The 8 Best Water Stocks: How To Profit From One Of Life’s Bare Necessities

Water is one of the basic necessities of human life. Life as we know it cannot exist without water. For this simple reason, water may be the most valuable commodity on Earth.

It is only natural, then, for investors to consider purchasing shares of the companies involved in water. There are many different companies that can give investors exposure to the water business, such as water utilities. Some other companies are engaged in water purification.

In all, we have compiled a list of 40 stocks that are in the business of water. The list was derived from three of the top water industry exchange-traded funds from Invesco (IVZ):

Furthermore, you can view a preview of our water stocks spreadsheet below:

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio | Beta |

|---|---|---|---|---|---|---|---|

| AEGN | Aegion Corp. | 18.83 | 0.0 | 602 | -38.8 | 0.0 | 0.96 |

| AOS | A. O. Smith Corp. | 44.99 | 1.9 | 6,337 | 0.93 | ||

| AQN | Algonquin Power & Utilities Corp. | 12.75 | 4.1 | 6,309 | 24.7 | 100.7 | 0.25 |

| AQUA | Evoqua Water Technologies Corp. | 14.11 | 0.0 | 1,547 | -112.9 | 0.0 | 0.88 |

| ARTNA | Artesian Resources Corp. | 35.36 | 2.7 | 325 | 22.6 | 62.0 | 0.46 |

| AWK | American Water Works Co., Inc. | 118.41 | 1.6 | 21,212 | 36.9 | 59.9 | 0.27 |

| AWR | American States Water Co. | 79.71 | 1.4 | 2,872 | 38.6 | 54.4 | 0.40 |

| BMI | Badger Meter, Inc. | 53.36 | 1.1 | 1,563 | 42.6 | 47.6 | 0.91 |

| CTWS | Connecticut Water Service, Inc. | 69.89 | 1.8 | 843 | 41.4 | 74.0 | 0.10 |

| CWCO | Consolidated Water Co. Ltd. | 13.97 | 2.4 | 209 | 17.7 | 43.1 | 0.29 |

| CWT | California Water Service Group | 52.56 | 1.5 | 2,516 | 42.8 | 63.0 | 0.50 |

| DHR | Danaher Corp. | 136.76 | 0.5 | 99,161 | 39.5 | 18.9 | 0.92 |

| ECL | Ecolab, Inc. | 198.30 | 0.9 | 56,609 | 38.2 | 34.8 | 0.78 |

| ERII | Energy Recovery, Inc. | 9.74 | 0.0 | 545 | 39.2 | 0.0 | 1.32 |

| FELE | Franklin Electric Co., Inc. | 44.70 | 1.2 | 2,102 | 21.8 | 25.4 | 1.04 |

| GRC | The Gorman-Rupp Co. | 31.06 | 1.7 | 820 | 21.4 | 36.1 | 1.01 |

| HDS | HD Supply Holdings, Inc. | 38.05 | 0.0 | 6,527 | 16.4 | 0.0 | 0.75 |

| IEX | IDEX Corp. | 157.06 | 1.2 | 12,103 | 27.8 | 32.5 | 1.04 |

| ITRI | Itron, Inc. | 65.98 | 0.0 | 2,670 | 42.4 | 0.0 | 1.43 |

| LNN | Lindsay Corp. | 89.02 | 1.4 | 960 | 170.5 | 237.4 | 1.13 |

| MLI | Mueller Industries, Inc. | 26.80 | 1.5 | 1,526 | 16.6 | 24.6 | 1.13 |

| MSEX | Middlesex Water Co. | 57.66 | 0.0 | 950 | 28.0 | 0.0 | 0.58 |

| MWA | Mueller Water Products, Inc. | 10.32 | 1.9 | 1,626 | 33.5 | 64.8 | 1.14 |

