TGB Stock Price: Riding The Copper Wave With Taseko Mines

TGB Stock Price Outlook: Navigating the Copper Market

Introduction:

Taseko Mines Limited (TGB), a Canadian copper mining company, presents a compelling investment opportunity in the dynamic and growing copper market. With a strong portfolio of assets, including the Gibraltar Mine, the second-largest open-pit copper mine in Canada, and the innovative Florence Copper Project in Arizona, Taseko is well-positioned to capitalize on the increasing global demand for copper.

The Gibraltar Mine boasts a proven and probable reserve of 2.3 billion pounds of recoverable copper, with an estimated mine life of 23 years. The Florence Copper Project, currently in the permitting stage, is expected to produce an average of 85 million pounds of copper annually over its 21-year mine life using an in-situ copper recovery process, which minimizes environmental impact and maximizes resource efficiency.

Copper’s critical role in the global transition to clean energy and electric vehicles has driven a surge in demand. The International Energy Agency (IEA) projects that the demand for copper will nearly double by 2040, reaching 60 million tonnes per year. This growth is primarily driven by the increasing adoption of electric vehicles, which require up to four times more copper than conventional vehicles, and the expansion of renewable energy infrastructure, such as solar and wind power.

Despite the growing demand, the global copper supply is facing challenges. Declining ore grades, operational disruptions, and the lack of new mining projects have led to concerns about a potential supply deficit. Taseko’s solid asset base and ongoing exploration efforts position the company to help bridge this gap and benefit from the rising copper prices.

From a contrarian perspective, Taseko Mines presents an attractive investment opportunity. The company’s TGB stock may not fully reflect its long-term potential, offering investors a chance to capitalize on the expected growth in the copper market. Additionally, Taseko’s commitment to environmental stewardship and community engagement aligns with the increasing focus on sustainable investing.

