The 5 Biggest Oilfield Services Stocks Ranked From Worst To First

Oilfield services companies were significantly affected by the downturn in the oil market that began in 2014. As the price of oil plunged, many oil producers drastically reduced their production and postponed their growth projects. Consequently, the oilfield services companies experienced a major hit.

However, thanks to the efforts of OPEC and Russia, the supply glut has eventually been eliminated from the oil market. Thus, the price of oil has enjoyed a strong rally in the last 12 months, and is now trading at a 3.5-year high. As a result, U.S. oil production has reached record levels this year and is expected to continue to climb to new all-time highs next year. In addition, the number of active rigs has more than doubled since it bottomed in 2016. The large oilfield services companies are now in the early phases of what could be a multi-year recovery.

In this article, we will compare the expected 5-year returns of the five biggest oilfield services companies: Schlumberger (SLB), Halliburton (HAL), National Oilwell Varco (NOV), Baker Hughes-GE (BHGE) and TechnipFMC (FTI).

We will calculate their expected returns by summing their expected earnings-per-share growth, their dividend and their expected annualized expansion or contraction of their price-to-earnings ratio. This data is from the proprietary Sure Analysis Research Database.

Oilfield Service Dividend Stock #5: National Oilwell Varco

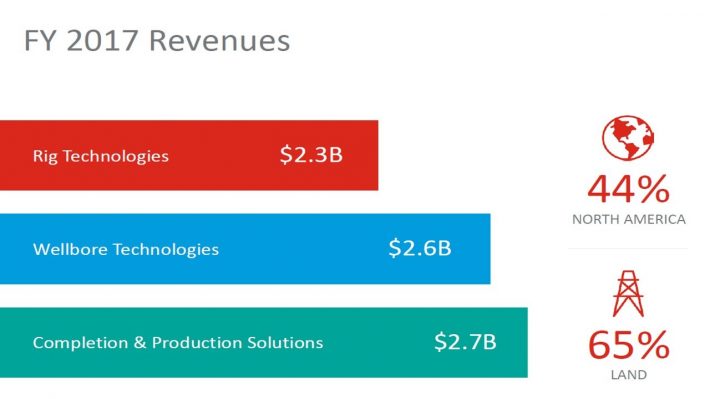

National Oilwell Varco generates 44% of its revenue in North America, while 65% of its business is in inland production. The company operates in three segments: Wellbore technologies, completion & production solutions, and rig technologies.

Before the downturn that began in 2014, the rig technologies segment was the flagship, as it used to generate approximately half of total revenue. However, as the number of new-built rigs collapsed during the downturn, this segment has been the most severely affected, and is now the smallest segment.

Source: Investor Presentation

Despite the downturn, National Oilwell Varco continued to post strong free cash flows in recent years, thanks to its drastic spending cuts. For instance, in the last three years, it has enjoyed free cash flow between $640 million and $879 million ($1.68 and $2.31 per share, respectively). As a result, the company is in the top quartile of free cash flow margin in its sector. As it also has a strong balance sheet. With a current ratio of 3.4, it can easily wait for the rebound of its business without any problem.

Thanks to the recent rally in oil prices, National Oilwell Varco’s fundamentals have improved in the last one year. However, it is a late-cycle company, as the oil price has to remain strong for a long period for its customers to regain their confidence and boost their capital expenses. For that reason, National Oilwell Varco is still far from making a meaningful profit, but it is likely to return to a solid profit in 2020. While it is expected to make a marginal profit of $0.20 per share this year, it is likely to see its earnings per share rebound to approximately $4.00 by 2023.

Thanks to the profits that the company will accumulate in the next five years, its book value per share is likely to grow from $37.00 to $47.00 over this period, for a 4.9% average annual growth rate. In addition, the stock is now trading at a price-to-book value ratio of 1.23, which is very close to its 10-year average of 1.26. If the stock reverts to its average valuation level within the next five years, it will enjoy a 0.5% annualized gain thanks to the expansion of its valuation level. Overall, given its 0.4% dividend, the stock is likely to offer a 5.8% average annual return over the next five years.

Oilfield Service Dividend Stock #4: Halliburton

Halliburton has operations in approximately 70 countries, and generates 56% of its total revenues in North America. Last year, its completion and production segment generated 63% of its total revenue, and 31% of its operating income, while its drilling and evaluation segment generated 37% of revenue and 69% of operating income.

