Tesla Bears: A Short Short Story

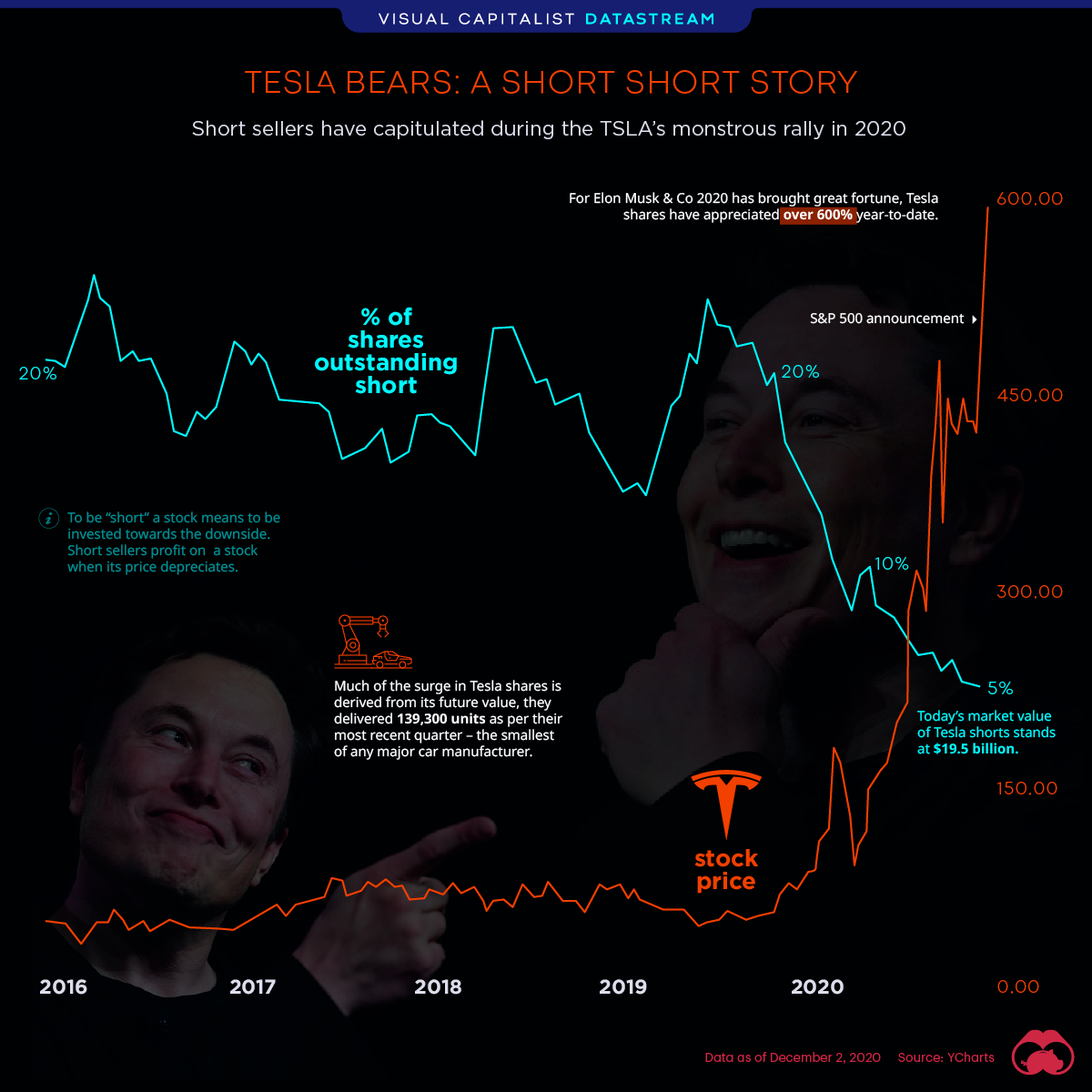

- Tesla, Inc has gained infamy for the sheer depth of short-seller activity on its stock. At its peak in 2019, over 200 million shares were short

- However, short-sellers have recently capitulated, thanks to Tesla’s monster year

- TSLA shares are up roughly 600% YTD

Tesla Bears: A Short Short Story

Short selling is often said to be the Wild West of financial markets. Where there’s a short seller, there can be whipsawing asset prices just around the corner. Tesla is no exception.

In some cases, billions of dollars pour behind these short ideas—conducted by some of the world’s most sophisticated investors.

The efficient market hypothesis suggests short selling is a necessary evil that helps the market reflect on all the information of a given security and obtain its true market value. Yet most market participants are anything but receptive to short sellers.

The market—which tends to be long, often panics when a short seller enters the arena and takes the opposite stance. What typically follows is an avalanche of legal and regulatory action from corporate lawyers to the SEC.

In the case of Tesla, short-sellers couldn’t have gotten it more wrong – at least for now. Some market commentators call it the most unprofitable short witnessed. The data shows that approximately 20% of Tesla shares have been held short since 2016. This year a reported $27 billion has been lost betting against Tesla.

| Date | Shares Sold Short | Dollar Volume Sold Short |

|---|---|---|

| October 30th, 2020 | 47,800,000 | $19 billion |

| October 15th, 2020 | 52,960,000 | $22 billion |

| September 30th, 2020 | 57,130,000 | $25 billion |

| September 15th, 2020 | 59,040,000 | $24 billion |

| August 31st, 2020 | 54,890,000 | $20 billion |

| August 14th, 2020 | 12,310,000 | $5 billion |

Tesla’s short thesis is often anchored around a few compelling narratives. The first is that Tesla’s present-day fundamentals are poor—a $530 billion company delivered 139,300 vehicles in Q3’20 and turned a $331 million profit. That’s after government subsidy programs.

The second, the electric vehicle market is expected to be competitive with many players, and short-sellers make the point Tesla is currently priced as the sole-winner in this space.

We don’t know how the future EV market will transpire, but with Tesla shares up 600% year-to-date, and with the company set to join the S&P 500, some bears look to be calling it quits.

Disclosure: None.

nd what about the weekly software recalls on those computer driven cars?

So far Tesla is looking good, but what happens when the whole neighborhood wants to recharge at the same time? There is a non-publicized problem on the horizon now. What will that do to share prices?