| OLN | Olin Corp. | 17.86 | 4.4 | 3,008 | 11.0 | 48.1 | 1.36 |

| PNR | Pentair Plc | 36.18 | 1.9 | 6,150 | 16.9 | 32.8 | 1.01 |

| ROP | Roper Technologies, Inc. | 345.89 | 0.5 | 36,587 | 31.9 | 16.3 | 0.98 |

| RXN | Rexnord Corp. | 27.44 | 0.0 | 2,944 | 44.7 | 0.0 | 1.49 |

| SJW | SJW Group | 64.08 | 1.8 | 1,798 | 34.9 | 64.0 | 0.37 |

| STN | Stantec, Inc. | 22.82 | 1.9 | 2,551 | 49.5 | 92.0 | 0.51 |

| TTC | The Toro Co. | 71.35 | 1.2 | 7,596 | 25.8 | 30.8 | 0.76 |

| TTEK | Tetra Tech, Inc. | 76.38 | 0.7 | 4,199 | 23.9 | 15.9 | 1.03 |

| VMI | Valmont Industries, Inc. | 129.06 | 1.1 | 2,835 | 28.2 | 32.3 | 1.13 |

| WAAS | AquaVenture Holdings Ltd. | 18.33 | 0.0 | 535 | -24.4 | 0.0 | 0.58 |

| WAT | Waters Corp. | 210.29 | 0.0 | 13,993 | 26.5 | 0.0 | 0.88 |

| WMS | Advanced Drainage Systems, Inc. | 33.32 | 1.0 | 1,936 | -10.0 | -9.8 | 0.94 |

| WTR | Aqua America, Inc. | 41.62 | 2.1 | 8,877 | 54.4 | 115.9 | 0.23 |

| WTS | Watts Water Technologies, Inc. | 91.30 | 0.9 | 3,141 | 24.4 | 22.7 | 1.05 |

| WTTR | Select Energy Services, Inc. | 8.20 | 0.0 | 910 | 19.7 | 0.0 | 1.15 |

| XYL | Xylem, Inc. | 75.00 | 1.2 | 13,649 | 23.5 | 27.9 | 1.10 |

| YORW | York Water Co. | 35.45 | 1.9 | 466 | 32.7 | 62.5 | 0.51 |

In addition to the Excel spreadsheet above, this article covers our top 8 water stocks today, as ranked using expected total returns from the Sure Analysis Research Database.

This article will discuss the top 8 water stocks ranked by expected total annual returns over the next five years, in order from lowest to highest.

Water Stock #8: Olin Corp. (OLN)

- Expected Return: 4.9%

Olin Corporation was founded in 1892. Today Olin Corp is separated into three business segments. The Chlor Alkali Products and Vinyls segment sells chlorine and caustic soda (accounts for 57% of 2018 sales), the Epoxy segment sells epoxy resins used in paints and coatings (33% of sales), and the Winchester segment sells ammunition and ammunition accessories (10% of sales).

Olin has customers in nearly 100 countries around the world, and the stock has a market capitalization of $3.5 billion.

On July 31st, Olin reported mixed second-quarter financial results. Revenue of $1.6 billion fell 8% year-over-year but beat expectations by $40 million. However, Olin swung to a net loss of $0.12 per share, a big miss as analysts had expected the company to report a positive EPS of $0.01 per share. In the same quarter last year, Olin generated a positive EPS of $0.35 per share.

Olin incurred a number of expenses that caused it to lose money for the quarter. These include depreciation and amortization expense of $151.4 million; restructuring charges of $3.8 million; information technology integration costs of $21.5 million; and a $20 million expense for environmental investigatory and remedial activities.

The good news is that Olin management expects these issues to be short-term in nature. The company expects higher volumes and operating rates across its chlorine, chlorine-derivatives, and epoxy products businesses. It also expects approximately $25 million of lower maintenance turnaround costs and improved caustic soda pricing. Plus, the multiple one-time charges that occurred in the first half are not expected to repeat in the second half of the year.