Due to the recent downturn in the oil market, Halliburton posted losses in 2015 and 2016. However, thanks to the ongoing recovery and the record U.S. oil production, the company has already enjoyed great improvement in its business performance. In Q1, despite delays and deliveries due to adverse weather, the company grew revenue by 34% from the same quarter last year, thanks to a 58% increase in revenue in North America.

The company is still facing weak business conditions and tough competition in international markets. On the other hand, thanks to its high exposure to North America, it is expected to more than double its earnings per share this year, from $0.94 to $2.45. As the price of oil is expected to remain strong in the upcoming years, Halliburton will grow thanks to two growth drivers; higher prices charged to its customers and increased utilization of its equipment.

Moreover, the company is in the process of reducing its debt load at a fast pace. As the company accumulated a great amount of debt due to the recent downturn and its failed attempt to acquire Baker Hughes, its interest expense takes up a large portion of its operating income. This is why the current focus of management is on debt reduction, which is likely to provide an additional boost to the company bottom line, through lower interest expense.

The company can be reasonably expected to grow its earnings per share to approximately $4.00 by 2023, for a 10.3% annual growth rate. On the other hand, the stock is now trading at a price-to-earnings ratio of 18.9, which is much higher than its historical average of 15.0. As its recovery unwinds over the next five years, the stock is likely to revert towards its average valuation level. In such a case, it will incur a 4.5% annualized drag due to the contraction of its valuation level. Overall, given its 1.6% dividend, Halliburton is likely to offer a 7.4% average annual return over the next five years.

Oilfield Service Dividend Stock #3: Schlumberger

Schlumberger is the world’s largest provider of oilfield services. It provides technology for reservoir characterization, drilling and production, and has operations in more than 85 countries.

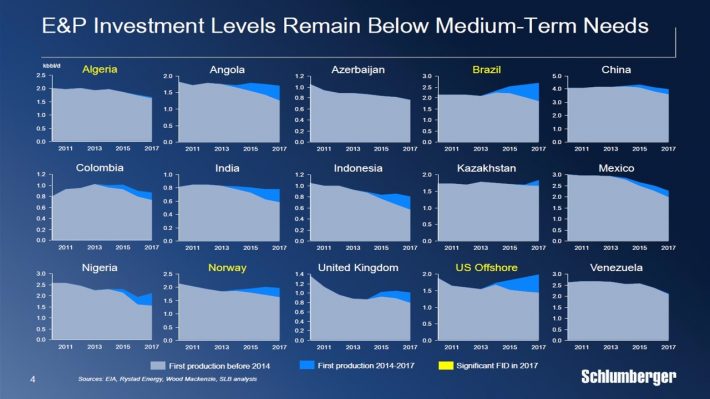

While U.S. oil production has reached a record daily rate, most countries have not grown their output yet, due to the investment cuts witnessed during the recent downturn.

Source: Investor Presentation

This is a problem for Schlumberger, which generates 69% of its revenues outside North America. As Schlumberger is less leveraged to the booming U.S. oil production than its peers, its results have not recovered as strongly as those of its peers yet.

However, as the oil price has rallied to a 3.5-year high and is expected to remain strong in the upcoming years, oil producers will begin to boost their capital expenses. As a result, Schlumberger will enjoy meaningful improvement in its business conditions in the years ahead. Over the next five years, the company can be reasonably expected to grow its earnings per share from $1.94 this year to approximately $4.00 in 2023, for a 15.6% annual growth rate during this period.

On the other hand, due to its depressed earnings, the stock is currently trading at an excessive price-to-earnings ratio of 35.8, which is much higher than its historical average of 20.5. As the company will continue to recover in the next five years, it is only natural to expect the stock to revert to its average valuation level. In such a case, the stock will incur a 10.6% annualized drag due to the contraction of its valuation level. Overall, given its 2.9% dividend, Schlumberger is likely to offer a 7.9% average annual return over the next five years.

Schlumberger offers by far the highest dividend yield in this group of stocks, and the dividend appears to be safe. Schlumberger has enjoyed strong free cash flow every single year in the last decade, even during the recent downturn, as it curtailed its capital expenses. This is in sharp contrast to its peers, Halliburton, Baker Hughes and TechnipFMC, which have posted poor (mostly negative) free cash flows in the last three years.

Oilfield Service Dividend Stock #2: TechnipFMC

TechnipFMC was created with the merger of Technip and FMC Technologies in January 2017. It has operations in 48 countries and operates in three segments: Subsea, onshore/offshore and surface technologies. These three segments currently generate 38%, 51% and 11%, respectively, of total revenue.

