The 10 Highest Yielding MLPs Analyzed For Income Investors

Master Limited Partnerships, or MLPs, are fairly popular investment choices among income investors. It is easy to see why—MLPs pass through the bulk of their cash flow to investors. Their high yields of 5%+ are very attractive for investors who desire higher levels of income from their investments. And, with the S&P 500 Index on average yielding under 2%, the income potential of MLPs is even more appealing.

However, not all MLPs are worthy of investment. MLPs have unique risk factors, which investors should weigh carefully before investing. In addition, a high dividend yield alone is not necessarily reason to invest. A sky-high yield of 10% or more can be a warning sign that the company’s fundamentals are deteriorating, which could be a precursor to a dividend cut.

The following 10 MLPs are the highest yielding we track in the Sure Dividend MLP database, with market capitalizations above $1 billion.

High-Yield MLP No. 10: Icahn Enterprises (IEP)

Distribution Yield: 10.0%

Icahn Enterprises is a diversified holding company. It gives investors the opportunity to follow the investments of Carl Icahn, one of the most famous activist investors in the world. Over his long investing career, he has become famous for taking large positions in companies, and then pushing for board seats and major operational changes. Icahn is the largest shareholder of Icahn Enterprises, with a ~91% stake.

Icahn Enterprises focuses its investments in 10 market sectors, with over $28 billion in invested assets as of 12/31/17.

Source: 2018 Investor Presentation, page 4

Icahn Enterprises has investments in many well-known companies. For example, among the automotive segment it has holdings in Pep Boys. Various other investments across Icahn Enterprises include railcar services, meat casings, metals recycling, rental real estate, and a mining operation in Brazil.

Source: 2018 Investor Presentation, page 6

Icahn Enterprises recently made a significant change to its portfolio when it announced it will sell Tropicana Entertainment’s real estate to Gaming and Leisure Properties, Inc. (GLPI) and merge its gaming and hotel operations into Eldorado Resorts, Inc. (ERI), for a total sale price of approximately $1.85 billion.

Tropicana is a good example of the successful investment strategy employed by Icahn Enterprises over the years. Icahn made its first investment in Tropicana in 2008, when it was bankrupt. Icahn quickly installed a new CEO and management team, and the company recovered strongly after the Great Recession ended.

On 5/3/18, Icahn Enterprises reported first-quarter financial results. Adjusted earnings-before-interest-taxes-depreciation-and-amortization (EBITDA) increased 31% to $551 million, driven by strong performance of the company’s underlying portfolio investments and subsidiaries.

Icahn Enterprises has gotten off to a very good start to 2018, which allowed the company to recently increase its distribution by 17%. The company currently pays an annual distribution of $7 per unit, which represents a 10% yield.

Icahn Enterprises reported earnings-per-unit of $14.80 in 2017, which means the new distribution represents a payout ratio of 47%. A payout ratio below 50% indicates the distribution is secure, making Icahn Enterprises an attractive high-yield stock.

High-Yield MLP No. 9: Suburban Propane Partners (SPH)

Distribution Yield: 10.4%

Suburban Propane Partners is engaged in selling propane and related services and accessories. It has approximately 1 million residential, commercial, industrial and agricultural customers in 41 states.

Source: Investor Fact Sheet, page 1

On 5/10/18 the company reported second-quarter earnings. Revenue of $536.3 million rose 19% year-over-year, but missed analyst expectations by $10.3 million. In addition, earnings-per-share of $1.73 also missed estimates, by $0.31 per share. This was a significant miss for Suburban Propane on both key metrics.

Revenue growth last quarter was due primarily to higher propane and higher volumes sold. However, Suburban Propane has struggled with a long-term trend of warm weather. Propane sales are closely tied to weather patterns. Over the first half of fiscal 2018, the company noted weather in its operating regions was 7% warmer than normal, based on average heating degree days over the prior 30 years.

Poor weather patterns contributed to a difficult year in 2017, which compelled Suburban Propane to cut its dividend by 32% on 10/26/17. Such a large dividend cut is never good to see, however the new distribution is much more sustainable for the company. Distributions paid over the first half of the current fiscal year represented a payout ratio of 52%, which is manageable.