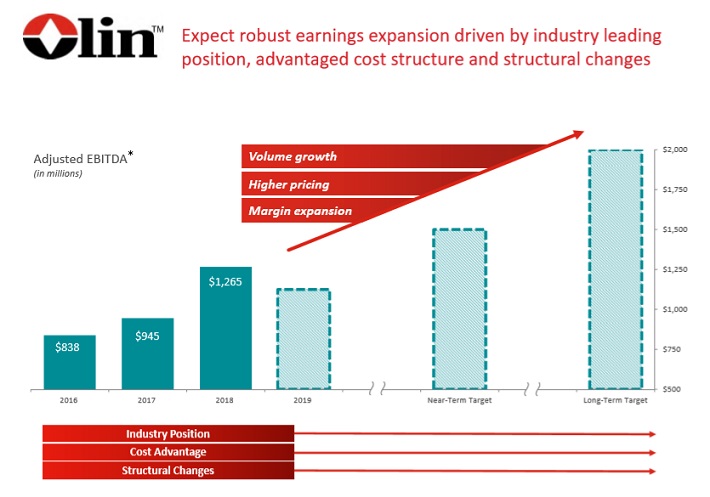

As a result, management maintains an optimistic long-term outlook for the company.

Source: Investor Presentation

Olin stock trades for a price-to-earnings ratio of 16.5x, which is well above our fair value estimate of 10.0x. The fair value estimate P/E is based on the 10-year historical average. As a result, the stock appears overvalued, which is expected to limit its future returns. A retracement of the P/E ratio to our fair value estimate would reduce annual returns by 9.5% per year over the next five years.

Future EPS growth (expected at 10% per year), as well as the 4.4% dividend yield, will push Olin’s total returns into positive territory, but total expected returns of 4.9% per year make this stock is a hold in our view.

Water Stock #7: Franklin Electric (FELE)

- Expected Return: 5.8%

Franklin Electric Company makes the list because it provides systems and equipment for moving water and fuel. It manufactures electric motors, pumps and controls that allow customers to pump freshwater, wastewater and fuel. As a result, its business model is heavily involved in water.

It also manufactures flexible piping, gas recovery systems and tank monitoring devices for the petroleum sector. The company was founded in 1944 and generates $1.3 billion in annual sales. Almost half of its sales come from international customers.

In late July, Franklin Electric reported (7/23/19) financial results for the second quarter of fiscal 2019. In North America, sales of groundwater products continued to be adversely affected by the record precipitation in the first half of the year. Nevertheless, the company grew its total revenues 3% and its adjusted earnings-per-share 8%.

Despite the strong results, the extremely adverse weather in the first half of the year caused management to lower its earnings-per-share guidance for the full year. Franklin Electric now expects 2019 EPS in a range of $2.15-$2.25, down from prior guidance of $2.37-$2.47.

That said, whether in the U.S. normalized in recent weeks, while the company continues to enjoy strong business momentum in International Water Systems and Fueling Systems markets. We expect a 7% annual EPS growth over the next five years. Revenue growth will fuel the company’s future earnings growth. Franklin Electric’s growth will be boosted by its recent acquisition of First Sales, LLC, a manufacturer of water treatment and filtration equipment for the residential and commercial markets.

First Sales designs, manufactures and distributes its products under the Sterling Water Treatment and Avid Water Systems brands. First Sales had sales of approximately $14 million last year. Franklin Electric expects the acquisition to be accretive to the company’s EPS in 2020.

Franklin Electric stock trades for a 2019 P/E ratio of 20.5x, significantly above our fair value estimate of 18.1x, which is equal to the 10-year historical average. A declining P/E multiple could reduce annual returns by 2.5% per year. The company’s 7% expected EPS growth rate, as well as the 1.3% dividend yield, will offset the impact of overvaluation. Total returns are expected to reach 5.8% per year through 2024, qualifying the stock as a hold at this time.

Water Stock #6: Xylem Inc. (XYL)

- Expected Return: 6.1%

Xylem has only been an independent company since 2011 when it was spun off from ITT Corporation. But it plays an important role in the water business. It is a machinery company that designs, manufactures and sells engineered technologies for the water industry.

