The 10 Best Dividend Kings For Long-Term Total Returns

When it comes to high-quality dividend growth stocks, the Dividend Aristocrats are hard to beat. The Dividend Aristocrats are a group of 53 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

The Dividend Aristocrats are a great source of dividend growth stocks, but there is a smaller group of stocks with an even longer history of dividend increases. The Dividend Kings are a group of just 25 stocks, each with 50+ consecutive years of dividend growth.

This article will discuss the top 10 Dividend Kings found in the Sure Analysis Research Database, based on expected future returns.

All 10 stocks on the list have increased their dividends for at least 50 years, and have a strong brand with durable competitive advantages. They should continue to increase their dividends each year, and generate positive returns for shareholders.

Dividend King No. 10: Illinois Tool Works

- Expected Annual Return: 6%-7%

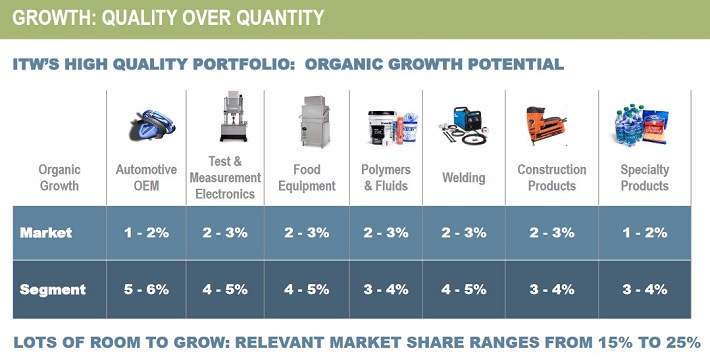

Leading off is diversified industrial manufacturer Illinois Tool Works (ITW). Over the 100+ years in the company’s operating history, Illinois Tool Works steadily expanded into new products and geographic markets. Today, Illinois Tool Works has a market capitalization of $50 billion, and generates annual revenue of more than $13 billion. It has a large portfolio, with strong growth potential across its core markets.

Source: Investor Day Presentation, page 24

Over time, Illinois Tool Works has reshaped its portfolio, to expand in growing categories, and exit non-performing areas. Illinois Tool Works’ current portfolio is diversified across industry groups, including automotive, food equipment, electronics, welding, polymers & fluids, and construction products. Its continuous portfolio evaluation process has allowed it to stay ahead of the competition, and grow steadily over many decades.

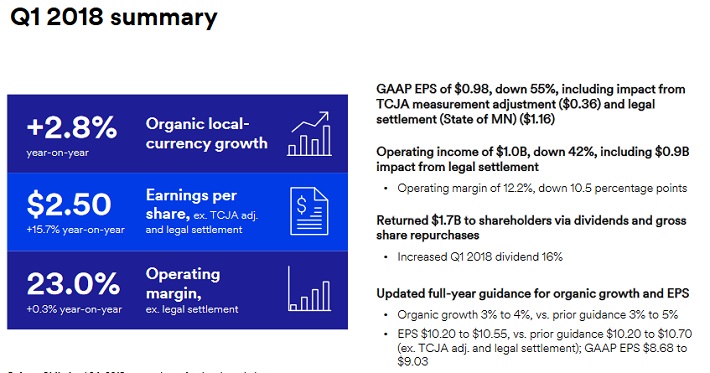

In the 2018 first quarter, total revenue increased 8%, driven by 3% organic growth. Operating income rose by 12% for the quarter. Earnings-per-share increased 23%, due to revenue growth, margin expansion, and share repurchases. For the full year, Illinois Tool Works expects 17% earnings growth at the midpoint of guidance.

The only negative for Illinois Tool Works is current valuation. With a current share price of $147 and a fair value estimate of $128, we believe the stock is undervalued. A declining price-to-earnings ratio could result in negative annual returns of approximately 3% per year, over the next five years. Still, the stock can generate positive returns, through earnings growth and dividends. We expect Illinois Tool Works to grow earnings by 7% per year. Combined with a 2.1% dividend yield, total returns are expected in the 6%-7% range each year.

Dividend King No. 9: SJW Group

- Expected Annual Return: 6%-7%

SJW was founded in 1866 and was initially known as the San Jose Water Company. SJW is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses. SJW currently consists of three subsidiaries: San Jose Water Company, SJWTX, Inc., and SJW Land Company.

San Jose Water Company, a regulated utility, has almost 230,000 connections and provides water to nearly one million people in the Silicon Valley area. SJWTX is a regulated water utility company that supplies water to more than 40,000 people in the area between San Antonio and Austin, Texas. The company also has a small real estate division that owns and develops properties for both residential and warehouse customers in California and Tennessee.

