The 10 Stocks Using AI To Develop New Drugs Were Up 4%, On Average, Last Week

The pharmaceutical industry is embracing AI to streamline drug discovery and development because creating a new drug using AI can help a company, in some cases, develop a new drug in a matter of days instead of the years it might take using the traditional clinical trial approach. This article highlights 10 micro- and small-cap companies using AI in drug discovery and drug development. [Ed. note: Penny stocks and mini-cap companies are readily manipulated; do your own careful due diligence.]

The "AI In Drug Discovery" Market Is Growing Rapidly

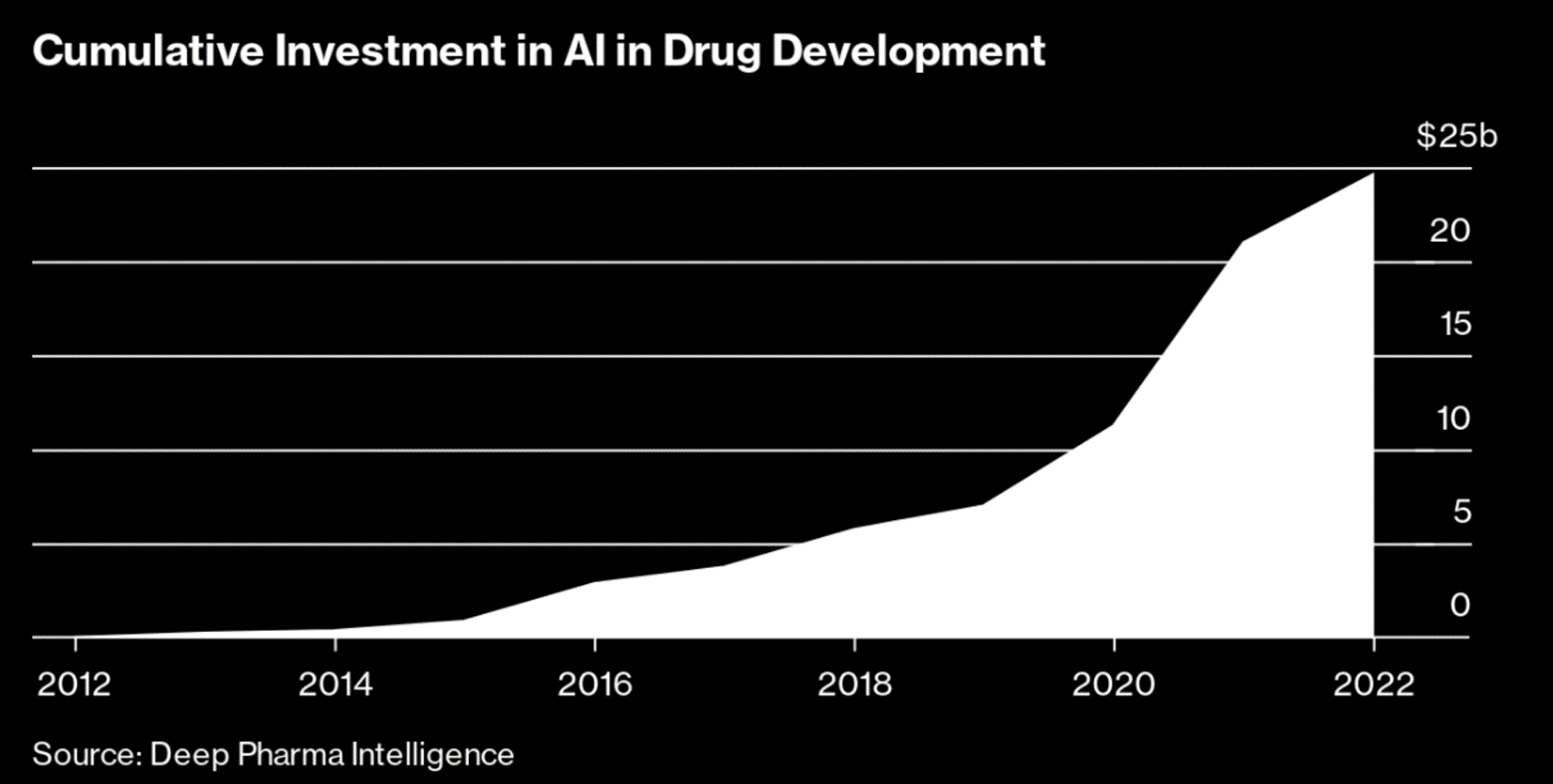

- According to Grand View Research the global "AI in drug discovery" market was worth about $1.1 billion last year but should grow at a 30% clip from 2023 to 2030,

- Research firm Deep Pharma Intelligence estimates that investments in the field of AI-powered drug discovery have tripled over the past four years to nearly $25 billion.

- Morgan Stanley believes that AI-powered drug discovery will lead to an additional 50 novel therapies being brought to market over the next decade, with annual sales in excess of $50 billion! In other words, a $50 billion AI drug discovery revolution is underway.

Source: Deep Pharma Intelligence

The Clinical Trial Process

New drugs are currently approved through human clinical trials: rigorous, year-long procedures starting in animal trials and gradually moving to patients in trials who are exposed to side effects that cannot be predicted or expected. The process typically cost billions of dollars and take many years to complete, sometimes more than a decade, and, even if their trials are successful, they still have to receive approval of a country's respective regulatory agency. Source

Source: Biosourcing

Why Use AI Technology In Drug Development?

AI technology, however, helps companies aggregate and synthesize a lot of information that’s needed for clinical trials, thus shortening the drug development process. It can also help understand the mechanisms of the disease, establish biomarkers, generate data, models, or novel drug candidates, design or redesign drugs, run preclinical experiments, design and run clinical trials, and even analyze the real-world experience. Source