Its portfolio for water and wastewater applications includes products for the full cycle of water: collection, distribution, use, and the return of water to the environment. Xylem has a market capitalization above $13 billion.

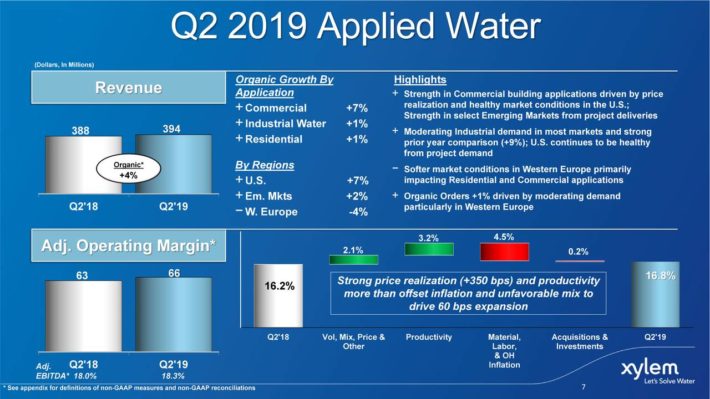

Xylem reported strong second-quarter financial results. Organic revenue increased 5% to $1.3 billion. Xylem saw double-digit sales growth in the U.S. last quarter. Adjusted EPS increased 10% from the same quarter last year.

The company’s Applied Water segment, its largest business, posted strong growth last quarter.

Source: Investor Presentation

For the full year, Xylem expects organic revenue growth of 5% to 6%. Adjusted EPS is expected to increase 8% to 12% this year, to a range of $3.12 to $3.22.

Xylem continues to expect a strong year from each of its end markets in 2019.

Source: Investor Presentation

For the full year, Xylem expects organic revenue growth of 5% to 6%. Adjusted EPS is expected to increase 8% to 12% this year, to a range of $3.12 to $3.22. The long-term outlook remains extremely positive for Xylem. The company has grown its earnings-per-share at a highly attractive 10% pace since the company went public in 2011.

It should have little trouble continuing its growth in future years. Water is a valuable resource that is critical for everyone’s life. Awareness about the importance of water usage is growing, and has made the products Xylem offers more important. Both tools for the analysis and control of water, as well as Xylem’s technology for moving water and wastewater, are experiencing growing demand.

Xylem stock trades for a 2019 P/E ratio of 24x, compared with our fair value estimate of 19.0x. As a result, we view the stock as slightly overvalued, and a declining valuation multiple could cut into total returns by 4.6% per year. Expected EPS growth of 9.4% per year, as well as the 1.3% dividend yield, result in total expected returns of 6.1% per year through 2024.

Water Stock #5: Algonquin Power & Utilities (AQN)

- Expected Return: 8.7%

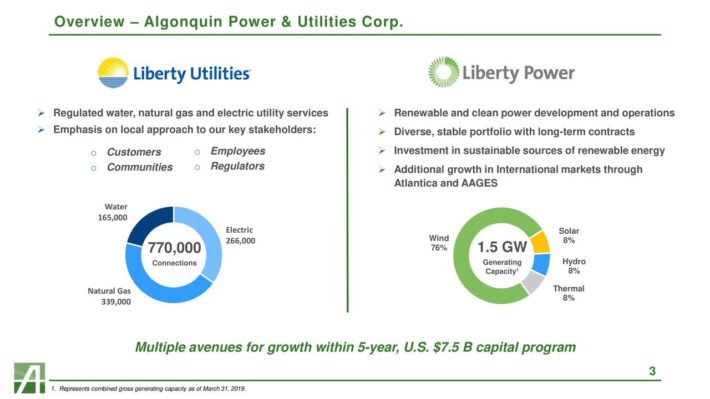

Algonquin Power & Utilities Corp. is headquartered in Canada. The stock trades on both the Toronto Stock Exchange and New York Stock Exchange under the ticker, AQN. The renewable power and utility company was founded in 1988. Algonquin’s market cap is $6.1 billion. The company has increased its dividend every year since 2011.