If weather patterns normalize, we believe Suburban Propane can generate satisfactory returns moving forward. We forecast EBITDA growth of 3%-4% per year, on average, in a normal operating environment. In addition, the 10% distribution yield will add significantly to annual returns. Lastly, we believe the share price is undervalued. The stock trades for a price-to-EBITDA ratio slightly above 5, and we believe fair value is a price-to-EBITDA ratio of 8.

The impact of a rising valuation could add approximately 9% to annual returns over the next five years. As a result, we believe total returns for Suburban Propane could reach into the high-teens on an annual basis.

High-Yield MLP No. 8: Golar LNG Partners (GMLP)

Distribution Yield: 11.1%

Golar LNG operates marine-based liquefied natural gas (LNG) infrastructure. The company liquefies and transports natural gas. It also has exposure to the upstream exploration and production segment through a joint venture with Schlumberger (SLB).

Source: 2018 Evercore ISI Energy Summit, page 3

Golar’s long-term growth proposition is driven by compelling fundamentals for natural gas. According to the company, gas is cheaper to produce than oil, and is cleaner than many other fossil fuels. Demand for LNG is growing at a high rate, particularly in the emerging markets. Golar expects global LNG demand to increase at a 5% annual rate going forward.

New projects are critical to Golar’s future growth plans. On that front, the company recently shipped first cargo from a major LNG project in Cameroon. Golar has an eight-year supply agreement with Gazprom (OGZPY). Golar hopes to roll out similar plants in Equatorial Guinea, and in Senegal.

However, Golar’s financial performance in recent years left a lot to be desired. For example, in 2017 the company reported a net loss of $145 million. It has reported net losses each year since 2014.

Golar currently pays a quarterly dividend of $0.5775 per share, which works out to $2.31 per share annualized. This results in a huge yield above 11%, but investors should also be concerned with sustainability of the dividend. Fortunately, things look better from the perspective of distributable cash flow. Golar had a DCF coverage ratio of 1.2 in 2017, but with a debt-to-EBITDA ratio of 4.0, the company also has a significant amount of debt on the balance sheet.

Golar is an example of a high-risk, high-reward stock.

High-Yield MLP No. 7: USA Compression Partners (USAC)

Distribution Yield: 11.5%

USA Compression Partners is one of the largest providers of compression services in the U.S. It partners with natural gas and crude oil producers and transporters to provide compression services. Compression helps move oil and gas through pipeline systems, and enhances oil and gas production and transportation.

The company has a significant presence in some of the highest-quality oil and gas fields in the U.S., including the Permian, Marcellus, Haynesville, and Eagle Ford regions.

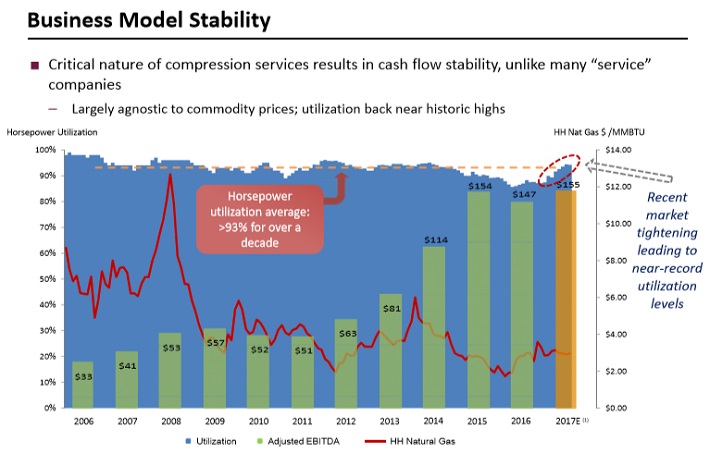

Another benefit of compression service is that it is largely unaffected by commodity prices. By servicing mostly midstream infrastructure such as pipelines, USA Compression Partners’ cash flow is based more heavily on demand. Fortunately, the company’s utilization has remained above 93% for more than a decade.