A study by Janssen Research & Development (JNJ arm) concludes that the AI method to be up to 250 times more efficient than the traditional method of drug discovery. It holds the potential to reduce timelines for drug discovery, to increase accuracy of predictions on efficacy and safety as well as to create better, and more, opportunities to diversify drug pipelines.

The following 10 clinical-stage companies are using AI to facilitate their discovery and development of new drugs and trade on various Canadian and American stock exchanges. They are listed in order of their stock performances last week along with their YTD performances, market capitalizations, a description of each, and links to the most recent news on each where present.

- Relay Therapeutics (RLAY): UP 6.6% last week; DOWN 37.7% YTD

- Company Description:

- RLAY specializes in developing an artificial intelligence-driven allosteric drug-discovery platform intended to detects and characterizes interactions that occur on a protein of interest and combines computational methods with experimental approaches across the fields of structural biology, biophysics, and chemistry. Its initial focus on precision oncology and genetic diseases.

- Market Capitalization: $1.2B

- News: Relay Therapeutics Reports Third Quarter 2023 Financial Results and Corporate Highlights

- Company Description:

- Absci Corporation (ABSI): UP 4.6% last week; UP 1.8% YTD

- Company Description:

- is focused on antibody design, creating new from scratch antibodies (“de novo antibodies”), and testing them in laboratories in a 6-week process.

- Market Capitalization: $214M

- News: Absci Announces Collaboration with AstraZeneca to Advance AI-Driven Oncology Candidate

- Company Description:

- Schrödinger (SDGR): UP 3.5% last week; UP 74.5% YTD

- Company Description:

- SDGR offers specialized solutions for both small molecule discovery and biologics discovery focusing on structure prediction and protein engineering, including antibody modeling.

- Market Capitalization: $2.3B

- News: Schrödinger Reports Third Quarter 2023 Financial Results

- Company Description:

- Recursion Pharmaceuticals (RXRX); UP 1.3% last week; UP 0.7% YTD

- Company Description:

- RXRX specializes in drug discovery through machine learning using its proprietary Recursion Operating System and has one of the world’s most extensive biological and chemical datasets.