The three parts of its business are regulated utilities (natural gas, electric, and water), non-regulated renewables (wind, solar, hydro, and thermal), and global infrastructure. Algonquin serves about 770,000 connections across 40 regulated utilities in 13 states and 1 Canadian province. It also has 36 renewable and clean energy facilities that have long-term contracts.

Source: Investor Presentation

Algonquin reported its first-quarter results on May 9, 2019. Year over year, revenues fell 3.6% to $477 million, adjusted net earnings fell 33% to $93.8 million, adjusted EBITDA fell 17% to $231.5 million, and adjusted earnings-per-share declined by 41% to $0.19. Adjusting for the one-time income boost that occurred in the first quarter of 2018 due to the U.S. Tax Reform, adjusted EBITDA would have increased by 3% and adjusted earnings-per-share would have declined by 10%.

Acquisitions will add to the company’s customer count and its revenue growth. For example, Algonquin recently acquired Ascendant Group, parent company of Bermuda Electric Light Company, for an equity value of $365 million. Bermuda Electric serves 63,000 residents and businesses in Bermuda.

The company expects the acquisition to be immediately accretive to its 2020 EPS, and the deal was executed at a reasonable valuation of 7.3x the acquired company’s expected 2020 EBITDA. The transaction is expected to close in late 2019. Overall, we expect annual EPS growth of 7.5% for Algonquin through 2024.

Based on 2019 expected EPS of $0.62, the stock has a P/E ratio of 20.8x, above our fair value estimate of 18.0x. A declining valuation multiple could reduce annual returns by 2.9% per year through 2024. Positive EPS growth and its attractive 4.1% dividend yield can serve as an offset, resulting in total expected returns of 8.7% over the next five years. This is a satisfactory rate of return, but the overvalued stock leads us to rate Algonquin as a hold.

Water Stock #4: The Toro Company (TTC)

- Expected Return: 10.7%

The Toro Company was founded in 1914 as an engine manufacturer, providing power to early tractors. The company quickly shifted focus to mowers, where it continues its focus today. Toro will also benefit from growth in the water industry because the company has a large irrigation business, which represents approximately 16% of annual sales.

In all, Toro generates annual revenue of $2.8 billion. Toro generates approximately 75% of its sales in the United States. It caters heavily to professional customers, which constitute 74% of annual revenue. Toro has generated steady, impressive growth over the past several years.

Source: Investor Presentation

Toro reported second-quarter earnings on May 23rd, 2019 and recorded a 9.9% increase in second-quarter sales to $962.0 million, boosted by the acquisition of Charles Machine Works. Adjusted net earnings for the second quarter period fell 2.5% to $1.17 per share, compared with the same quarter last year.

Fortunately, management expects margin improvement over the back half of 2019, as well as improved commodity pricing. The company has also identified margin improvement opportunities associated with their acquisition of Charles Machine Works. Management forecasts adjusted EPS of about $2.90 to $3.00 on revenue of $3.2 billion for 2019.

With expected EPS of $2.95 for 2019, Toro stock trades for a P/E ratio of 24.5x. Our fair value estimate is a P/E ratio of 21.5x, implying the stock is overvalued today. This could negatively impact shareholder returns by approximately 2.6% per year through 2024.

Still, we expect Toro to generate annual EPS growth of 12% per year, more than offsetting an overvalued stock. In addition, the stock has a 1.3% dividend yield, which leads to total expected returns of 10.7% per year over the next five years. Toro is not a high-yield dividend stock, but its impressive growth and nearly 11% expected annual return give the stock a buy recommendation from Sure Dividend.

