Ten Clean Energy Stocks For 2020

If it’s tough to follow a winner, 2020 is going to be an especially tough year for my Ten Clean Energy Stocks model portfolio.

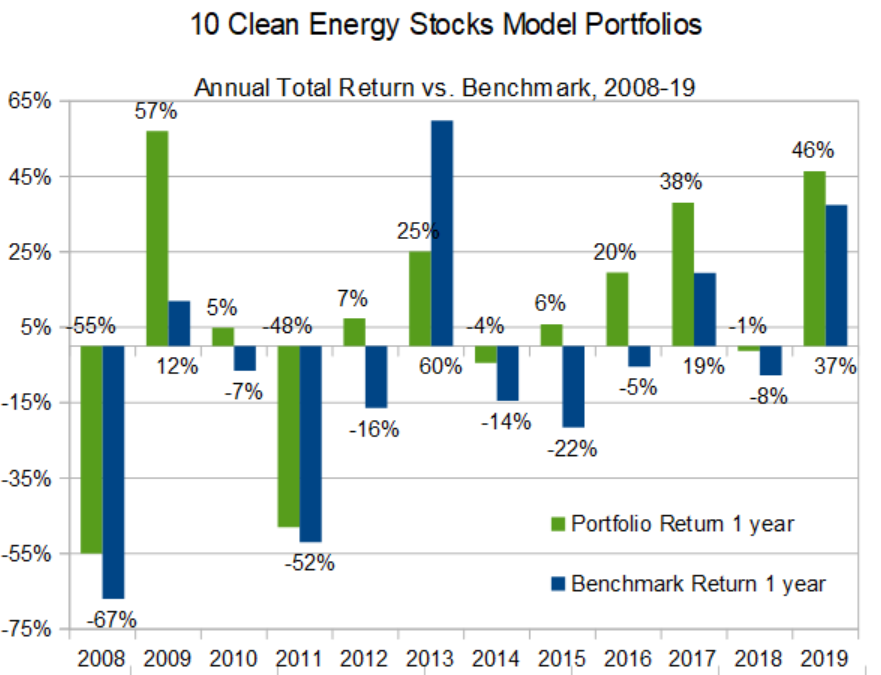

I’ve been publishing lists of ten clean energy stocks that I think will do well in the year to come since 2008. With a 46 percent total return, the 2019 list has had its best year since 2009, when it managed a 57 percent return by catching the rebound off the 2008 crash. This year’s returns were also achieved in the context of full- to over-valuation of most of the clean energy income stocks I now specialize in.

Going International

With this as background, my main goal with the 2020 list is to find stocks which will be resilient in the event of a US bear market. Early 2019 saw bear market fears surface when the US yield curve inverted, only to fade again when the inversion vanished. The yield curve has inverted before every recession over the last 50 years, and there has only been one yield curve inversion which did not proceed a recession in that time. Will we get another recession in the two years following March 2019? It is clearly too early to say. Investor complacency is not a predictor of a recession, but it is an ingredient of bull market peaks.

I am not at all complacent about the prospects of the US stock market, European and emerging markets have not enjoyed the same bull run the US did in 2019, so they still have some relatively good values left. If you do not have much experience in trading foreign stocks, I’ve published some thoughts here. The short version is: Decide how much you want to pay for the stock and use a good-til-canceled limit order.

The article also has some notes in what the multiple ticker symbols mean. For the purposes of tracking performance, I will be using the stock price in the company’s home market translated into dollars at current exchange rates.

The List

Returning Stocks from 2019

Unsurprisingly, the stocks I’m keeping from last year’s list are those that have not seen the biggest run-up.

Covanta Holding Corp. (CVA) and Valeo SA (FR.PA, VLEEF, VLEEY) have both been making progress implementing their business plans, but have not been fully rewarded by the market the way I would expect given the massive run-up in other stocks.