Source: Investor Presentation, page 6

On 3/14/2018 SJW announced that it will be merging with Connecticut Water Service (CTWS), which will add 135,000 customers in Connecticut and Maine to SJW’s customer base. SJW shareholders will own approximately 60% of the combined company. SJW believes the deal will be accretive to earnings in the first year, due to cost synergies.

Perhaps the biggest reason that SJW has attained Dividend King status, is its competitive advantage. As a water utility, SJW operates in a highly regulated industry that would make it virtually impossible for a new company to enter and take market share. In addition, water is a necessity for human survival, which basically ensures a steady stream of cash flow for the company.

The other benefit for a regulated utility is that it can pass along rate hikes each year. For example, San Jose Water was granted a rate increase of 4.2% for 2018. The company also submitted its application for rate increase for 2019-2021. If granted, San Jose Water will be able to see increases of 9.8%, 3.7% and 5.2% for 2019, 2020, and 2021, respectively.

Because of these various advantages, water utilities generate surprisingly strong growth rates. On 4/25/18 SJW reported first-quarter results. Revenue increased 8.6% year over year, due to higher customer usage, new customers, and higher rates.

SJW stock trades for a price-to-earnings ratio of 23.6. At $63, the stock appears overvalued, as we have a fair value price of $53. Even though a declining valuation could reduce annual returns by ~3% per year, the stock can still generate annual returns of 6%-7%, due to 8%-10% earnings growth plus dividends.

Dividend King No. 8: 3M

- Expected Annual Return: 7%-8%

Next is another diversified industrial manufacturer. 3M (MMM) has a portfolio of more than 60,000 products that are used in homes, offices, hospitals, schools and businesses around the world. The company sells its products in more than 200 countries. It has five main operating segments: Industrial, Safety & Graphics, Healthcare, Electronics & Energy, and Consumer.

3M has raised its dividend for 60 consecutive years. Its long history of dividend growth is due to the company’s competitive advantages. 3M has a reputation for product innovation, thanks to its technology and intellectual property.

Source: Jefferies Industrials Conference, page 14

3M has 46 technology platforms and a team of scientists, dedicated to fueling innovation. It also has over 100,000 patents obtained throughout its history, which helps fend off competitive threats. 3M’s intellectual property has proven to be a major asset. In 2017, 3M increased organic revenue and adjusted earnings-per-share by 5.2% and 12%, respectively.

On 4/24/18, 3M announced strong quarterly earnings. Sales increased 7.7% to $8.3 billion, while organic sales rose 2.8%. All five operating segments grew revenue, led by Safety & Graphics which reported 6.9% growth. Organic sales increased 2.3% in the U.S., 4.9% in Asia, 3.5% in Latin America & Canada, and 0.1% in Europe, the Middle East, and Africa. Adjusted earnings-per-share increased 16% from the same quarter a year ago.

Source: 2018 Annual Meeting, page 7

3M is a high-quality business, but it appears to be overvalued right now. With a current share price of $200, 3M stock is above our fair value estimate of $180. If the stock returns to our estimate of fair value, a declining valuation could reduce annual returns by 2% per year over the next five years.

That said, 3M should continue to grow earnings at a high rate. If the company could manage 7% earnings growth each year, along with a 2.7% dividend yield, total returns could reach 7%-8% annually.

Dividend King No. 6: The Coca-Cola Company

- Expected Annual Return: 7%-10%

Coca-Cola (KO) was founded in 1892. Today, it is the world’s largest beverage company. It owns or licenses more than 500 non-alcoholic beverages, including both sparkling and still beverages. It sells products in more than 200 countries around the world, and it has 21 brands that generate $1 billion or more in annual sales.

Coca-Cola’s sparkling beverage portfolio includes the flagship Coca-Cola brand, as well as other soda brands like Diet Coke, Sprite, Fanta, and more. The still beverage portfolio includes water, juices, and ready-to-drink teas, such as Dasani, Minute Maid, Vitamin Water, and Honest Tea.

Source: Investor Presentation, page 9

Coca-Cola dominates sparkling soft drinks, where it commands over 50% market share. And yet, this is a challenging time for Coca-Cola. Consumer preferences are shifting in the U.S. Consumers are gradually becoming more health-conscious, and appear to be steadily turning away from soda for its high sugar and calorie content. Soda sales have fallen in the U.S. for more than a decade. In response, Coca-Cola has broadened its portfolio beyond soda.

