Tesla's Executive Turnover Seems About Average (Updated)

Updated July 5, 2018

Tesla’s (TSLA) executive turnover is widely believed to be unusually high, although this belief seems to be based on anecdotal evidence, rather than quantitative evidence. Famed short seller Jim Chanos, for instance, calls Tesla’s rate of executive turnover “stunning”. He says it’s among the highest turnover he’s seen at any company he’s looked at. Chanos never mentions, however, whether he actually benchmarks Tesla’s rate of turnover against any kind of average, or even compares it on a quantitative basis to another company.

It is possible that Chanos’ firm Kynikos Associates has data or analysis that it hasn’t shared publicly. However, Chanos makes other bizarre claims about Tesla that cause me to seriously question his research methodology. For instance, in an interview with CNBC he claimed that Tesla was behind on autonomy because Enhanced Autopilot is a Level 2 system, whereas Waymo’s (GOOG, GOOGL) test vehicles use a Level 4 system. This is a basic misunderstanding that shows a surprising lack of due diligence. Tesla’s internal test vehicles, just like Waymo’s, are intended Level 4 systems in development. Tesla’s driver assistance system, Enhanced Autopilot, is a Level 2 system, like other driver assistance systems. Waymo has no driver assistance product. To not understand this distinction is to not understand autonomy. This is a mistake as big and glaring as not understanding the difference between all-electric cars and hybrids.

In another interview, Chanos expressed his view that Elon Musk will step down as Tesla’s CEO. As evidence, he cited the fact that in the photographs of Musk in a profile by Rolling Stone, Musk was pictured next to SpaceX rockets, not next to Tesla cars. This is a bizarre, bewildering thing to say. First, in the online version of the article at least, there is a stock image of Musk standing on stage next to a Tesla Model 3. Second, this is just such an odd logical leap to make. Presumably, Musk did not make these kinds of creative decisions for Rolling Stone. Maybe Rolling Stone thought photos of rockets looked cooler and more novel than photos of cars.

These kinds of bizarre statements lead me to doubt whether Chanos has actually benchmarked Tesla’s executive turnover rate against an average, even privately. There are some clear gaps in his due diligence and his weighing of evidence. I also haven’t seen anyone publicly attempt to benchmark Tesla’s turnover against an average. So, I pulled together the data I could find to attempt it myself.

I found two sources of data on average executive turnover:

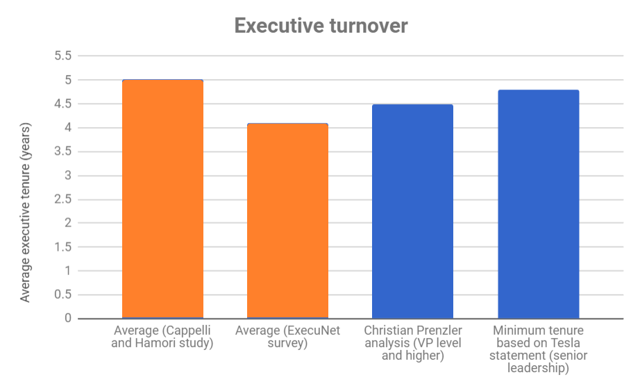

- A 2014 academic study by Peter Cappelli and Monika Hamori that exclusively covered executives at financial companies in the New York area. (Non-paywalled manuscript.) It found an average executive tenure of 5 years.

- A 2015 survey by job site ExecuNet that covered U.S. executives across industries. It found an average tenure of 4.1 years.

The academic study’s methodology is probably more rigorous than the survey’s methodology, but the survey data is more generalizable than the study data. So I’ll use both averages.

I also found two sources of data pertaining to Tesla’s average executive tenure:

- A May 2018 analysis by Christian Prenzler at Teslarati, who looked at the LinkedIn profiles of Tesla executives at the VP level and higher. Prenzler found that the average tenure of these executives was 4.5 years.

- A March 2017 statement from Tesla to Bloomberg pertaining to Tesla’s “senior leadership team”. Doing some simple math, Tesla’s statement implies that the average tenure of its senior leadership team is at least 4.8 years, and likely higher. To complement this statement, Reuters’ tally shows no increase in the rate of executive departures between 2017 and 2018 year-to-date, so this statement should still be relevant today.

Using Prenzler’s finding of 4.5 years, Tesla’s average executive tenure is 10% or 6 months shorter than the Cappelli and Hamori study average of 5 years, and 10% or 5 months longer than the ExecuNet survey average of 4.1 years. So, between 10% shorter and 10% longer than average. Let’s call that about average.

Using Tesla’s statement, which implies a minimum average tenure of 4.8 years, the average tenure of Tesla’s senior leadership team is no more than 4% or 10 weeks shorter than the study average of 5 years. It’s at least 17% or 8 months longer than the ExecuNet survey average of 4.1 years.

So, is Tesla’s rate of executive turnover “stunning”? It doesn’t look like it. It looks about average. Maybe a little higher, maybe a little lower.

If you’re aware of any data or analysis that contradicts this finding, please let me know. I would love to hear about it.