The thesis for retaining Green Plains Partners (GPP) remains the same as the one for including it last year: the ethanol MLP enjoys revenue guarantees from its parent, Green Plains, Inc (GPRE). Despite the continuing pain the ethanol market caused in large part by the Trump administration’s trade war and giveaways to friends in the petroleum refining industry, these guarantees should allow GPP to maintain its healthy $1.90 annual dividend. If Trump loses in November, I expect that the stock price to produce further gains as the market anticipates a return to business as usual and an end to the Trump EPA’s giveaways to refiners.

New Stocks for 2020

NFI Group, Inc. (NFI.TO, NFYEF) (formerly New Flyer Industries) is a leading manufacturer of transit buses and motor coaches. New Flyer was a great 10 Clean Energy Stocks success story; it appeared on the 2012 list at $5.65, gaining 54% that year. It returned in 2014 for a 22% total return, and in 2015 with an 80% return. I dropped it from the 2016 list because it was starting to look overvalued.

The stock did not peak until the start of 2018, but for the last two years, it has since been struggling. When the stock was last in the list, it was simply the leading manufacturer of heavy-duty transit buses in North America… now it is a leading global manufacturer of both transit buses and motor coaches. Its current problems do not seem permanent in nature. Some arose from the recent acquisition of Alexander Dennis and a build-up of work in progress as NFI experienced some hiccups internalizing much of its parts manufacturing.

Despite many people’s unpleasant experiences with diesel buses, bus transit is an inherently clean and low emission form of transport because it is an effective way to take numerous cars off the road. But buses are rapidly getting greener as they have some of the best economics for electrification.

Electric transit bus manufacturers like Proterra argue that an electric bus is best designed from the ground up as electric, in order to take advantage of the flexible layout possibilities that electric propulsion enables. In contrast, NFI takes a propulsion-agnostic approach and uses third-party drivetrains including diesel hybrids, natural gas, battery-electric, and fuel cell electric to meet its customers needs. I see value in both approaches. I think many of the large transit agencies that are considering heavy-duty electric transit buses from both Proterra and NFI will find comfort in the new technology when it is backed by a large, traditional supplier with a large parts and service arm that they have been dealing with for years, while others will prefer a bus designed from the ground up to be electric. From a competitive standpoint, I expect both strategies to flourish, at the expense of smaller competitors without the resources to deliver credible electrified and hybrid options. Proterra, however, is not a public company. NFI is, and it currently trades at an attractive price with a healthy dividend.

Like New Flyer, MiX Telematics (MIXT) is also a blast from the past. The company provides vehicle management systems and telematics systems to fleet owners. Their systems improve safety, reduce fuel use and theft, and help with regulatory compliance. The company’s software as a service (SaaS) platform enables it to leverage its technology platform for relatively rapid growth and high margins. MiX is a global company based in South Africa with operations on six continents. This global presence gives it an edge over its competitors in serving large, multinational clients, especially in transportation and resource industries.

MiX first entered the list in 2014 at $12.17. I was too optimistic about its valuation at the time, and it was the biggest loser of the year, falling 45%. There were nothing wrong with the company’s fundamentals, however, and I kept it in the list in 2015, when it fell another 32%. In 2016 I doubled down and it gained 51%, followed by a 110% gain in 2017, closing the year $12.76 plus a few dividends. I dropped it from the list in 2018 because I felt the valuation was reasonable, but not as attractive as many other opportunities that year. I sold most of my holdings in the mid-teens (which I mentioned here) as the stock rose further in 2018. MIXT eventually made it as high as $20, before falling back to near where it was at the end of 2017 two years later. Overall, that would not have been that great a run except that when stocks I like fall, I tend to buy more.

Today. MIXT stands near where it was in late 2019, with the difference being that it has been growing its subscriber base at a little more than ten percent annually. Subscription revenue has been growing even faster as MiX adds more products and features to its offerings. There is plenty of room for this growth to continue as well; only 19% commercial vehicles have a telematics solution.