Source: Wells Fargo MLP Symposium, page 6

On 3/15/18, the Federal Energy Regulatory Commission (FERC) announced that it will no longer allow interstate pipelines owned by MLPs to recover an income tax allowance in the cost of service. In response to this announcement, USA Compression Partners stated that it does not currently provide services pursuant to FERC jurisdictional cost of service-based rates or own any interstate pipelines. As a result, the company does not expect any negative impact by the FERC announcement.

On 5/9/18, USA Compression Partners announced strong first-quarter results. Adjusted EBITDA was $44.1 million for the first quarter of 2018, an increase of 22% from $36.0 million for the first quarter of 2017. Distributable cash flow was $33.7 million, up 24% from the same quarter a year ago.

USA Compression Partners has a high yield above 11%, but investors should be aware that the company had a DCF coverage ratio of just 1.03x in the first quarter. This is a tight coverage ratio, and it indicates that the company barely generated enough cash flow to cover its distribution. Like Golar, USA Compression Partners is better served for investors with a high tolerance for risk.

High-Yield MLP No. 6: Sunoco LP (SUN)

Distribution Yield: 12.4%

Sunoco distributes motor fuel to convenience stores, independent dealers, commercial customers and distributors located in more than 30 U.S. states at approximately 9,200 sites. The company’s General Partner is owned by Energy Transfer Equity (ETE).

The company has three separate and stable income streams that contribute cash flow.

Source: 2018 Investor Presentation, page 8

In 2017, Sunoco had adjusted EBITDA of $732 million, an increase of 10% from 2016, while distributable cash flow increased 21% for the year. Growth was due to higher fuel prices as well as higher gallons sold. Sunoco’s momentum slowed somewhat in the 2018 first quarter. Sunoco reported adjusted DCF of $85 million, up 10% from $77 million in the same quarter a year ago. The first-quarter increase was due to lower interest expense and lower maintenance capital spending.

Sunoco’s main growth strategy is to grow the core fuel distribution business and add fee-based refined product terminals into its portfolio. An example of this is the recent acquisition of multiple assets from Superior Plus Corporation. The assets consist of a network of approximately 100 dealers, several hundred commercial contracts and three terminals, which are connected to major pipelines serving the Upstate New York market.

The wholesale fuels business sells approximately 200 million gallons of fuel annually through multiple channels. The three terminals have a combined 17 tanks with 429 thousand barrels of storage capacity. The acquisition is expected to be immediately accretive to Sunoco with respect to distributable cash flow.

Sunoco has a very high distribution yield above 12%, but there are warning signs. In the past four quarters, the company had DCF coverage of 1.22x, but coverage eroded to just 1.0x in the 2018 first quarter. Investors need to closely monitor the company’s results in future quarters to make sure coverage rises.

High-Yield MLP No. 5: Alliance Resource Partners LP (ARLP)

Distribution Yield: 11.3%

Alliance Resource is a coal mining company, and it was the first coal MLP. The company operates nine mining complexes in Illinois, Indiana, Kentucky, Maryland, and West Virginia. Its production facilities are located in two coal-producing regions, Appalachia and the Illinois Basin.

The past few years have been very difficult for Alliance Resource. Revenue declined significantly in 2015 and 2016, as demand for coal dropped. Many utilities across the U.S. have transitioned from coal to natural gas as a source of electricity generation. Alliance Resource kept growing production through this time, but weak pricing and soft demand more than outweighed the benefits of rising output.

Alliance Resource has two major competitive advantages, which at least helped the company stay afloat while so many other coal miners have gone bankrupt in recent years. First, the company’s coal mines are situated close to its industrial customers. This helps keep distribution and transportation costs low.

Second, Alliance Resource primarily produces thermal coal, which is used to generate electricity. The economics of thermal coal have remained intact relative to metallurgical coal, which is used to produce iron and steel.

While the company cut its quarterly distribution by 35% in 2016, to $0.4375 per unit, it has returned to distribution growth since then. Alliance Resource has increased its distribution for four quarters in a row, and now pays a quarterly distribution of $0.515 per unit, or $2.06 per unit.

