Tech Talk: Canada’s Oil Sands Story

For reasons that will become clear, I think it’s time to put a few Shekels into Suncor, which has been a spectacularly successful oil sands company.

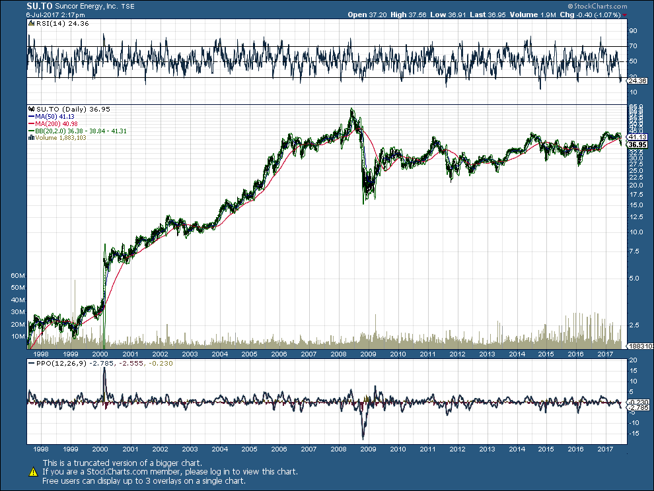

1. The first chart shows that, if you had bought shares 30 years ago, you would have paid a couple of bucks per share, and made off like a bandit. Prices did crash during the Great Recession of 2008-9, but even since that short-term catastrophe the company has done pretty well. Until you look at the short term, anyway.

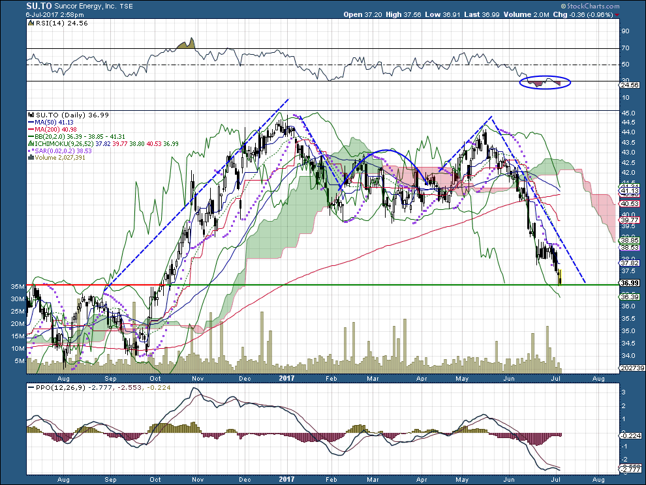

2. The one-year chart, however, suggests that the company is on the mend.I’ve drawn a fancy “M” chart around recent market action, with the red and green support/resistance line forming the bottom.

The pattern here is a classic double top, with the peak on the right-hand side suggesting a big fall in price. As you would expect, the stock did what double-top practice calls for. In keeping with practical charting practice, a 16% fall ensued. And as the chart began stretching toward its bottom, the Relative Strength Index (RSI) panel began sending out warning signals, alerting attentive chart watchers that the stock was oversold at C$37 or thereabouts.

So that’s where I picked it up, just today. I’m optimistic. Think hard on these things, though. A couple of other Canadian oil sands companies recently overpaid by a long shot for their properties, and are paying big time. Suncor is the safest oil sands bet – at the moment, but also for the last quarter century or so.

Disclosure: I do not own any of the stocks mentioned in this article.

Disclaimer: The analysis and ideas presented here should never be seen as a buy or sell recommendation. I am an ...

more

With the recent shift in corporate opinions moving towards a future with clean energy, I wouldn't invest in any kind of oil sands company. The net energy produced by oil sands is so low they will be the first to go when clean energy begins the real takeover, so any gains will be very very short term and unpredictable.

I agree with some of that. In this case I'm looking at the near-term move. Also, please remember that demand for oil continues to increase around the world, and investment in developing new supplies has been declining for years.