TGB Stock Price Outlook

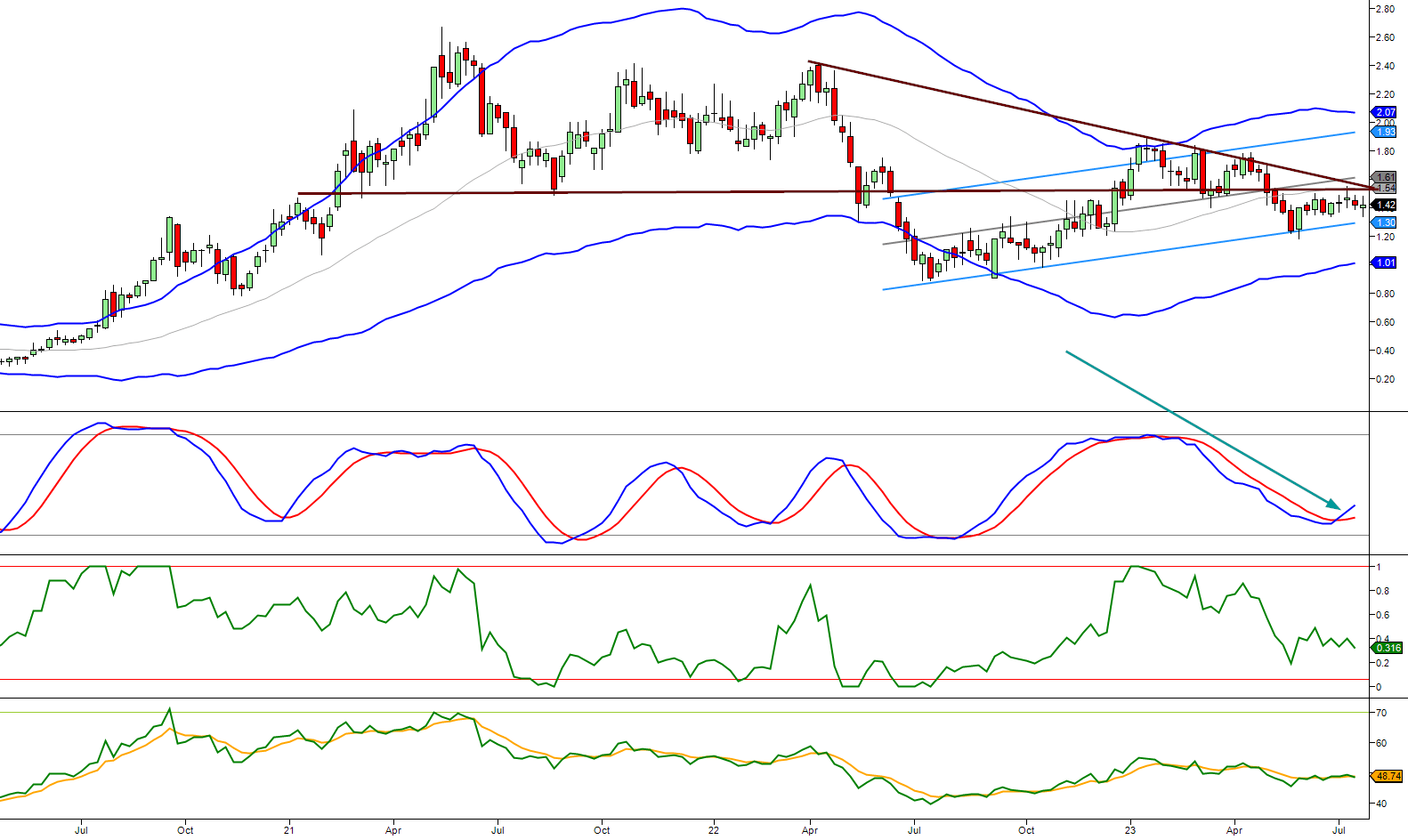

From a technical perspective, the stock has ample potential to continue its upward trajectory. The weekly chart indicates that TGB is currently trading in the oversold range, suggesting room for further growth. Similarly, the monthly chart echoes this sentiment. However, it is worth noting that TGB is encountering resistance within the 1.50 to 1.55 range. A significant breakthrough would occur with a weekly close at or above 1.50, preferably surpassing 1.55. Such a development would signal a new breakout and potentially propel TGB to even greater heights. Tactical Investor Update Jan 21, 2024

It successfully closed above $1.55 on a weekly and monthly basis, leading to a strong rally as predicted. Trading exceeded $2.80 before retracing. This validates the importance of patience and discipline, key principles we consistently emphasize for long-term success.

At this stage of the game, it makes sense to wait for it to consolidate before considering entry. Ideally, a drop to the $1.80 to $1.90 range would present a good opportunity. Overall, we anticipate TGB trading well past $5.50 in the months ahead. Strong pullbacks should be embraced, and if copper shortages persist as projected, TGB could be trading north of $7.20 before reaching a long-term peak.

Copper’s long-term outlook remains positive as long as it stays above $1.90. It can achieve substantial upward momentum if it achieves a weekly close above $3.90 or a monthly close at $4.20, possibly reaching the $6.50 plus range.

Taseko Mines: A Strategic Investment in the Copper Market

The company’s strong position in the market, coupled with its robust mining operations and growth potential, make it an attractive choice for investors looking to capitalize on the increasing need for this essential metal.

Recent data from the International Copper Study Group (ICSG) suggests a shift from a balanced market in 2023 to a potential surplus of 467,000 metric tons in 2024. However, this short-term forecast does not diminish the long-term bullish outlook for copper. The World Bank projects a steady 1.9% annual growth in copper demand through 2030, driven by the rapid expansion of electric vehicles (EVs) and renewable energy sectors.

Taseko Mines is well-positioned to benefit from this growing demand. The company’s flagship project, the Gibraltar Mine in British Columbia, Canada, is the second-largest open-pit copper mine in the country, with a proven and probable reserve of 3.2 billion pounds of copper. Additionally, Taseko’s Florence Copper Project in Arizona, USA, is expected to produce an average of 85 million pounds of copper annually over its 21-year mine life.

The increasing adoption of EVs worldwide is a significant driver of copper demand. According to the International Energy Agency (IEA), the number of EVs on the road is expected to reach 145 million by 2030, up from just 11 million in 2020. This rapid growth will require substantial copper for electric motors, batteries, and charging infrastructure.

Moreover, the global push towards renewable energy sources, such as wind and solar power, further bolsters the demand for copper. The metal is essential for constructing transmission lines and energy storage systems, making it a critical component in transitioning to a more sustainable future.

Taseko Mines: Expanding Copper Production through Key Projects

Taseko Mines, a Canadian copper producer, is strategically positioned to meet the growing global demand for copper through its existing operations and development projects. The company’s flagship Gibraltar Mine in British Columbia, Canada’s second-largest open-pit copper mine, has a processing capacity of 85,000 tons daily and reserves of 640.5 million tonnes grading 0.25% copper and 0.008% molybdenum. Recent investments have extended the mine’s life by 23 years and increased its processing capacity.

In a significant move to consolidate its position, Taseko acquired an additional 12.5% interest in the Gibraltar Mine from Sojitz Corporation in 2023, bringing its total ownership to 87.5%. This acquisition is expected to increase Taseko’s annual copper production by 30 million pounds and annual cash flow by C$60-70 million.