Still, the challenging macroeconomic environment for Alliance Resource has kept a lid on its growth opportunities. For the 2018 first quarter, reduced coal sales volumes and prices resulted in a 3.4% revenue decline. Lower sales volumes were due to weather-related transportation disruptions. Fortunately, Alliance Resource is actively pursuing exports to fuel growth. The company has now booked contracts to export 6.8 million tons of thermal coal and 490,000 tons of metallurgical coal in 2018.

The company expects to increase its distribution by 4% in 2018. Alliance Resource had a payout ratio of 67% in 2017, which indicates the distribution is sustainable.

High-Yield MLP No. 4: Buckeye Partners (BPL)

Distribution Yield: 13.4%

Buckeye Partners is a midstream MLP. It has approximately 6,000 miles of pipelines, and more than 135 liquid petroleum product terminals, with over 176 million barrels of total storage capacity. Approximately 95% of EBITDA is derived from fee-based sources.

Source: 2018 Investor Presentation, page 4

Buckeye’s portfolio of pipelines and terminals is located in the East Coast, Midwest, and Gulf Coast regions of the U.S. It also has a significant international presence, with a 50% interest in VTTI. In 2017, adjusted EBITDA and DCF rose 8.3% and 0.7%, respectively. However, performance deteriorated to start 2018. In the first quarter, adjusted EBITDA declined 5.7% year-over-year, while DCF fell 11%. The company’s distribution coverage ratio was just 0.91x in the first quarter, which is a bad sign.

Buckeye’s growth will be fueled by new projects. For example, its South Texas Gateway project calls for construction of a 600-mile long-haul pipeline, with total expected capacity of up to 400,000 barrels per day.

Source: 2018 Investor Presentation, page 19

Once the project is completed, it will significantly expand Buckeye’s distribution capabilities in the high-quality Permian Basin. The project is set for completion in 2019. Buckeye is also considering a natural gas liquids pipeline in the Permian, to further add to its presence in one of the most attractive oilfields in the U.S.

Another project set to ramp up in the near-term is the Michigan/Ohio expansion project. The company has secured 10-year commitments from oil customers, totaling 50,500 barrels per day. Phase two of the project, expected to be completed by the end of 2018, is projected to add another 40,000 barrels per day of capacity.

Buckeye reported a distribution coverage ratio of 1.0 for 2017, and coverage weakened to 0.91x in the 2018 first quarter. The company also has a debt-to-adjusted EBITDA ratio of 4.41x, which is slightly high but manageable. Investors should closely monitor company reports to make sure the company increases its DCF enough to once again cover the distribution.

High-Yield MLP No. 3: Energy Transfer Partners (ETP)

Distribution Yield: 11.7%

Energy Transfer Partners owns and operates crude oil, natural gas liquids, natural gas, and refined product transportation and storage assets. It also owns NGL fractionation assets. The company has a large network of assets, which includes over 70,000 miles of pipelines.

Source: 2018 UBS Conference Presentation, page 6

In 2017, Energy Transfer generated adjusted distributable cash flow per unit of $3.60. This was a 4.3% increase from DCF-per-unit of $3.45 in 2017. Growth was primarily due to higher throughput volumes, and higher commodity prices. Energy Transfer’s strong performance has continued in 2018. On 5/9/18, Energy Transfer released first-quarter earnings. Adjusted EBITDA and distributable cash flow increased 30% and 40%, respectively, from the same quarter a year ago.

The major growth catalyst for Energy Transfer Partners is new pipeline projects. Fortunately, Energy Transfer has an impressive lineup of growth projects, several of which are ramping up, while others are still in the construction phase and moving towards completion.

Source: 2018 UBS Conference Presentation, page 14

One of the most important projects for Energy Transfer is the Rover project, of which it owns approximately 33%. Rover is now capable of transporting more than 1.7 Bcf per day, with the goal of total storage capacity of 3.25 Bcf per day by the second quarter of 2018.

Separately, Energy Transfer’s Red Bluff Express pipeline is under construction, and it will consist of 80 miles of pipeline, with capacity of at least 1.4 Bcf per day. It is expected to be online in the second quarter of 2018. The company is also expanding its Permian Express 3, which has the potential to add an additional 200,000 barrels per day of capacity.