Brazilian utility Companhia Energetica de Minas Gerais, a.k.a Cemig (CIG) is a relatively conservative pick in a very volatile stock market. It is the third-largest electricity generation utility and has the largest transmission and distribution utility in Brazil. In terms of sustainability, the company’s generation assets are almost all hydroelectric, with a few relatively new wind farms and one fossil plant. It also has a gas distribution utility in its home province of Minas Gerais.

From the perspective of risk, the biggest risk of investing in Cemig is investing in Brazil itself. The current (Bolsonaro) administration is business-friendly… Cemig shares saw a sharp spike in late 2018 when the current president was elected. Bolsonaro is not environmentally friendly, however, and I generally avoid holding stocks which put my financial interests at odds with my ideals. In this case, I am hoping that Bolsonaro loses the next election in 2022, so I would not plan to hold Cemig more than a couple of years.

Red Eléctrica Corporación, S.A. (REE.MC, RDEIF, RDEIY) is the electric transmission utility for Spain. It also owns some transmission assets in Portugal and Latin America, as well as some telecom assets. Long-distance transmission and the integration of electric grids over large areas is an essential part of all plans to transition to high percentages of renewable electricity. Red Electrica sees sustainability and renewables integration as key parts of its mission and has been making large investments in interconnections with France and Spain’s outlying islands.

As a regulated utility, the company is included in the portfolio as a relatively low-risk pick that pays a healthy dividend.

Veolia Environnement S.A. (VIE.PA, VEOEF, VEOEY) is a France-based global company operating in the water, waste, and energy management. Although I generally prefer to invest in more focused companies, an investment in Veolia gives access to a number of interesting clean energy technologies which are not available as pure-plays. One of the most interesting to me is the production of biogas and other useful products from sewage.

Building energy management also has great potential to cost-effectively reduce waste, energy use, and greenhouse gas emissions. The problem is that most companies do not have the in-house expertise to achieve its full potential. Veolia has the scale and expertise to solve this problem at practically any scale. They can also bring their expertise to bear to reduce energy use by understanding and influencing the behavior of building occupants through communication and education.

Hedging and Pseudo-cash

In line with my goal of protecting the model portfolio against a possible market downturn, I settled on using Puts on SPDR S&P Oil & Gas Exploration & Production ETF (XOP) as a hedge. In particular, my model $20,000 portfolio will include one XOP January 2022 $20 Put contract. That put gives us the right to sell 100 shares of XOP for $20 each at any time before January 21, 2022. As of the close of trading on December 31st, these puts were trading for $253. A single contract gives control of $2,000 worth of XOP, which should make this holding about as volatile as the other positions in the portfolio.

While I plan to use the January 2022 $20 Put for tracking purposes, really any put with a strike price between $20 and $25 expiring in January of 2021 or 2022 will do the trick. Puts that have higher strike prices will cost more but have a higher chance of paying off, which puts that expire in 2021 will cost less but not act as a hedge for as long. Shorting XOP and selling XOP calls are also valid hedging options, but keep in mind that both these strategies can potentially produce unlimited losses, far greater than the size of the initial investment. I generally avoid these strategies for this reason, but the losses can be manageable if the hedge is a very small portion of your portfolio. I currently have sold naked calls on Nextera Energy Partners (NEP) as a hedge against my many large Yieldco holdings. I am currently losing money on this hedge because all Yieldcos have been going up for the past few months, but my gains on other Yieldcos far outweigh the losses on NEP calls because the hedge is tiny compared to the other Yieldco holdings.

The oil and gas E&P sector has had several bad years, and I was a little hesitant to choose an effective short position in a sector which has had such a bad run. However, stocks in declining industries don’t necessarily have a bottom. A quick look at the long term chart for the VanEck Vectors Coal ETF (KOL) will show you that. I would have considered KOL for this hedge if not for the fact that KOL only has options contracts going out 6 months, and so using KOL should have required options trading in the middle of the year.

