Tesla - It's Been A Great Ride

This Is Jeopardy!

The category is World Auto Makers.

- Contestant - "I'll take World Auto Makers for $500, Alex."

- Alex - "The world's most valuable auto company has a logo consisting of three symmetrical ellipses."

- Contestant - "Who is Toyota [TM]?"

- Alex - "Correct."

- Contestant - "World Auto Makers for $1,000."

- Alex - "The #2 most valuable company features a logo conveying innovation and efficiency."

- Contestant - "Who is Volkswagen?"

- Alex - "I'm sorry, the answer is Tesla [TSLA]."

The Fundamentals

Surprised? Volkswagen would have been correct earlier this week. Tesla's ascendance to #2 in ranking is due to its stratospheric rise since June 2019.

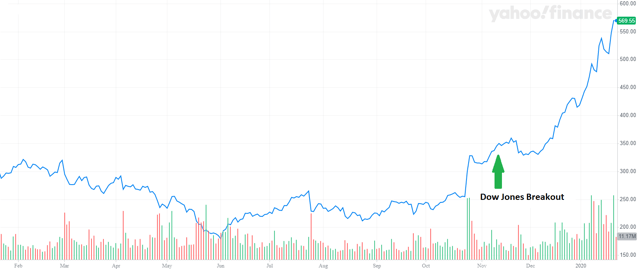

(Click on image to enlarge)

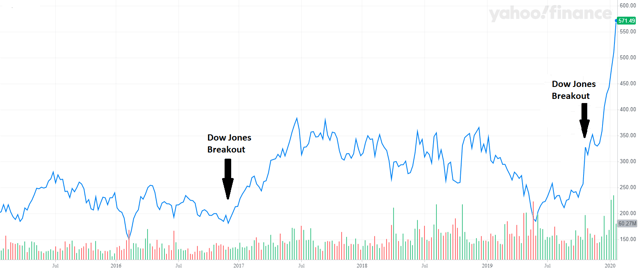

The automaker's price tripled since early summer. Its rise in the last 3 months parallels the broader stock market. Is Tesla pulling the market or is the market pulling Tesla? Below is another example of Tesla's price bounce in late 2016 once again paralleling similar broad market action.

(Click on image to enlarge)

Do fundamentals support Tesla's price? I present the following metrics.

|

Sales (billions) 12 mo fwd estimate |

Market Cap (billions) | Market Cap/Sales |

|

||||

|---|---|---|---|---|---|---|---|---|

| Toyota | $276 | $233 | 0.85 | 1.15 | ||||

| Tesla |

$31 |

$100 |

3.23 | 17.03 | ||||

| VW |

$283 |

$99.4 |

0.35 | 0.75 |

Note: As of 1/31/2020 figures higher for Tesla except Sales

Trailing twelve months earnings per share are a minus $4.77 implying a PE ratio of infinity since they have no earnings. Analysts' earnings estimates for Tesla [Q4 2019] average $1.72 per share yielding a PE ratio of 330. Using consensus earnings estimates for 2020 of $5.93 per share delivers a PE ratio of 85. With that still lofty PE, they'd need to more than triple earnings.

By comparison, Ford's [F] trailing PE ratio is 22 and its forward ratio is 7.2. General Motors' is about 5.5 for both trailing and forward.

General Motors [GM] has seven times the revenue and a stockholder's equity that is eight times that of Tesla's yet its market cap is half as much.

Analyst View

The analyst community is giddy about the company's prospects. In a recent CNBC interview, the founder of an investment research company forecast a $6,000 price in five years. The same analyst suggested a $4,000 price two years ago despite their concerns about market share.

The market share to which they referred is Tesla's roughly 2% of global vehicle sales. Will they increase their market share? Analysts must believe that if the company is to more than triple earnings in 2020 from earnings estimates in Q4 2019 and trailing earnings that are negative.

Consider the new challenge, however, of competing with large global players like Toyota, GM and VW, the latter which committed to an overwhelming shift towards electric vehicle (EV) production and away from internal combustion engines (ICE). Producing and servicing vehicles on a global scale is no easy feat and Tesla will have much work to catch up to its competitors.

Considering share price and earnings, investors are demonstrating endless faith in the company's ability to make substantial profits and capture market share they don't have. Is this faith misplaced?

Some analysts, including Grant Williams, see a very different future. Williams has gone as far as suggesting the company is a fraud with no equity value.