Despite the recent slowdown, Coca-Cola is still a very strong business. Coca-Cola is the 5th most valuable brand in the world. The company commands high market share, which gives it the ability to raise prices over time. When the company accelerated its investments in new products back in 2014, it saw higher organic growth rates in the following two years.

Source: Investor Presentation, page 9

Coca-Cola is off to a good start to 2018. In the first quarter, organic revenue and adjusted earnings-per-share increased 5% and 8%, respectively. Case volume grew 3% thanks to strong performance of smaller, immediate-consumption packaging.

Coca-Cola has a current share price of $42. We estimate a fair value price of $38, and a price-to-earnings ratio of 18-19. Coca-Cola appears slightly overvalued, which could reduce returns by 2% per year. However, we expect the company to generate 6%-8% annual earnings growth, driven by revenue growth through price increases, margin improvements, and share repurchases.

In addition, Coca-Cola stock has a current dividend yield of 3.7%. Putting it all together, and we believe Coca-Cola stock could return 7%-10%

Dividend King No. 5: Johnson & Johnson

- Expected Annual Return: 9%-10%

Johnson & Johnson (JNJ) is a legendary dividend growth stock, with 56 consecutive years of dividend increases. J&J is a diversified healthcare company, with a pharmaceutical, consumer, and medical devices franchise.

For the 2018 first quarter, J&J generated earnings-per-share of $2.06 on revenue of $20.01 billion. On a year-over-year basis, total revenue increased 12.6% (core organic revenue up 4.3%), while adjusted earnings-per-share rose 13%.

Source: Earnings Presentation, page 1

The revenue breakdown by product segment is as follows:

- Consumer: $3.398 billion (up 5.3%)

- Pharmaceutical: $9.844 billion (up 19.4%)

- Medical Devices: $6.767 billion (up 7.5%)

J&J saw broad-based growth from all segments. In consumer products, beauty and oral care grew 10.5% and 4.7%, respectively. J&J has multiple industry-leading consumer brands, including Band-Aid, Listerine, Neutrogena, Aveeno, and more.

The pharmaceutical segment led the way again for J&J. In the pharmaceutical portfolio, infectious diseases revenue increased 10.8%, while oncology sales soared 45% year over year.

Source: Earnings Presentation, page 10

J&J’s pharmaceutical pipeline is a positive growth catalyst moving forward. The company is on track to meet its goal of filing 10 new major products by 2019, each with at least $1 billion in annual sales potential. In addition, J&J expects as many as 40 line extensions by 2019, 10 of which have at least $500 million in potential sales.

For 2018, J&J expects revenue of $81 billion to $81.8 billion, along with adjusted earnings-per-share of $8.00 to $8.20. Importantly, J&J lifted its revenue guidance. Previous expectations were for full-year 2018 revenue of $80.6 billion to $81.4 billion. Revenue is expected to increase by at least 6% this year, along with 10%+ adjusted earnings growth. As a result, 2018 is likely to be another very good year for J&J.

We believe J&J stock is fairly valued, which means it will generate satisfactory returns from earnings growth and dividends. Combining 6%-7% annual earnings growth with a 2.9% current dividend yield, would result in total returns of approximately 9%-10% per year.

Dividend King No. 4: Colgate-Palmolive

- Expected Annual Return: 9%-10%

Colgate-Palmolive (CL) has increased its dividend for 56 years in a row. The company was founded in 1806. Today, it manufactures oral care products like toothpaste, personal care products such as soap, home cleaning products, and pet food. Colgate-Palmolive has many competitive advantages which have fueled its growth over the past 200+ years.

First, it has built a dominant position in its core product categories. For example, in toothpaste, Colgate-Palmolive it commands a higher market share than the next-three largest competitors combined. The company’s major brands include Colgate, Palmolive, Hill’s Science Diet, and more.

Source: 2018 CAGNY Presentation, page 4

On 4/27/18, Colgate-Palmolive announced first-quarter earnings. Net sales of $4.0 billion rose 6.5% from the same quarter last year. The revenue increase was due to 2.0% volume growth, and a 4.5% benefit from foreign exchange. Organic sales increased 1.5% for the quarter. For 2018, Colgate-Palmolive expects net sales growth in the mid-single digits, with organic sales to be up in the low to mid-single digit range.

To combat higher raw materials costs, Colgate-Palmolive is also launching a company-wide productivity initiative, to help reduce expenses. The company expects gross margin to rise 75 to 125 basis points in 2018 as a result, which will help Colgate-Palmolive continue to grow earnings and dividends. And, thanks to its strong brands, the company can raise prices each year to stay ahead of rising costs of raw materials.