The reasons I think XOP might continue to go down are

- Stranded asset risk

- Political risk

- Divestment risk

- Legal liability from past deception about climate change

Stranded asset risk is the risk that past investments to develop fossil fuel reserves will never see a payoff. The world simply cannot burn all the oil and gas that companies count among their “proven” reserves, and avoid catastrophic global warming. I’m not confident that we will avoid that, but I do know that the more fossil fuels we use, the more catastrophic the outcome will be. Since climate-change fueled natural disasters are becoming a commonplace occurrence, I see governments and individuals around the world starting to take swifter action to deal with the problem. This takes the form of political risk when governments decide to regulate emissions, increase fuel economy standards, regulate oil drilling, and remove existing subsidies. But it can also arise when individuals worried about climate change take steps like driving less by taking actions like combining trips, using mass transit, and walking and biking more, and ridesharing. As well as by shifting to electric vehicles.

Divestment risk is simply the risk that as more individuals and institutions adopt policies of not investing in fossil fuel companies, the stock prices will fall simply because of a lack of buyers. As I wrote in September 2014, in divesting, the last one out loses. Anyone who read that article back then could have sold XOP for over $70 a share, as opposed to $23 today. But there are still more people who can sell.

Legal liability arises from big oil companies long term deception about climate change. Right now there are a large number of state lawsuits alleging that big oil companies knew about the risks of climate change but deceived the public and investors about the risks. None of these lawsuits has a giant chance of succeeding, but it only takes one. If a single such lawsuit succeeds, it will open the floodgates to every state and municipality which has seen some negative effect of climate change to file additional lawsuits. I don’t know when (or even if) it will happen, but Big Oil could be on the verge of its “Big Tobacco” moment.

The reason I chose to use puts is because shorting is always risky. Even with all the risks above, there could still be a short term oil price spike in 2020 which sends all oil stocks gushing upward. Buy buying a single put, we are limiting the risk to the option premium.

Yieldco Pattern Energy Group (PEGI) is currently in the process of being bought out by the Canada Pension Plan Investment Board for $26.75 per share. The transaction is expected to close before June 30, 2020, and the company will continue to pay its quarterly dividend of $0.422 per share until it closes. I’m including Pattern in this list mainly because I think of it as a good place to park cash for 4-6 months as insurance against a market downturn.

Compared to a bank CD, there is a small risk that the transaction will not go through, in which case the stock might fall 10% or so in the short term. The upside is that readers who buy at or below the $26.75 will collect a $0.422 (1.57%) dividend for holding the stock for 4-6 months, approximately double the return available from comparable CDs. There is further upside from the chance that the buyout is delayed until after June 30 and holders collect a second $0.422 dividend. This is also unlikely, but considerably more probable than the merger falling through.

I suggest readers who do not still own Pattern from 2019 and previous years buy PEGI using limit orders at the buyout price ($26.75) or better. If the price rises and your trade does not execute, just keep the money in cash. I will have a new stock pick to replace PEGI after the deal is complete.

For the purposes of tracking the portfolio, I will be considering the $2000 which I would have allocated to PEGI to be held as cash unless or until the stock trades at $26.75 or below in 2020. Excess cash from the $2000 position allocated to XOP will also be allocated to PEGI if it trades at or below $26.75 in 2020. All of this money will be allocated to one or two new or existing positions chosen after the PEGI sale completes.

Bonus Pick

Polaris Infrastructure Inc. (PIF.TO, RAMPF) is a tiny geothermal and run-of-river hydropower Yieldco build around the assets of Ram Power. Long-time readers may recall Ram Power as a bonus “speculative” pick from the 2014 list. Like most speculations, that particular gamble did not pay off, and the company went into bankruptcy after repeated drilling failed to stabilize electricity production at its main geothermal asset, San Jacinto-Tizate in Nicaragua even after extensive additional drilling. Unable to meet its debt obligations with the lower-than-expected electricity revenues, the bondholders ended up owning the company, and they re-listed it without its former heavy debt burden and a healthy dividend in 2015.