Party Like It's 1999

What has to happen to generate and sustain faith? Let's take a trip down memory lane to the year 1999. I was in the technology field and remember reading about companies who found it virtuous to burn investor cash. Many dot-coms were destined for failure since their business model offered no path to profitability, yet their stock price reflected happy times ahead.

I think of greater importance were well-known tech companies that were profitable and had sound business models with equity valuations that defied reason. Those companies are still around and profitable despite their market cap being eviscerated in the ensuing dot-com crash. If a profitable company can have their market cap slashed, then why should we expect anything less for an unprofitable one?

Another phenomenon of the dot-com years were the number of unprofitable companies reaching IPO stage. In 1999 and 2000, between 75 and 80 percent of companies reaching their IPO were unprofitable. This compares with figures in the 30 to 40 percent range in the 1990s. The dot-com market reflected a faith unseen just a few years earlier in that decade.

Faith, Optimism, and Dreams

The overall market reflects similar optimism today and projects faith in companies like Tesla despite being unprofitable. The number of unprofitable companies reaching IPO stage has been consistently above 60 percent since 2013 and reached 80 percent in 2017 — back to dot-com era levels.

Answering the earlier question, market mood and a herding instinct lifts valuations of unprofitable companies like Uber [UBER], Pinterest [PINS], Peloton [PTON] and Tesla. Investors fear missing the next big opportunity.

It's not just market mood and herding that lifted Tesla. Low-interest rates, low cost of capital, climate change activism, government involvement in selecting winners/losers, and a celebrity culture made Tesla into today's darling. The constellation of these conditions allowed investors to ignore fundamentals.

The low cost of capital is well documented — we have central bank wizards to thank. Even though the technology might have developed ten or twenty years ago, climate change activism pushed development of EV over ICE. In the same regard, the government rewarded Tesla when the company augmented their profits through carbon offset sales. Unintended consequences often result from the government being the arbiter of winners and losers in the economy.

Elon Musk is an international celebrity with vision. How many celebrities build the hope of Mars colonization and hyperloops? The public likes to dream — it's human nature. Has Musk gotten ahead of himself selling dreams? A website called ElonMusk.Today chronicles his messaging. Here are a few examples.

- 7/20/2017 – Claimed he secured government approval to build a hyperloop along the Atlantic corridor connecting NYC-Philadelphia-Baltimore-D.C that would ferry passengers in 29 minutes end-to-end.

- 7/11/2018 – Committed to fix water problems in any home in Flint, MI if found to be above EPA contamination standards.

- 7/15/18 – Offered to rescue children trapped in Thailand cave with a mini-sub. The offer spiraled into a tiff with a cave diver after a series of tweets.

- 8/7/18 – Tweeted he secured funding to take Tesla private for $420/share. The stock traded in the $300 range when he tweeted.

Fallen Heroes

It doesn't take much for investors to lose confidence. Though not a perfect analog, the WeWork debacle comes to mind. This is another company selling a dream. Recall that WeWork was days away from a $90 billion IPO. Mood collapsed after the company reported losses of $1.9 billion in 2018 and nearly $1 billion in 2017. The company's lifeline came from Softbank whose CEO, Masayoshi Son, came under scrutiny for continuing to shower cash on a business whose purpose is leasing office space.

When someone who's held in high esteem falls from grace, I label them a fallen hero. A change in social mood triggers their fall because the public loses belief or there's a discovery of fraud. I chronicled this phenomenon in Escaping Oz: Navigating the crisis. Our financial history is replete with examples of fallen heroes. Will Elon Musk be the next one?

An Opportunity

Those bashing Tesla and its tribe will be vilified for being short on vision and not embracing the dream. Here's a reply to Ralph Nader's recent disparaging tweet about Tesla (even social activists have gotten into the debate),

Tesla is a tech company, not just an auto maker...

The person replying to Mr. Nader also referenced Uber, another company that's lost billions in recent years.

Investors chasing yield, with many stocks and not just Tesla, either don't care or have not taken the time to read the company's balance sheet. This posture is common during an omnibubble. It will be interesting to see the tug-of-war continue. It's reminiscent of 1999-2000.

Tesla has no doubt served as a catalyst for EV production worldwide. The cars are cool, innovative and have a fantastic rating from the National Highway Traffic Safety Administration (NHTSA). It's the company's valuation raising concern.

Tesla's valuation reflects optimism that makes it one of the better short selling opportunities in this market, a market that's as risky as we've seen in quite some time. At a minimum, it would be a great time to lock in capital gains.

Disclosure: None.