Source: 2018 CAGNY Presentation, page 60

In addition, the company has drastically improved its performance in North America. Sales in North America increased 5.0% last quarter, thanks to the successful launch of many new products. In manual toothbrushes, Colgate widened its brand market leadership in the U.S. with its market share in that category to 42.6%.

We expect Colgate-Palmolive to generate earnings growth of 6%-7% per year, due to revenue growth, cost cuts, and share repurchases. Combined with a 2.7% dividend yield, Colgate-Palmolive stock can generate annual returns of over 9% per year.

Dividend King No. 4: Procter & Gamble

- Expected Annual Return: 10%

Procter & Gamble (PG) has increased its dividend for 62 years in a row. This is a period of transition for P&G. The company divested dozens of under-performing brands that had exhibited slowing growth, including the sale of battery brand Duracell to Berkshire Hathaway (BRK-A) for $4.7 billion, and a collection of 43 beauty brands to Coty (COTY) for $12.5 billion.

P&G has slimmed down to just 65 brands, down from 170 previously.

Source: 2018 CAGNY Presentation, page 15

Now, P&G is a much leaner and more efficient organization, with lower costs and higher margins. For example, in the most recent quarter, P&G grew total revenue by 4.3%. Organic revenue increased 1%. Pricing was down 2%, but volumes increased 2%. Earnings-per-share increased 4% from the same quarter last year. P&G also raised its forecast for fiscal 2018. The company now expects 6%-8% core earnings growth for the full year.

The announcement of a major acquisition could accelerate P&G’s growth potential even further. P&G will acquire the global consumer health business from German pharmaceutical giant Merck, for approximately $4.2 billion in cash.

Source: Acquisition Presentation, page 6

This is an attractive acquisition for P&G. The business it will acquire from Merck generates $1 billion in annual sales. P&G states the acquired businesses are growing at a “mid-to-high single digit pace”. The acquisition includes 10 core brands, with products such as vitamins, nutritional supplements, and other over-the-counter products.

The deal will help boost P&G’s existing healthcare product line, and it will add new product categories currently unaddressed by P&G’s portfolio. According to Merck, the global OTC market is expected to grow 5% annually through 2025, which explains why P&G wants to invest more heavily in this area moving forward.

We expect mid-single-digit earnings growth for P&G each year going forward. In addition, the stock appears to be undervalued, and a rising valuation could add to annual returns. For example, if it took four years to reach our fair value estimate, the expanding price-to-earnings ratio would add approximately 3% to P&G’s annual returns. With a 3.9% dividend yield, P&G’s total returns could exceed 10% per year.

Dividend King No. 3: Genuine Parts Company

- Expected Annual Return: 10%

Genuine Parts (GPC) has been in business for 90 years. The original Genuine Parts store had annual sales of just $75,000, and only 6 employees. Today, Genuine Parts has nearly 40,000 employees, and generates annual sales exceeding $16 billion.

The company has four segments: Automotive Parts, Industrial Parts, Office Products, and Electrical & Electronics Materials. The automotive parts segment is Genuine Parts’ largest, and includes the core NAPA brand.

Source: Investor Presentation, page 8

The industrial parts group sells industrial replacement parts to MRO (maintenance, repair, and operations) and OEM (original equipment manufacturer) customers. Customers are derived from a wide range of segments, including food and beverage, metals and mining, oil and gas, and health care. The office products segment distributes business products in the U.S. and Canada. Customers include office products dealers, office supply stores, college bookstores, office furniture dealers, and more. Genuine Parts also distributes electrical and electronic materials to original equipment manufacturers and industrial assembly firms.

On 4/19/18, Genuine Parts reported first-quarter results. Sales rose 17% to a record $4.6 billion, while adjusted earnings-per-share increased 18% from the same quarter a year ago. Genuine Parts expects sales to be up 12% to 13% in 2018, and adjusted diluted earnings per share in a range of $5.60 to $5.75.

Our fair value estimate for Genuine Parts is a stock price of $97. With a current share price of $91, the stock is undervalued. A rising valuation could add 1% to the stock’s annual returns over the next five years. In addition, we expect Genuine Parts to grow earnings by 6%-7% per year, and the stock also has a 3.1% dividend yield. As a result, we believe Genuine Parts stock could generate total returns of 10%+ each year.

Dividend King No. 2: Dover Corp.

- Expected Annual Return: 11%-12%

Dover (DOV) is another industrial manufacturer, with over 60 years of consecutive dividend increases under its belt. Its products include equipment, components, specialty systems, and related services. Dover’s largest segment, Engineered Systems, designs and manufactures components. Its products are used across multiple end markets, including consumer goods, textile printing, automotive service, environmental solutions, and industrials.