For now, we should treat this as a cautionary tale. Sometimes a lot people believe things without quantitative evidence, and even when the quantitative evidence available contradicts it. I think this happens a lot with Tesla. Human cognitive bias and systemic media bias toward negative, rare events has created a set of predictably irrational beliefs about Tesla that are widespread.

Skepticism about Tesla’s ability to grow enough to justify a higher valuation is fair and reasonable. If the case for a market-beating return on Tesla stock were obvious and free of serious risk, then the valuation would already be higher and there would be no opportunity. This is something reasonable people can disagree about, and it isn't obvious who is right.

There is inadequate skepticism, however, of sensational claims about why the company is doomed to fail. I would encourage short sellers to discount anecdotal evidence and base their beliefs only on quantitative evidence and other hard evidence. To believe things without checking the data to see if they are true is to risk falling into a financially painful trap.

Update (July 5, 2018): Galileo Russell at HyperChange found Jim Chanos’ spreadsheet tallying Tesla’s executive departures and calculated an average tenure of 4.6 years among departed executives. That’s right in line with the 4.5 years that Christian Prenzler at Teslarati found.

As of April 30, 2018, Chanos’ spreadsheet showed 7 executive departures from January to April 2017 and 8 departures from January to April 2018. This pretty much matches up with Reuters’ tally (credit to Tom Randall at Bloomberg for pointing this out). So, there is no discernible major increase in the rate of departures from 2017 to 2018.

Chanos’ spreadsheet shows a marked increase from 2016 to 2017, but there are two variables that need to be controlled for: 1) change in the overall number of executives as the company has grown and 2) any increase in the level of media scrutiny, since with more scrutiny more departures are reported.

Disclosure: I am long TSLA.

Disclaimer: This is not investment advice.

I should also mention: in the Cappelli and Hamori study, the standard deviation was 3.7 years.

Good unbiased take on #Tesla, which is pretty hard to find these days. I keep going back and forth on this company. People seem to love the cars and #Musk and tend to ignore some of the problems the company face. Others highlight Musk's somewhat unpredictable behavior, the numerous companies that distract him and only focus on the negatives. What's your personal take on $TSLA, Trent? Worth investing in?

I think Tesla is one of the most exciting technology companies in the world. The opportunity that gets me excited is autonomous ride-hailing, which could be a $10 trillion market by the early 2030s (https://ark-invest.com/research/self-driving-cars). Unlike any other company, Tesla’s production cars are collecting real world training data every day that Tesla’s neural networks are learning from. The volume of training data is most likely the main bottleneck to the development of fully self-driving cars. This is an area where Tesla can sail ahead of the competition because of its data advantage.

That’s the primary reason I’m invested in Tesla. It’s primarily about the immense opportunity of self-driving cars. A 10% market share by the early 2030s would propel Tesla to a $1.5 trillion valuation (at a 1.5x revenue multiple) and a ~30x return. If you’re willing to invest on a 15-year time horizon and take a risk on an uncertain technology, then I think Tesla is a really exciting company to invest in.

This is a reasonable statement on $TSLA and makes much sense. I will say that I was much more gung-ho about the self-driving technology but I've become somewhat soured on it after reading several of @[Gary Anderson](user:4798)'s articles on the subject. He seems to have much expertise and believes that it will ultimately prove to be a failed, unsafe technology. While I do believe we'll get there eventually it has certainly delayed my expectations of when it will be viable. I'm thinking maybe 20 to 25 years before I'd trust a car over myself.

I don't think it will take that long. For one thing, if you look at the advancements in tech over the last 25 to 50 years, it is mind boggling and those advancements are coming at an increasingly rapid pace.

Saying you don't want to use a self-driving car because there have been deaths and it is not safe is like saying you won't fly ("the safest way to travel") bcause there have been deaths. Hell, it's like saying you want drive a NON-selfdriving car because it's not safe.

Ah, no. That is not a valid comparison. You can have the fastest computer in the world, but if sensor equipment is both flawed and way too expensive, the vehicles will be inherently unsafe. Even 5G does not fix the basic flaw. And add to that a fast computer does not guarantee sound judgement and it may be programmed to kill you on a moment's notice.

I don't think that's quite fair. Is self-driving technology perfect? No. But it's learning and gets better with more and more data. Is it completely safe? No, there have been some fatalities. But you need to ask yourself, would those deaths have occurred had there been a human driver behind the wheel? I believe yes. And probably many more too. Human drivers are the most dangerous.

$TSLA is not having a good day today. This may change your mind about them being a worthwhile investment:

"Tesla Tumbles Back Below $300 As Musk Attacks Analysts' 'Poor Track Records'"

www.talkmarkets.com/.../tesla-tumbles-back-below-300-as-musk-attacks-analysts-poor-track-records

So since when did Telsa own any thing over Telecom International who owns the full system and this telco thinks that they can make money when Telecom International will be closing down over all these illegal other companies who say they own everything.

Regards,

Mandi

What are you talking about, Mandi?

Fair article. There is so much mystery surrounding #ElonMusk. I think that's why so many people are so captivated by him.

Gotta love $TSLA. Not sure why there are so many haters out there. Probably people who have never even been inside one of their vehicles.