Taseko’s Florence Copper Project in Arizona represents a key growth initiative. Using innovative in-situ copper recovery technology, the project aims to produce 85 million pounds of copper annually over a 21-year mine life with minimal environmental impact. As of 2023, the project has received its final operating permit from the U.S. Environmental Protection Agency, paving the way for commercial production.

The company’s focus on sustainable and efficient copper production aligns with the increasing demand driven by the green economy transition. The International Energy Agency projects that copper demand for clean energy technologies could rise by 40% by 2030, highlighting the strategic importance of Taseko’s expansion efforts.

Taseko’s project pipeline includes the New Prosperity Project, one of the largest undeveloped gold-copper deposits globally, and the Aley Niobium Project. These projects provide additional growth potential and diversification for the company’s portfolio.

In Q3 2023, Taseko reported copper production of 24.1 million pounds, a 9% increase from the previous quarter. Taseko Mines is well-positioned to capitalize on the growing demand for copper in the global transition to clean energy technologies.

Global Copper Market: Navigating the 2024 Deficit

The global copper market is bracing for a potential 2024 deficit driven by supply challenges and increasing demand pressures. Goldman Sachs has revised its forecast, anticipating a more significant shortfall of over 500,000 tons in the refined copper market for 2024. This shift from a previously expected surplus to a deficit is primarily due to production cuts and operational issues in Latin America.

Anglo-American has reduced its copper production target for 2024 by approximately 200,000 tons, effectively removing the equivalent of a large copper mine from global supply. The company expects production to fall even further in 2025. Similarly, Vale has lowered its production guidance, contributing to the tightening supply outlook.

Analysts at BMO Capital Markets, who previously forecasted a substantial surplus of refined copper for 2024, now predict a small deficit. Macquarie Bank adjusted its price forecast, raising its call for a price low from $7,600 per ton to $8,000 in the third quarter of 2024. This revision is due to a more significant concentration deficit and a smaller metal surplus than anticipated.

On the demand side, a rebound in copper consumption from mainland China is expected to support prices, along with a weakening US dollar. China’s support for the property sector and the easing of COVID-19 restrictions will likely boost demand for the metal. Goldman Sachs sees copper benefiting the most from these policy changes, given its higher usage in clean energy technologies.

The refined copper market is now projected to face a deficit of 200,000-300,000 tons in 2024, according to Antofagasta CEO Iván Arriagada. This reflects improving demand and revisions to production estimates seen in late 2023. Fastmarkets analyst Boris Mikanikrezai forecasts global refined copper production to grow 1.5% in 2024 compared to 2023 levels, while demand is expected to rise by 2.6%, resulting in a deficit of around 200,000 tons.

Conclusion

The global copper market’s projected deficit in 2024 is not just a matter of supply and demand; it’s also influenced by various psychological factors that shape market behaviour.

The shift from an expected surplus to a deficit, driven by production cuts and operational issues in Latin America, demonstrates how quickly market perceptions can change. This rapid shift in outlook could trigger a bandwagon effect, where investors and traders rush to adjust their positions based on the new consensus, potentially amplifying price movements.

The revised forecasts by major institutions like Goldman Sachs and BMO Capital Markets highlight the role of anchoring bias in market analysis. Initial predictions can significantly influence subsequent estimates, even as new information becomes available. Macquarie Bank’s adjustment of price forecasts, raising its projected low from $7,600 to $8,000 per ton, illustrates how analysts must constantly recalibrate to avoid being anchored to outdated predictions.

China’s expected demand rebound showcases the impact of herd behaviour in markets. As positive sentiment about China’s economic recovery grows, it could lead to a self-reinforcing cycle of increased investment and higher copper prices. This phenomenon is often exacerbated by confirmation bias, where market participants selectively interpret information confirming their beliefs about market trends.

The growing focus on copper’s role in clean energy technologies demonstrates how **narrative bias** can influence market perceptions. The compelling story of copper as a critical component of the green economy transition could lead investors to overemphasize this factor, potentially overlooking other essential market dynamics.

As the copper market navigates these complex dynamics, investors and analysts must be aware of these psychological factors. Recognizing cognitive biases and mass psychology effects can lead to more balanced analysis and decision-making in the face of market uncertainty.

More By This Author:

3 Ways Investors Can Make Money from Common Stock: Let’s Dig DeepAre We in a Bull Market: Yes, But Stay Vigilant

The Working Poor - The Price Of The American Dream