As mentioned above, while the U.S. is currently producing oil at a record rate, most countries have not grown their output yet due to the investment cuts witnessed during the recent downturn. Since investment has begun to recover in most countries, TechnipFMC is likely to experience a significant increase in its subsea and deep-water projects in the upcoming years.

Source: Investor Presentation

Moreover, thanks to the $13 billion merger, the company is on track to achieve $400 million in annual synergies this year, and $450 million in annual synergies from next year.

In Q1, TechnipFMC exhibited lackluster performance, as it missed the analysts’ earnings-per-share estimates ($0.26 vs. $0.34) and reported an 8% decrease in its revenues. However, that performance mostly resulted from adverse weather and seasonal factors. Management expects improvement in business trends in Q2.

Analysts expect TechnipFMC to grow its earnings per share to $1.39 this year. Thanks to its promising growth prospects, the company can be reasonably expected to grow its earnings per share to approximately $2.50 by 2023, for a 12.5% annual growth rate.

However, the stock is currently trading at a price-to-earnings ratio of 22.3, which is much higher than its historical average of 16.9. The stock is likely to revert towards its average valuation level. As a result, it will incur a 5.4% annualized drag due to the contraction of its valuation. Overall, given its 1.7% dividend, the stock is likely to offer an 8.8% average annual return over the next five years.

Oilfield Service Dividend Stock #1: Baker Hughes-GE

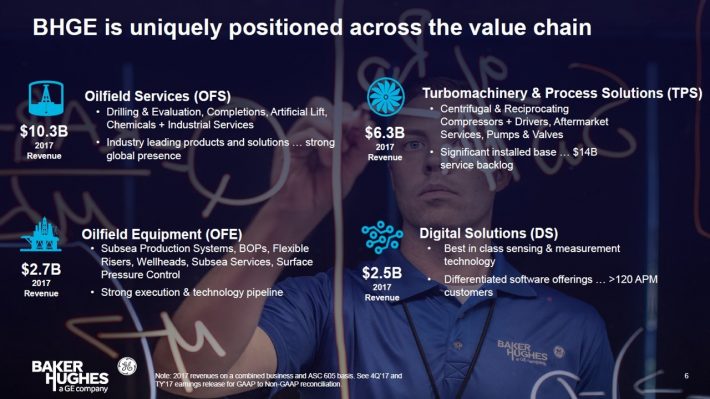

Baker Hughes, in its current form, was created last year with the merger of Baker Hughes and General Electric Oil & Gas. The company provides integrated oilfield products, services and digital solutions and has operations in more than 120 countries. In 2017, its oilfield services division generated 47% of its total revenue. The Equipment, Turbomachinery & Process Solutions, and Digital Solutions generated 12%, 30% and 11% of revenue, respectively.

Source: Investor Presentation

Baker Hughes was severely affected by the downturn of the oil market. It incurred heavy losses in 2015 and 2016, and a marginal loss of $0.17 per share last year. In Q1, the company grew revenue by 9% over last year, but revenue decreased 8% compared to the previous quarter. Management attributed the sequential decrease mostly to seasonal factors.

Nevertheless, thanks to the ongoing recovery of the oil market, the company is expected to make a profit of $0.79 per share this year. Moreover, as oil producers have begun to regain their confidence, they are likely to significantly boost their capital expenses in the years ahead. As a result, Baker Hughes is poised to experience solid growth in the upcoming years. Overall, the company can be reasonably expected to grow its earnings per share to approximately $2.50 by 2023. Book value per share is expected to grow from $34.85 this year, to about $38.00 by 2023, for a 1.7% annual growth rate.

The stock is currently trading at a price-to-book value ratio of 0.96, which is much lower than its 10-year average of 1.40. As the company will continue to recover in the next five years, the stock is likely to revert towards its average valuation level. In that case, it will enjoy a 7.8% annualized gain, thanks to the expansion of its valuation level. If its 2.1% dividend yield is also taken into account, the stock is likely to offer an 11.6% average annual return over the next five years.

Final Thoughts

Due to the downturn of the oil market that began in 2014, the oilfield services stocks have dramatically under-performed the market. However, thanks to the solid improvement in the fundamentals of the oil market and the rally of the oil price to a 3.5-year high, the oilfield services companies have begun to recover from the recent downturn. Even better, they seem to be only in the early phases of a multiyear recovery. As a result, these stocks are likely to offer decent returns over the next five years.

Investors should keep in mind that these stocks are highly cyclical, and are vulnerable to recessions and downturns in the oil market. All the above stocks saw their earnings collapse in the Great Recession, and in the recent oil market downturn. Therefore, they should be viewed as highly cyclical.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure Dividend ...

more