Dover’s fluids segment helps customers improve transfer and dispensing of fluids. The refrigeration segment supplies energy-efficient equipment to the food industry, and the energy segment offers solutions and services to improve safety and efficiency of fuel production.

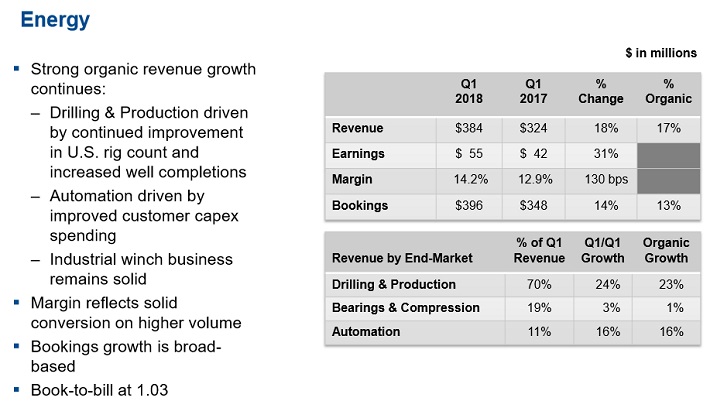

On 4/27/18, Dover reported strong first-quarter results. Revenue and earnings-per-share increased 6% and 26%, respectively. The energy segment led the way, with 17% organic sales growth for the quarter, boosted by higher commodity prices.

Source: Earnings Presentation, page 8

Dover’s major growth catalysts are rising oil and gas prices, and acquisitions. The recovery in oil and gas prices over the past year has resulted in renewed spending activity among Dover’s major customers. Increased rig counts and well completions have driven higher U.S. drilling and production.

In addition to a recovery in the oil and gas markets, Dover’s growth will benefit from acquisitions, which are a key part of the company’s growth strategy. From 2014-2016, Dover spent $2.9 billion on 17 bolt-on acquisitions. Acquisition activity has slowed a bit over the past year, but acquisitions still added 1% to Dover’s revenue growth in the 2018 first quarter. More recently, Dover announced it will acquire Germany-based manufacturer Ettlinger Kunststoffmaschinen. The acquired business will fit into Dover’s existing Fluids segment.

We expect Dover to reward shareholders with an earnings growth rate of 8% to 10% per year. Along with its 2.3% dividend yield and a mild expansion of the price-to-earnings ratio, Dover is expected to generate annual returns of 11%-12%.

Dividend King No. 1: Lowe’s Companies

- Expected Annual Return: 11%-12%

Lowe’s (LOW) is the #2 home improvement retailer in the U.S., behind only The Home Depot. As of last quarter, Lowe’s operated 2,154 home improvement and hardware stores in the U.S., Canada and Mexico. Lowe’s offers a wide range of products, for maintenance, repair, remodeling, and decorating the home. It has a wide selection of leading national brands, as well as a large number of private brands.

Source: Investor Presentation, page 5

Lowe’s continues to perform well, as consumers remain willing and able to spend on their homes. First-quarter sales rose 3%, thanks to new store openings and a 0.6% increase in comparable store sales, which analyzes sales at stores that have been open at least one year. Adjusted earnings-per-share increased 15%, despite the fact that unfavorable weather reduced consumer demand in the first quarter. Lowe’s expects trends to normalize over the remainder of the year, and the company forecasts 5% sales growth in 2018, along with 3.5% comparable sales growth.

Lowe’s is benefiting from several tailwinds. The economy continues to grow, as does the housing market. Rising wages and home prices are incentivizing more consumers to invest in their homes, while unemployment is well below 5%. These trends are all positive for Lowe’s.

International growth is also a priority for Lowe’s, which is why it acquired Canadian home improvement retailer Rona, for $2.3 billion.

Source: Investor Presentation, page 9

Adding Rona gives Lowe’s access to the large, and growing, Canadian home improvement market. Lowe’s forecasts 4% annual growth for the overall Canada home improvement market in 2018. The company also expects to generate over $1 billion of cost synergies from the Rona deal.

With a fair value price of $93 and a current share price of $97, Lowe’s is fairly valued. While investors may not see further expansion of Lowe’s valuation, we believe its high rate of earnings growth more than makes up for it. We expect 10%+ annual earnings growth for Lowe’s going forward, assuming the U.S. stays out of recession. Combined with a 1.7% dividend yield, Lowe’s could generate total returns approaching 12% annually.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more