Water Stock #3: Pentair (PNR)

- Expected Return: 11.3%

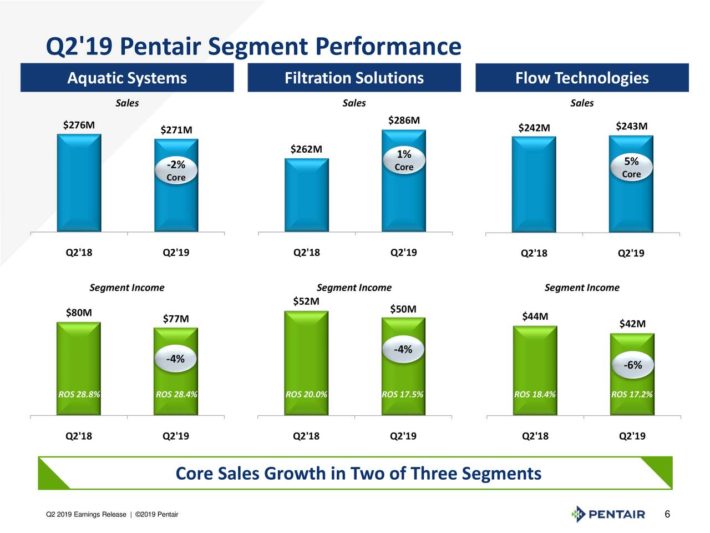

Pentair was a diversified industrial conglomerate. The company recently spun off its Technical Solutions segment and now operates as a pure-play water solutions company that operates in 3 segments: Aquatic Systems, Filtration Solutions, and Flow Technologies. Pentair was founded in 1966 and trades with a market capitalization of $6.7 billion. Pentair has increased its dividend for 42 consecutive years when adjusted for spin-offs, which makes Pentair a member of the Dividend Aristocrats list.

Pentair recently reported its second-quarter financial results. Net sales rose 2% from the same quarter last year, to $800 million in the most recent quarter. Growth in the Filtration Solutions and Flow Technologies businesses was slightly offset by a decline in the Aquatic Systems segment. A breakdown of Pentair’s financial performance by segment can be seen in the image below.

Source: Earnings Slides

Pentair management believes the company can grow EPS by 10% per year over the long-term. We take a slightly more cautious view, with expectations of 6%-7% annual EPS growth through a combination of revenue growth, some margin increases, and share repurchases.

Pentair’s future growth will be fueled by its durable competitive advantages. Specifically, Pentair enjoys a dominant position with a lean, highly efficient structure. Pentair employs a strategy called the Pentair Integrated Management System – or PIMS – which allows its organizational structure to remain lean and encourages efficiency through the company’s supply chain and distribution operations. Pentair is a leader in the niche markets it targets, and through tuck-in acquisitions, Pentair can grow its size and scale further.

Pentair stock has a 2019 P/E ratio of 15.7x, which is below our fair value estimate of 18.0x. An expanding price-to-earnings ratio could boost annual returns by 2.8% per year through 2024. Pentair also has a 2% dividend yield which will contribute to shareholder returns. In all, total returns are expected to reach 11.3% per year over the next five years. We rate Pentair a buy for its high expected returns and its status as a Dividend Aristocrat.

Water Stock #2: A.O. Smith (AOS)

- Expected Return: 12.0%

Next on the list is A.O. Smith, which like Pentair is a member of the Dividend Aristocrats list. A.O. Smith is a leading manufacturer of residential and commercial water heaters, boilers and water treatment products. As a result, A.O. Smith is directly involved in the water business and is a beneficiary of higher demand for water down the road.

A.O. Smith generates 64% of its sales in North America, 34% in China and the remaining 2% in the rest of the world. The company has a particularly impressive growth outlook, as it conducts a large portion of its business in emerging markets like China and India. These countries have very large populations and high rates of economic growth, and where demand for water will be particularly strong in the coming years.

The company has gained market share in water heaters for 15 consecutive years. It has generated highly impressive EPS growth of 25% per year over the past several years.

Source: Investor Presentation

A.O. Smith reported its second-quarter earnings results on July 30th. It was a difficult quarter overall, as A.O. Smith reported an 8% decline in both revenue and earnings-per-share. The company is facing pressure from the global trade conflict over the past several months. As China represents a large portion of its business, a protracted trade dispute could continue to weigh on the company’s financial results.

