TerrAscend Q2 Financials: Results Very Negative, Forward Guidance Withdrawn, Stock Sinks

TerrAscend Corp. (OTCQX: TRSSF), a leading North American cannabis operator with vertically integrated operations in Pennsylvania, New Jersey, and California, reported financial results for its Q2 ending June 30, 2021, on Thursday, as follows:

Q2 Financial Highlights

(Unless otherwise stated, the results are in American dollars - to convert to other currencies go here - and compared to the previous quarter.)

- Net Sales: +9.9% to $58.7M

- Adj. Gross Profit: -0.6% to $34.7M

- As a % of Net Sales: declined to 59.1% from 65.4%

- Gross Margin: declined to 61% from 65%

- Gen./Admin. Exp.: -6.3% to $14.8M

- As a % of Net Sales: declined to 25.2% from 29.6%

- Adjusted EBITDA: +7.5% to $24.3M

- As a % of Net Sales: declined to 41.4% from 43.3%

- Net Income: +50.7% to $22.9M

- Adj. Net Income (Loss): +112.0% to $(22.9)M

- Net Loss/Share: increased to $(0.14) from $(0.08)

- Cash Balance: unchanged at $154M

Q2 Operational Highlights

- Acquired the remaining 90% of KCR, doubling dispensary footprint in Pennsylvania to six.

- Purchased HMS Health, LLC (HMS), a cultivator and processor of medical cannabis in Maryland.

- Opened second New Jersey dispensary in Maplewood, the largest Apothecarium on the East Coast.

- Launched a portfolio of Kind Tree branded products in Maryland.

- Made final earnout payment of $30 million to Ilera Healthcare in June 2021.

Management Commentary

Jason Wild, Executive Chairman said:

- "We are excited to announce our agreement with COOKIES to be the sole cultivator and manufacturer in New Jersey for one of the country's most recognized cannabis brands and the planned opening of 'COOKIES Corners', a store-in-store concept, within each of our three retail locations, subject to certain conditions and regulatory approval...

- During the second quarter, we continued to deliver...industry-leading Adjusted EBITDA margins above 40%.

- Due to expansion-related yield reduction in Pennsylvania, which I believe to be temporary, and a decision to prioritize allocation of our branded products to our own New Jersey dispensaries."

Forward Guidance

Last quarter the company raised its full-year guidance to $300 million versus the previous guidance of $290 million and Adjusted EBITDA was expected to exceed $128 million versus previous guidance of $122 million but the company has withdrawn said guidance due to temporary yield declines of quality flower in Pennsylvania related to ongoing construction and expansion.

Stock Performance

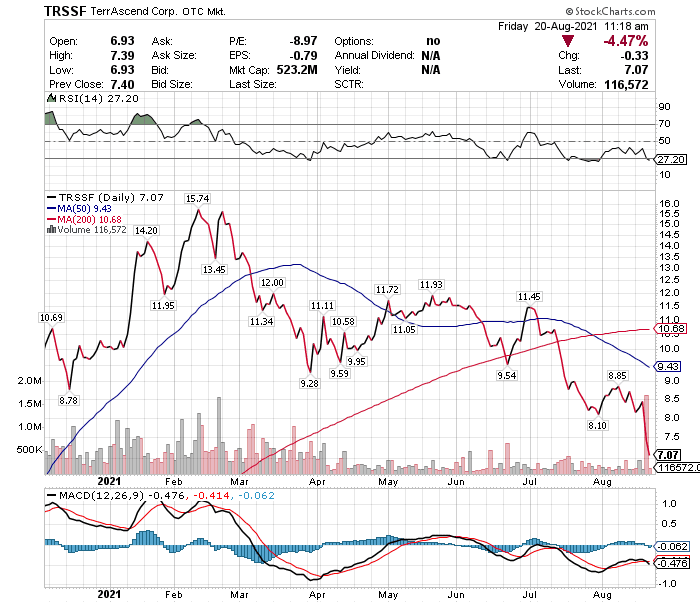

While the TerrAscend stock price went UP 12.5% during Q2 it has gone DOWN a further 38.4% YTD since then (i.e., the end of June) and is now DOWN 29.9% YTD as illustrated in the chart below:

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more