- It has several compounds in phase 1 and 2 studies, including a small molecule therapeutic for cavernous cerebral malformation and another for neurofibromatosis type 2.

- Recursion claims to conduct millions of experiments per week using supercomputers, machine learning and automated robotic labs.

- Market Capitalization: $1.5B

- News: RXRX Could Soar by 120%, According to Wall Street

- Company Description:

- AbCellera Biologics (ABCL): UP 0.1% last week; DOWN 48.7% YTD

- Company Description:

- ABCL develops antibody therapeutics using AI focusing on searching and analyzing the immune systems to find potential antibodies, then outsourcing their initial findings to their partners for further drug discovery.

- Market Capitalization: $1.4B

- News: AbCellera Reports Q3 2023 Business Results

- Company Description:

- e-therapeutics plc (ETXPF): No Change last week; DOWN 45.8% YTD

- Company Description:

- is focused on developing in-silico new RNAi (RNA interference) therapies

- Market Capitalization: $66M

- News: None

- Company Description:

- Lantern Pharma (LTRN): DOWN 0.3% last week; DOWN 37.9% YTD

- Company Description:

- LTRN specializes in developing new classes of precision cancer drugs with novel mechanisms of action and “recycling” previously unsuccessful cancer drugs using machine learning algorithms, genomic data, and novel precision oncology biomarkers.

- Market Capitalization: $42M

- News: Lantern Pharma Reports Third Quarter 2023 Financial Results and Operational Highlights

- Company Description:

- Exscientia (EXAI): DOWN 11.2% last week; DOWN 0.5% YTD

- Company Description:

- EXAI reported the first AI-designed drug candidate to enter clinical trials and has expanded its AI-based platform to develop novel therapeutic antibodies through generative AI design.

- Exscientia is collaborating with Bristol-Myers Squibb on a handful of drug candidates and has partnered with Sanofi, GSK and PathAI on drug discovery projects.

- Market Capitalization: $697M

- News: Exscientia Business Update for Third Quarter 2023

- Company Description:

- Evaxion Biotech A/S (EVAX): DOWN 16.3% last week; DOWN 60.1% YTD

- Company Description:

- focus on infectious diseases and oncology.

- Market Capitalization: $19M

- News: Evaxion to Unveil Potentially Groundbreaking AI-Immunology™ Precision Cancer Vaccine Concept

- Company Description:

- BioXcel Therapeutics (BTAI): DOWN 17.9% last week; DOWN 85.2% YTD

- Company Description:

- BTAI leverages existing approved drugs and/or clinically evaluated product candidates together with big data and machine learning algorithms to identify new therapeutic applications.

- Most of their drug candidates fit within the field of neuroscience disorders but the company's pipeline also includes clinical studies for combining small molecule cancer drugs with an antibody pembrolizumab, for specific cancer cases.

- Market Capitalization: $93M

- News: BioXcel Reports Q3 2023 Financial Results and Strategic Updates

- Company Description:

Summary

On average, the above 10 stocks were UP 4.0% last week but are still DOWN 21.3%. In comparison the 5 psychedelic compound-based clinical stage drug stocks being followed (see here) were UP 2.8% last week and are DOWN 10.1% YTD.

In addition to the above small cap and primarily clinical-stage companies there are 12 Big Pharma companies using AI to transform the landscape of drug discovery, clinical trials and manufacturing, namely: Moderna, Sanofi, Pfizer, Novartis, Janssen, Astra Zeneca, Bristol Myers, Bayer, Merck, GSK, Roche and Lilly. Source

More By This Author:

5 Largest Psychedelic Compound-Based Drug Stocks Up 3% Last Week

7 Largest Cannabis (Marijuana) MSOs Were Up 10% This Week

5 Largest Cannabis (Marijuana) LP Stocks Up 9% This Week

Disclosure: None

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more