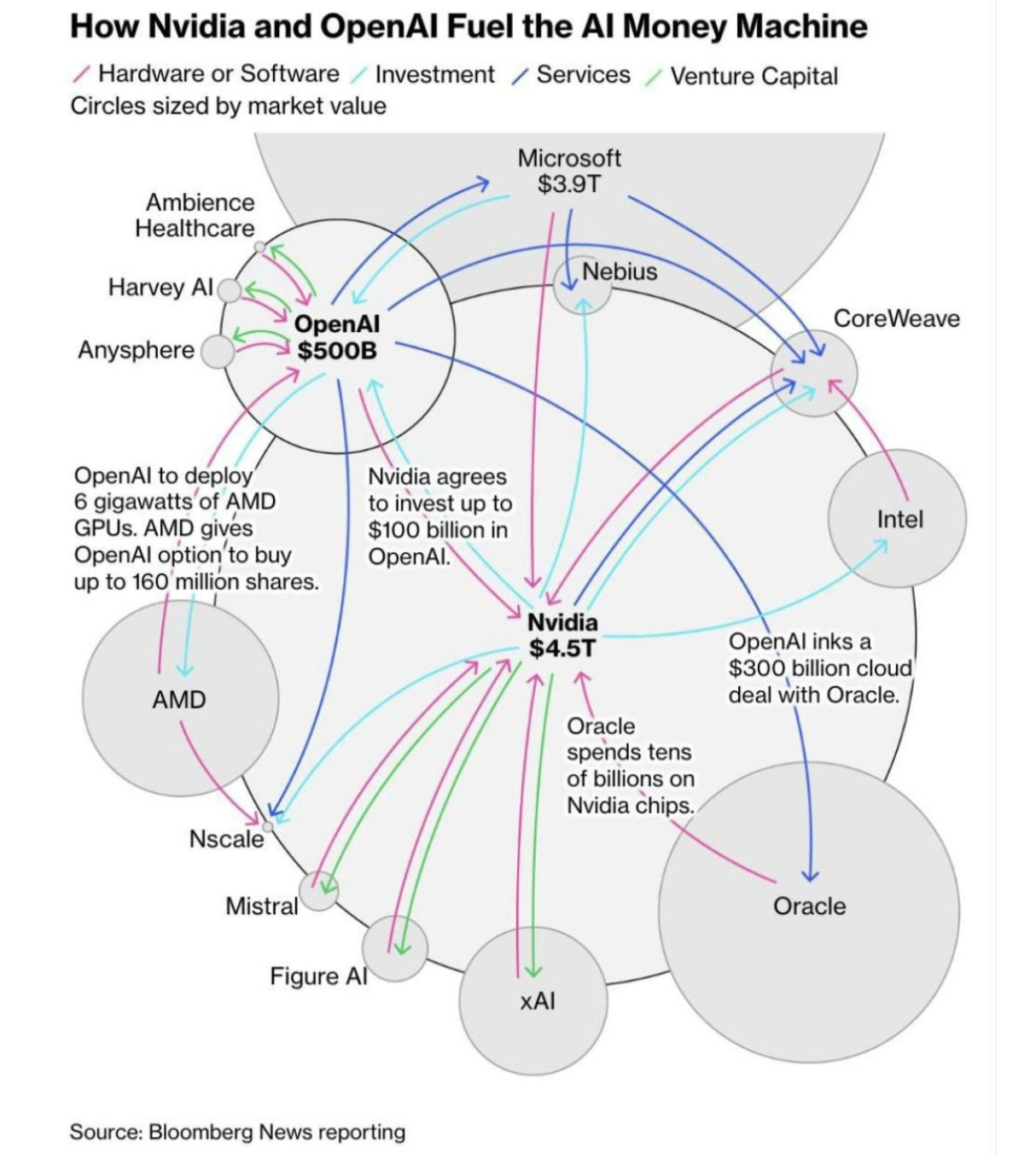

Here's what's happening: OpenAI does deals with Broadcom. OpenAI does deals with Nvidia (NVDA). OpenAI does deals with AMD. Somehow they're all winning while Apple (AAPL) gets left out completely.