In early December, I had hoped to include Polaris in the list, but the stock price ran up over 10% in the last two weeks of the year. While its yield is very attractive compared to other Yieldcos, its small size and continued need for additional drilling at San Jacinto-Tizate to offset natural production declines make me cautious about buying this company at anything but rock-bottom prices. Nevertheless, it is one to watch, and if the price falls back in 2020, it’s a leading candidate to replace PEGI when the buyout is complete.

Portfolio

For the first time this year, I plan to track the model portfolio based on an initial $20,000 investment, using actual share numbers and cash. In the past, I have assumed that dividends would be re-invested in each position; this year I will track them as cash and only re-invest if I see an attractive opportunity.

I will track foreign stocks using their stock prices in their home markets with values translated into US dollars at current exchange rates using the five-letter foreign stock ticker. Readers should note that stock price quotes for these tickers are often stale, and so they will likely vary slightly from my calculated prices. Readers who are using ADRs rather than foreign stocks in their own portfolios should use 2 shares of VLEEY and RDEIY in place of one share of VLEEF or RDEIF because of the ADR multipliers. In contrast shares of VEOEY and VEOEF have equal value. See my recent article on trading foreign stocks and options for more details.

I will track the price of the XOP Put option using the midpoint of the bid and the ask at market close rather than the most trade, which could be hours or even days old and so may not reflect recent price movements in the underlying ETF, XOP.

As I have for the last few years, I will continue to use Global X YieldCo & Renewable Energy Income ETF (YLCO) as a clean energy benchmark and SPDR S&P Dividend ETF (SDY) as a broad market benchmark.

| Ticker | Shares | 12/31/19 | Price |

| CVA | 135 | $2,003.40 | $14.84 |

| VLEEF | 64 | $2,010.24 | $31.41 |

| GPP | 145 | $2,003.90 | $13.82 |

| NFYEF | 75 | $1,998.75 | $26.65 |

| MIXT | 155 | $2,010.35 | $12.97 |

| CIG | 587 | $2,001.67 | $3.41 |

| RDEIF | 112 | $2,007.04 | $17.92 |

| VEOEF | 84 | $1,991.64 | $23.71 |

| XOP Jan ’22 $20 Put | 1 | $255.00 | $2.55 |

| PEGI | 139 | $3,718.25 | $26.75 |

| Cash | $0.00 | ||

| Portfolio | $20,000.24 | ||

| YLCO (Benchmark) | 1344 | $20,000.24 | $14.88 |

| SDY (Benchmark) | 186 | $20,000.24 | $107.57 |

Conclusion

Looking forward to 2020, the only thing I am sure of is that I have no idea what is going to happen to the stock market. I have been preparing for a large market correction for more than half of 2019, and the US stock market has continued to advance unstoppably. Valuations seem extremely stretched, the political climate could not be more volatile, and the Federal Reserve has indicated that they do not intend to keep lowering interest rates. With this backdrop, it should not take much to send the stock market into a tailspin.

On the other hand, my friend Jan Schalkwijk, CFA of JPS Global Investments (an advertiser on this website) recently reminded me that most bull markets end in euphoria when there is no one left to get excited about the stock market. That is hardly the situation today and I am hardly the only voice of caution among stock market pundits.

I also have a track record of being too early… I often get out of bull markets long before they peak and start buying declining stocks long before they bottom. So I’m far from confident that the bear I expect will appear soon, or even in 2020. But when it comes to bear markets, it’s better to get out too soon than too late.

Ten Clean Energy Stocks for 2020 is probably the most diversified and defensive model portfolio in the series since I started it in 2008. Yet with my worries about the coming year, I will not be surprised if the portfolio ends 2020 lower than it begins the year. Let’s hope that does not happen, but if it does, the model portfolio should decline much less than its benchmarks, especially the ever-volatile YLCO.

Disclosure: Long PEGI, CVA, GPP. VLEEF, NFYEF, RAMPF, MIXT, CIG, RDEIY, RAMPF, VEOEF, Puts on XOP, short NEP.

Disclaimer: Past performance is not a guarantee or a reliable ...

more