Tech Stocks Tumble Towards 2nd Worst December Ever; Bonds Worst Week Since April

After three months of divergence, hard data started to lag this week, catching down to the more sentiment-driven 'soft' survey data, and dashing hopes of a soft landing happening in the US economy...

(Click on image to enlarge)

Source: Bloomberg

The market has shifted hawkishly this week, with expectations for the terminal Fed rate rising and expectations of subsequent rate-cuts falling (both back up near pre-CPI levels)...

(Click on image to enlarge)

Source: Bloomberg

And that reality check weighed on the equity market broadly with Nasdaq hammered hardest (Nasdaq down three weeks in a row). The Dow managed to make gains on the week (best week since Thanksgiving)...

(Click on image to enlarge)

As they careen towards putting in the second worst December performance ever with Nasdaq -9% so far (Dow down 4.2%)...

(Click on image to enlarge)

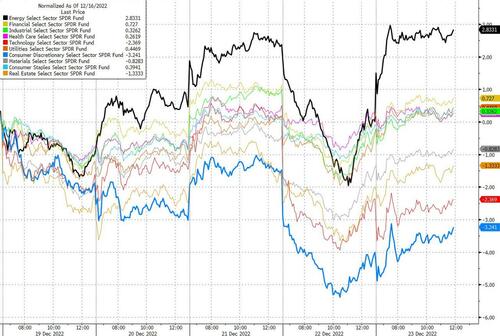

Energy stocks outperformed on the week while Tech and Consumer Discretionary lagged...

(Click on image to enlarge)

Source: Bloomberg

TSLA is down 6 straight days (and 9 of the last 10 days) and 10 of the last 14 weeks.

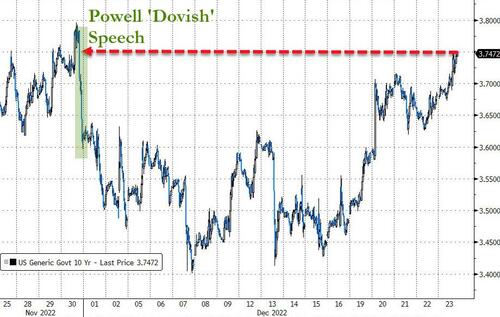

Bonds (which closed early today) were also dumped this week, led by the long-end with the 10Y yield up 26bps - the biggest weekly yield surge since April...

(Click on image to enlarge)

Source: Bloomberg

The 10Y Yield is back up at one-month highs (erasing all the price gains since Powell's dovish address in late November)...

(Click on image to enlarge)

Source: Bloomberg

The dollar slipped lower on the week, back to post-CPI lows...

(Click on image to enlarge)

Source: Bloomberg

Cryptos continued their low-vol range-bound trading with Bitcoin holding just below $17,000 for the week...

(Click on image to enlarge)

Source: Bloomberg

Gold ended the week unchanged (basically the 3rd week in a row where - despite intra-week volatility - the precious metal has ended flat around $1800)

(Click on image to enlarge)

Source: Bloomberg

Oil prices rallied for the 2nd straight week with WTI topping $80 on its best week since early October

(Click on image to enlarge)

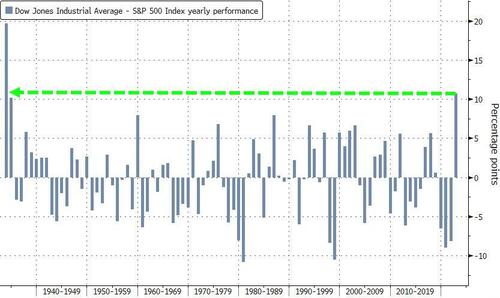

Finally, while December looks set to be the second worst month for stocks ever, The Dow is set for its best year since 1933 relative to the S&P 500...

(Click on image to enlarge)

Source: Bloomberg

As Bloomberg notes, The Dow's reliance on blue-chip companies has made it a place of relative safety as rising interest rates pushed investors away from technology stocks. Some bears are betting the outperformance won’t last: short interest in the SPDR Dow Jones Industrial Average ETF Trust is hovering at 3% of shares outstanding, the highest level since August 2020, IHS Markit data show.

More By This Author:

Where Price Hikes Are Causing More Stress This ChristmasNatGas Production Collapses As Deep Freeze Paralyzes US

November Home Sales Suffer Biggest Crash In History

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more