They're just signing pieces of paper back and forth at this point. I call it the "circle of life trade" - the nice way of putting it.

Broadcom announces this deal with OpenAI - which is NOT Nvidia, they're competitors - but somehow Nvidia isn't down today. Neither is AMD. Because they've all done deals with the same guys too.

Meanwhile, apparently Apple's left out in the cold. Nobody has done a deal with Apple.

(Click on image to enlarge)

The Math Doesn't Work…

Let me break down why this 10-gigawatt announcement is complete BS:

First: 10 gigawatts of power doesn't exist in the grid. Period. Look into it - you don't have to be a genius to figure out none of this is likely to happen.

Second: If this one project happens, then five other projects that were also announced by OpenAI and Nvidia can't happen. There's literally no power for it.

Third: The deployment "might be about 2029." By the way, 10 gigawatts is not gonna exist by 2029, especially with some of the other projects already announced.

One Stock Carrying Everything

This morning's "recovery" is completely fake. The NASDAQ is up 2%, but it's really up 2% on Broadcom.

Strip out this one 10% move on vaporware, and here's what you're really looking at year-to-date:

- Apple: flat for the entire year (basically 0%)

- Amazon: flat for the entire year (0.40%)

Two of your biggest NASDAQ components have done absolutely nothing in 2024. Meanwhile, you need vaporware announcements about impossible power requirements just to keep the index afloat.

Without Broadcom carrying everything today, this "recovery" would look a lot more tentative.

Why This Ends Badly

I've been saying it for weeks: you have a significant bubble inside AI. Any given catalyst can be the pin that starts real volatility in the marketplace.

When this bubble pops, it won't be gradual like people think. The leverage and cross-connections mean everything unravels fast - just like we saw in crypto on Friday, but across the entire tech sector.

People are pointing fingers already - "they screwed me out of my position." Look, nobody's getting screwed that is aware of their risk. But if you're not prepared for two-sided trade, you better get out of the kitchen right now because it's coming.

The Real Signal

Here's what nobody's talking about: on Friday, we went from one of the biggest contangos in volatility futures history to backwardation in a few hours. That's record-breaking stuff.

Normally you need weeks of selling pressure to flip volatility futures. We almost did it in one day. That displays the seriousness of the risk at hand.

Today, the volatility futures are only 40 cents away from going back into backwardation. If they contract to 20 cents wide, they're gonna sell the living hell out of these S&Ps.

How to Actually Trade This

Look, I'm not telling you to go short the market and pray. That's stupid money thinking.

The smart play here is using defined-risk spreads.

When these futures contract to 20 cents wide, you want to be positioned for the expansion that's coming.

For example, here’s an idea for the VIX.

Buy VIX calls and sell the higher strikes - profit from the volatility spike without trying to time the exact market direction. The beauty is you don't need to be right about WHEN the bubble pops, just that volatility is gonna rip when it does.

The risk-reward on vol spreads is asymmetric here. You risk pennies to make dollars when this thing finally breaks.

Don't try to hero short individual AI names. Don't try to time the exact top. Trade the volatility structure that's screaming at you right now.

Bottom Line

Forget about China and tariffs. None of that crap actually matters at this point. The ball is in play, and you're not going to stop it no matter what catalysts come out.

Watch the tape.

The AI trade is getting desperate, and desperate markets do desperate things.

When 10-gigawatt announcements that can't possibly happen are needed just to keep the market afloat, you know exactly where this is heading.

More By This Author:

Is The Defensive Rotation Complete?Do You Suffer From Big Short Syndrome?

Market Internals Vs. Trump's Tariff Noise

Neither TheoTrade nor any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered ...

more