Tesla: Exploring The March 2020 Precedent

Image: Shutterstock

Paul Tudor Jones Uses 29’ Precedent to Predict 87’ Crash

As the adage goes, “History doesn’t always repeat, but it does tend to rhyme.” Legendary investor Paul Tudor Jones, founder of Tudor Investment Corporation, made a career of that simple saying and some timeless investing principles. In 1980, Jones started his investment firm. At the time, Jones was an obscure trader who started his investing operation on a shoestring budget of a mere $30,000 outside investment.

However, by 1987, Jones kick-started his legendary career with a windfall trade shorting the stock market into one of the worst single-day declines in history. How did Jones predict the Oct. 19, 1987 “Black Monday” crash, which saw the S&P 500 plunge some 20% in a single session?

- Historical precedent: Jones, a keen student of market history, recognized excessive market speculation and overvaluation.

- Technical analysis: Jones and his partner at the time used an overlay chart, the 200-day moving average, and “Elliott Wave Theory” (which identifies recurring wave patterns) to predict the crash.

The simple yet effective contrarian process helped him make ~$100 million and start his path to his current net worth of ~$8 billion. As I have learned from mentors and my own trading, precedents can also be used for individual stocks.

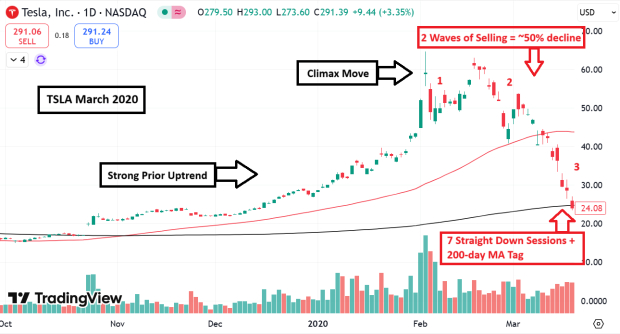

Tesla March 2020 Precedent

Over the years, Tesla (TSLA - Free Report) has become one of my favorite stocks to trade. The stock has a unique character: It tends to rise over time, but it can also be very volatile. Short-term volatility in long-term uptrends can often equate to opportunity for savvy investors.

While looking at Tesla’s recent chart, I immediately got a flashback that reminded me of March 2020. At the time, the market was uncertain due to COVID-19. Meanwhile, Tesla shares were defined by the following characteristics:

- A strong uptrend ending in a climactic/gap move.

- Three waves of selling resulting in ~50% decline in a short time.

- Seven straight red sessions before a tap of the 200-day moving average.

Presented below is the 2020 chart:

Image Source: TradingView

Provided below is a more recent stock chart for comparison:

Image Source: TradingView

Tesla Enters “Value Zone”

The 2020 to current-day comparisons don’t end at the technical chart for Tesla's stock. Another striking similarity was in Tesla’s valuation. In 2020, Tesla's price-to-sales ratio was in the single digits. By late 2024, the stock's valuation dipped back to the same levels.

Image Source: Zacks Investment Research

Tesla Exits Transitional Period

In 2020, Tesla was exiting a transitional period. Finally, the Tesla Model Y would be released, and by 2023, it would be the world’s best-selling car. Currently, Tesla is exiting another transitional period. Tesla will soon launch Robotaxis in Austin, Texas, this summer – a project Elon Musk is confident enough to “bet the company on.”

How Did Tesla Perform in 2020?

After tagging the 200-day moving average in March 2020, Tesla stock would soar from ~$23 to $294 a share by January 2021. While history may not repeat itself exactly, the risk-reward ratio looks very favorable to my eye, at least based on the stock's history.

More By This Author:

Is Bitcoin Set For A Big Rally? $100K Breakout, Coinbase Win Say YesChina Stocks: Why The Party Is Just Starting

Investing In The Future: 3 Disruptive AI Robotics Stocks

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more