That said, trade issues are typically a short-term challenge. The long-term outlook remains supportive of growth for A.O. Smith. And, it still expects 2019 to be another highly profitable year. A.O. Smith guides for EPS in a range of $2.35 to $2.41 for the current fiscal year.

A.O. Smith has grown its earnings-per-share by 18% annually over the last decade, which is a very attractive growth rate. The company’s profits grew relatively consistently during that time frame. Earnings-per-share declined from 2009 to 2010 but rose during all other years. The last financial crisis did not have an overly large impact on A.O. Smith’s profits, as earnings-per-share rose between 2008 and 2009.

Importantly, A.O. Smith raised its dividend during every year of the financial crisis. We assess the sustainability of A.O. Smith’s dividend in further detail in the video below:

The future outlook is highly positive for A.O. Smith. Thanks to the booming housing market in the U.S. and stronger consumer spending, the company has enjoyed consistent growth in the domestic market. The company is poised to keep growing for years in China thanks to the country’s huge population, its robust GDP growth, and its booming middle class. Over the long-term, we believe that A.O. Smith can grow EPS by 9% per year over the next five years.

A.O. Smith stock trades for a 2019 P/E ratio of 19.0x, based on the midpoint of its revised full-year guidance. This is slightly below our fair value estimate of 20.0x. An expanding P/E ratio could boost annual returns by 1% per year over the next five years.

In addition, EPS growth of 9% and the current dividend yield of 2% lead to total expected returns of 12% per year over the next five years. This is a very attractive rate of return, making A.O. Smith a buy for dividend growth investors.

Water Stock #1: Consolidated Water Company (CWCO)

- Expected Return: 15.5%

The top-ranked water stock is Consolidated Water Company, which was founded in 1973 as a private water utility in Grand Cayman. Since its founding, it has discovered a very nice niche for itself in the water business. The company uses a desalination process that helps provide water where naturally potable water is scarce or does not exist.

Consolidated Water has since grown to more than $65 million in annual revenue and a ~$210 million market capitalization. It serves a wide variety of customers in six different countries with 14 plants across its service area.

Consolidated Water reported strong first-quarter results on 5/13/19, including 17% revenue growth and 13% gross profit growth for the period. Earnings-per-share increased to $0.41 per share, nearly tripling from the same quarter last year.

Future growth is highly likely for Consolidated Water. The company won a seven-year bulk water supply agreement from the Water-Authority Cayman, beginning July 1st. Additionally, the company completed the expansion of the water production and storage capacity of the Abel Castillo Water Works plant in Grand Cayman.

Furthermore, the development of the Rosarito, Baja California, Mexico projects involving the construction and operation of a major seawater desalination plant and distribution pipeline continued to make solid progress.

As the largest potable water producing plant in the Western Hemisphere and a major, much-needed new source of drinking water for the coastal region of Baja California for at least the next 37 years, the project will have a sizable moat around it and provide considerable growth for the company. In all, we expect annual EPS growth of 7% per year over the next five years.

Consolidated Water shares trade for a 2019 P/E ratio of 16.4x, below our fair value estimate of 22.0x. An expanding P/E ratio could boost annual returns by 6.1% per year over the next five years. Including EPS growth and the 2.4% dividend yield, total returns are expected to reach 15.5% per year. This makes Consolidated Water the top stock for investors interested in gaining exposure to water.

Final Thoughts

Water could be one of the biggest investing themes over the next several decades. An increasing global population is only going to cause demand for water to rise in the future. And, given the fact that water is a necessity of human life, demand for water should hold up extremely well even during the worst recessions.

These factors make water stocks appealing for risk-averse investors looking for stability from their stock investments. Not all the stocks on this list receive buy recommendations at this time, as some appear to be overvalued today. But all the stocks on this list pay dividends and are likely to increase their dividends for many years in the future.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more