Energy Transfer had a leverage ratio of 3.98x last quarter, which indicates a manageable level of debt. In addition, the company had a distribution coverage ratio of 1.15x last quarter, more than covering the distribution with cash flow. Energy Transfer appears to be one of the stronger high-yielding MLPs, and is an attractive option for income investors.

High-Yield MLP No. 2: NGL Energy Partners (NGL)

Distribution Yield: 14.4%

NGL Energy Partners is a diversified energy company. It owns and operates a vertically integrated energy business with five primary businesses: water solutions, crude oil logistics, NGL logistics, refined products/renewables and retail propane.

Source: 2018 Investor Presentation, page 4

On 2/9/18, NGL reported quarterly financial results. Distributable cash flow declined 20% from the same quarter a year ago. Performance was adversely affected by declining volumes in ethanol and biodiesel. Liquids segment performance was negatively impacted by unrecovered railcar fleet costs, and excess storage capacity.

Over the first three quarters of the current fiscal year, adjusted EBITDA declined 3%. Distributable cash flow declined 43%, due largely to a 47% increase in interest expense, and a 49% increase in maintenance capital expenditures.

NGL has taken measures to reduce its debt load, which will help secure its high distribution. For example, the company sold a portion of its Retail Propane business to DCC LPG for $220 million in cash, which the company utilized to reduce debt. It also sold its 50% interest in the Glass Mountain Pipeline to a fund managed by BlackRock Real Assets, for $300 million.

The company expects its debt-reduction efforts will reduce its leverage ratio to 3.25x, and also allow it to achieve an investment-grade credit rating. Until then, investors should view the distribution with some skepticism. The company currently has a leverage ratio of 5.1x, as of the most recent quarter. In addition, the distribution coverage ratio of 0.70x in the past 12 months is a clear warning sign that the distribution may not be sustainable.

High-Yield MLP No. 1: Summit Midstream Partners (SMLP)

Distribution Yield: 14.4%

Summit Midstream Partners is the highest-yielding MLP in our database, with a market capitalization over $1 billion. It owns and operates midstream energy assets in unconventional resource basins, such as shale formations. It provides natural gas, crude oil and produced water gathering services, primarily under long-term and fee-based gathering and processing agreements.

Summit has five core areas of operation in the U.S., which are the Utica Shale, the Williston Basin, the Piceance/DJ Basins, the Barnett Shale, and the Marcellus Shale. The company has natural gas capacity of 1.6 billion cubic feet per day, along with 76,000 barrels per day of liquids throughput volumes. The core areas of operation have strong fundamentals.

Source: 2018 Investor Presentation, page 7

Among Summit’s growth initiatives are the start-up of the Delaware gathering and processing plant, expected in the 2018 third quarter, and an expansion project in the DJ Basin expected to ramp up in the fourth quarter. The company also notes expanded well drilling at the Williston Basin, which should lead to higher transportation volumes in that region.

The company did not get off to a good start to 2018. First-quarter adjusted EBITDA and DCF declined 1.5% and 17%, respectively, from the same quarter last year. The declines were due to a recent contract amendment with a Piceance/DJ Basins customer which required this customer to make monthly payments, rather than what historically had been an annual payment in the first quarter of the year.

Summit currently pays a quarterly distribution of $0.575, and it has not increased its distribution since 2015. But with a yield exceeding 14%, even a flat distribution can generate strong returns for investors. However, the company had a distribution coverage ratio of 0.98x in the 2018 first quarter, which means it did not generate enough DCF to fully cover the distribution.

Helping to boost distribution sustainability is the company’s relatively low level of debt. Summit ended the 2018 first quarter with a leverage ratio of 3.63x, which is fairly low for a midstream MLP.

Still, Summit has a credit rating of BB- from Standard & Poor’s, a non-investment grade credit rating that elevates the company’s cost of capital. With a sub-investment grade credit rating and weak coverage, investors should be aware that the dividend may be cut in the future, if DCF growth does not meet expectations.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more