Teekay Tankers Ltd: Is This Deeply Undervalued Stock A Hidden Gem?

Image source: Pixabay

As part of an ongoing series, each week we focus on one of the stocks on our stock screeners, and discuss how it could be a deeply undervalued gem. The stock this week is Teekay Tankers Ltd (TNK).

Teekay Tankers Ltd is a provider of marine services to the global oil and natural gas industries and an operator of medium-sized oil tankers. The company operates in two segments: tanker and ship-to-ship transfer. The vast majority of its revenue comes from the tanker segment, which consists of crude oil and product tankers for different contracts.

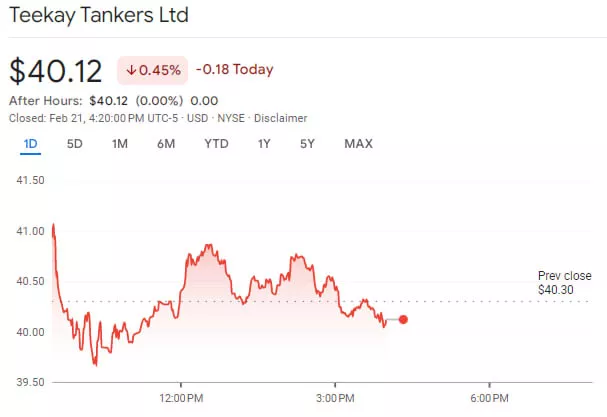

The share price history over the past twelve months (provided below) shows how the price has moved down around 28.97%.

Source: Google Finance

One of the metrics we use in our screens is the IV/P (Intrinsic Value to Price). Let us simplify what that means. IV/P (Intrinsic Value to Price) tells you if a stock is a good deal or not based on how much value you’re getting for the price you pay. Here’s how it works:

- The calculation: It adds up the stock’s ability to make money (earning power), grow (incremental growth), and pay back investors (shareholder yield). This gives you an idea of what the stock is really worth, called its implied value.

- The meaning of IV/P: If IV/P is greater than 1, it means you’re getting more value than you’re paying for. For example, for every $1 you invest, you’re getting more than $1 of value. That’s a good deal. If IV/P is less than 1, it means you’re getting less value than you’re paying for. For example, for every $1 you invest, you’re getting less than $1 of value. That might not be a great deal.

- What it’s used for: It’s a quick way to spot undervalued stocks (good deals). If IV/P is very low, like 0.6 (you’re only getting 60 cents of value for $1), it’s likely overpriced. It's important to note that this is just an estimate. Other factors, like market trends or company issues, can affect how accurate this is.

So, IV/P helps investors find stocks that are “cheap” based on how much value they give back. Higher is usually better.

We have an IV/P of 2.20 for Teekay Tankers Ltd, which means the stock’s implied value is calculated to be 2.20 times greater than its recent price. In simpler terms:

- For every $1 you invest, you’re potentially getting $2.20 of value.

- This is an extremely high ratio, which might suggest the stock could be deeply undervalued, or that there’s some mispricing or unusual calculation in the data.

Possible Reasons for This Undervaluation

There are several macroeconomic factors that suggest the stock may be undervalued. Such factors include the following:

- Global oil demand recovery: As the global economy rebounds, oil consumption is increasing, leading to heightened demand for oil transportation services. This surge can positively impact Teekay Tankers' revenue and profitability.

- Constrained fleet growth: The global tanker fleet is experiencing limited growth due to a decrease in new ship orders and the phasing out of older vessels. This supply constraint can bolster freight rates, benefiting companies like Teekay Tankers.

- Geopolitical dynamics: Ongoing geopolitical events are altering traditional oil trade routes, resulting in longer voyages and increased demand for tankers. The company is well-positioned to capitalize on these shifts.

- Industry consolidation: The tanker industry is witnessing consolidation, leading to more disciplined capacity management and potentially higher profitability for established players such as Teekay Tankers.

Financial Factors

Next, let’s take a look at some of the company’s financials. Here are some notable factors:

- Low price-to-earnings (P/E) ratio: Teekay Tankers' P/E ratio is notably low at 3.8x, compared to the U.S. market average of over 19x. This disparity indicates that the stock might be undervalued relative to its earnings potential.

- High return on equity (ROE): The company boasts an ROE of 26%, significantly surpassing the industry average of 16%. This high ROE reflects efficient management and a strong ability to generate profits from shareholders’ equity.

- Robust earnings growth: Over the past five years, the company has achieved a net income growth of 42%, aligning closely with the industry average growth rate of 40%. This consistent growth underscores the company’s operational efficiency and strategic positioning in the oil transportation market.

- Strategic reinvestment of profits: With a low three-year median payout ratio of 5.7%, Teekay Tankers retains approximately 94% of its profits for reinvestment. This strategy has facilitated significant earnings growth and operational expansion.

- Under-exposure: With a market cap of just $1.37 billion, Teekay Tankers sits in our small- and micro-cap screen. Companies of this size are typically under-the-radar for most analysts.

The company has an Acquirer’s Multiple of 2.64, a FCF yield of 30%, and a five-year ROA of 20.39%.

More By This Author:

Tesla Inc. DCF Valuation - Is The Stock Undervalued?

TSM: One Stock Superinvestors Are Dumping: Is It Time To Sell?

SCHW: One Stock Superinvestors Are Loading Up On