TeraWulf Vs. Riot Platforms: Which Bitcoin Miner Stock Is The Smarter Investment?

Image: Bigstock

Key Takeaways

- Riot Platforms operates 1.86 GW of power capacity, supporting Bitcoin mining today and AI/HPC growth ahead.

- Riot Platforms reported strong Q3 revenues and net income, aided by operating leverage and power curtailment credits.

- TeraWulf's AI push brings long-term contracts, but heavy debt, losses, and execution risk pressure the stock.

The Bitcoin mining sector is in a transition phase as operators are increasingly focusing on digital infrastructure and AI hosting to diversify revenues. TeraWulf (WULF - Free Report) and Riot Platforms (RIOT - Free Report) are publicly traded Bitcoin miners in the United States that operate large-scale facilities powered by low-cost energy.

TeraWulf differentiates itself through a strong focus on zero-carbon energy and expanding AI and high-performance computing capacity via joint ventures, while Riot Platforms stands out as one of the largest pure-play miners with a growing data-center footprint.

Recent moves, including TeraWulf’s secured-project financing tied to its Fluidstack joint venture and Riot Platforms’ stable November BTC production and infrastructure expansion, highlight how each are adapting to a rapidly evolving mining and computing landscape.

So, which stock offers greater upside, TeraWulf or Riot Platforms? Let’s find out.

The Case for TeraWulf Stock

The company's evolution from Bitcoin mining to AI and HPC infrastructure is associated with several structural risks and implementation challenges. Although TeraWulf maintains 245 megawatts of mining capacity at Lake Mariner, revenues are still at risk due to Bitcoin price volatility, rising network difficulty, and halving-related pressures. This exposure was evident as Bitcoin output steadily declined to 377 BTC in the third quarter of 2025.

HPC expansion has materially increased TeraWulf’s capital intensity and leverage. The company raised more than $5 billion in 2025 through convertible notes and secured debt, pushing total debt to roughly $1.5 billion. High leverage increases refinancing and interest expense risk and contributes to severe earnings volatility, including a large GAAP loss associated with a non-cash revaluation in the third quarter of 2025.

TeraWulf faces challenges from executing large-scale data center builds, higher operating expenses from AI and HPC expansion, and continued sensitivity to Bitcoin volatility. Against this backdrop, the company's stock fell nearly 11% to $11.57 during the trading week as investors became wary of heavy AI spending.

Nonetheless, TeraWulf benefits from low-cost, clean power, vertically integrated site development and long-term, credit-enhanced HPC leases. During the third quarter of 2025, the company commenced recurring HPC lease revenues and secured over $16 billion in long-term HPC contracts, including Fluidstack leases backed by Google, providing strong revenue visibility.

Opportunities lie in AI and hyperscale demand. Management reaffirmed a target of 250-500 MW of new HPC capacity contracted annually, supported by expansion at Lake Mariner, the Abernathy JV in Texas (up to 600 MW), and the long-dated Cayuga site lease beginning in 2027.

The Zacks Consensus Estimate for the first quarter of 2026 loss is currently pegged at 18 cents per share, unchanged over the past 30 days, slightly worse than a loss of 16 cents reported a year ago.

Image Source: Zacks Investment Research

The Case for Riot Platforms Stock

Riot Platforms is transitioning from a pure-play Bitcoin miner toward a data center development model, supported by its vertically integrated operations and fully permitted land and power portfolio. In the third quarter of 2025, the company operated Texas and Kentucky mining sites with approximately 1.86 GW of power capacity, positioning it for future AI and HPC expansion.

Key advantages for Riot Platforms include its large scale, low-cost power access and financial flexibility. In the third quarter, the company generated $180.2 million in revenues, primarily from Bitcoin mining, and reported net income of $104.5 million, benefiting from strong operating leverage and power curtailment credits of $30.7 million.

Riot Platforms’ growth opportunity lies in AI and HPC development at the Corsicana site, where Core & Shell construction has started on two data center buildings with 112 MW of critical IT capacity. The campus is planned to scale to 1 GW over time, and management noted ongoing leasing talks with hyperscaler, neocloud, and enterprise customers, creating potential upside as contracts are executed.

Despite growth plans, the company faces pressure from roughly $214 million in near-term capex for the Corsicana buildout and ongoing Bitcoin market volatility. These factors weighed on production, which fell 14% year-over-year to 428 in November 2025 and decreased 2% sequentially.

The Zacks Consensus Estimate for the first quarter 2026 loss is currently pegged at 20 cents per share, unchanged over the past 30 days, representing a sharp improvement from the 90-cent loss reported in the year-ago quarter.

Image Source: Zacks Investment Research

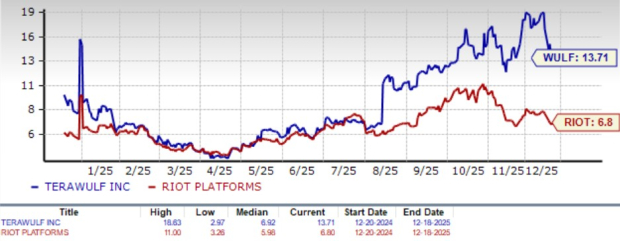

TeraWulf vs. Riot Platforms: Price Performance & Valuation

Over the past six months, TeraWulf shares have soared 215.3%, far outpacing Riot Platforms’ 40% gain and the Financial - Miscellaneous Services industry’s 5.4% decline. However, TeraWulf’s sharp rise comes with higher risk, including heavy debt, ongoing losses, warrant liabilities, and costly HPC expansion that strains flexibility and raises execution risk.

In contrast, Riot Platforms offers a more balanced profile, with a lower EV per available megawatt ratio and an experienced in-house development team that has completed more than 200 projects, reducing execution risk as its AI-focused expansion progresses.

Stock Performance

Image Source: Zacks Investment Research

Both TeraWulf and Riot Platforms' are currently overvalued, as suggested by a shared Value Score of F.

On the valuation front, TeraWulf trades at a forward 12-month price-to-sales (P/S) multiple of 13.71, more than double Riot Platforms’ 6.8. TeraWulf’s higher multiple reflects optimism but increases sensitivity to execution and financing risks, whereas Riot Platforms’ lower valuation offers a more conservative and appealing entry point.

Price-to-Sales Forward 12-Month Ratio

Image Source: Zacks Investment Research

Conclusion

While TeraWulf offers strong AI and HPC growth potential, its premium valuation, higher leverage, and increased execution risk from capital-intensive expansion make the stock riskier. Riot Platforms stands out with greater scale, lower EV per megawatt ratio, steadier cash generation from Bitcoin mining, and a proven in-house development track record.

With stronger financial flexibility to fund AI expansion and a more conservative valuation, Riot Platforms provides to have more durable upside and thus emerges as the better investment choice. Riot Platforms currently carries a Zacks Rank #3 (Hold) rating, whereas TeraWulf presently maintains a Zacks Rank #4 (Sell) rating.

More By This Author:

3 Manufacturing Stocks Benefiting From Supply-Chain Shifts Into 20263 Stocks To Watch Near All-Time Highs: COF, MAR, TSLA

3 Large-Cap Blend Mutual Funds To Buy Ahead Of 2026

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more