Tesla Pre-Market Boost By TSLA S&P 500 Listing

TSLA up in the pre-market with about 13% and trades around $460 a share boosted by the news about to include and list the company into the S&P 500. The market might open around the higher balance extreme and swing highs back from September and October. A rotational behavior is expected with the bullish tendency as of the gap scenario.

For several weeks the market found buyers off and around the EMA50 on the daily periodicity.

(Click on image to enlarge)

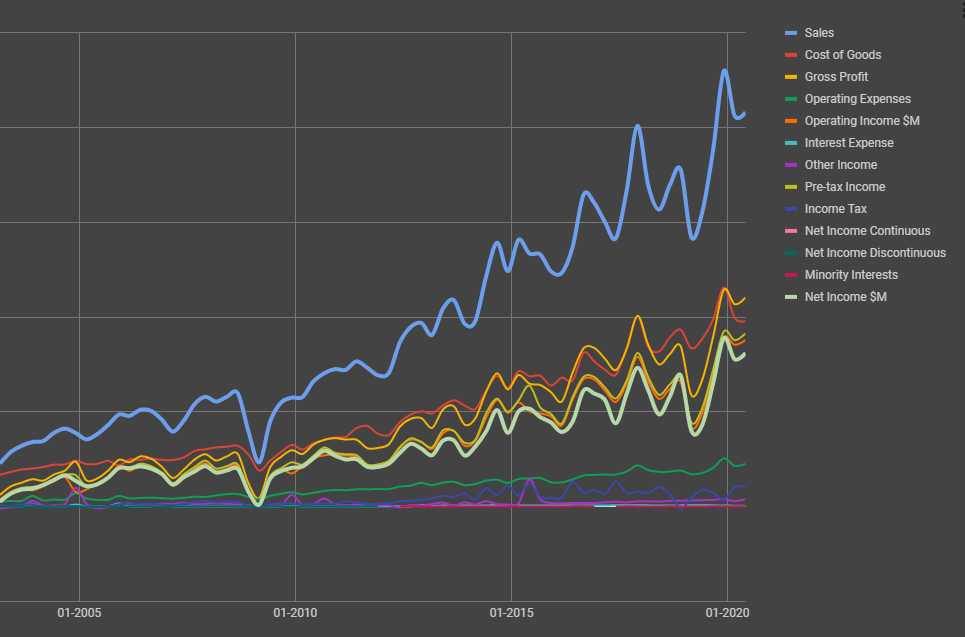

Here the Income Statement as a visual graphic:

(Click on image to enlarge)

Update three hours after the New York trading session’s open: The market opened around the mentioned balance extreme above the swing high, found sellers combined with possible long liquidation, and is trending lower since the RTH open on the hourly periodicity. The market might target the EMA structure which is confluent with the swing high. A break would lead the market towards the lower balance extreme for potential absorption purposes. Rotational balanced behavior still might establish in the next hours by short-covering and new buyers. The stock is up about 9%.

(Click on image to enlarge)

Looking at the intra-day VWAP perspective we can observe the trend lower below the developing VWAP. The market found some support by buyers around the previous VWAP close level/area which might lead the market to the mentioned rotational behavior while it targets the open level.

(Click on image to enlarge)

Visit our trading community to read more market insights and to learn the more indepth analysis process with various tools such ...

more

What's your current take on $TSLA?