Tech Stocks: No, You Shouldn't Sell Your Winners Due To A Couple Of Rough Days

Image Source: Unsplash

Technology stocks experienced a really rough time on Wednesday as political wrangling sent professional money managers scurrying to close positions in their 2024 winners. Don’t follow their lead, writes Jon Markman, editor of Digital Creators & Consumers.

Professionals do this all of the time. They believe they can accurately rotate between stocks, and from one sector to another, catching the upswing in the new leader while avoiding the downdraft in the previous champion. These professionals are fooling themselves. They have no history of success.

Longer-term studies from S&P Global show that an astounding 94% of money managers fail to keep pace with their unmanaged benchmarks. In fairness, this is a difficult task because pros also have to manage risk.

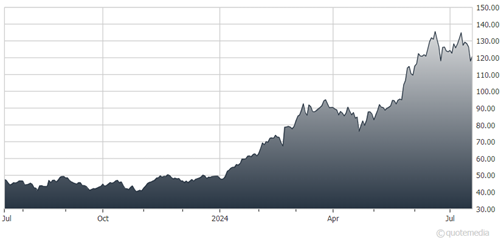

Regular readers likely know that some positions have remained in our portions for a decade. Undoubtedly, shares of Nvidia Corp. (NVDA) happily make up huge portions of many investors' net worth. Longer-term gains of 25,763% led to this, and that is noteworthy.

Nvidia Corp. (NVDA)

Professionals can’t seem to hold onto winners because they have to manage against over-concentration. However, pros are now rotating from winning shares of Nvidia, Taiwan Semiconductor Manufacturing Co. (TSM), and Arista Networks Inc. (ANET) into losers like Intel Corp. (INTC), GlobalFoundries Inc. (GFS), and Cisco Systems Inc. (CSCO). At the session highs on Wednesday, these stocks were up 8.2%, 13.8%, and 2.8%, respectively.

Many pros say Nvidia, Taiwan Semiconductor, and Arista have become too expensive, and that the latter represent great “value.” These professionals may be delusional. The best longer-term investors buy shares in great businesses with durable competitive advantages. Intel, GlobalFoundries, and Cisco have underperformed because their businesses are being disrupted by Nvidia, Taiwan Semiconductor, and Arista Networks.

Moreover, the cause of the tech weakness on Wednesday was a pair of Bloomberg political stories. The first was a report that the Biden Administration is considering tougher trade restrictions on semiconductor exports to China. Separately, former President Trump opined that Taiwan should pay the US government for protection from Chinese aggression. In other words, two candidates for president were trying to score political points.

I’m not saying bulls get a mulligan on Wednesday. But some perspective is warranted. Occasionally, there will be selloffs, and that’s fine. Some giveback was inevitable.

We are monitoring closely, however, and we are committed in the near-term to buying our digital transformation stocks into weakness.

About the Author

Jon Markman is a veteran journalist, investment adviser, and futurist whose research on ground-breaking technology companies over the past four decades has helped thousands of customers achieve their financial goals. He has served as an investment strategies columnist at the Los Angeles Times and Forbes magazine, as well as the founding managing editor at MSN Money.

Leveraging the power of Microsoft engineers, in 2001, he created the first successful stock-rating system for the public using advanced quantitative analytics.

Mr. Markman is currently the author of seven stock and options services: Disruptors & Dominators, Strategic Options and Weiss Technology Portfolio for Weiss Ratings; Fast Forward Investing for Forbes; and Strategic Advantage, Tactical Options and Counterpoint Options for his own independent site. He is also the author of five books on investing.

More By This Author:

GDX: A Great Way To Play Seasonal Strength In Gold And Silver Miners

Dividends: A Tool to Help You Achieve Financial Independence

Mama's Creations: A Small-Cap Food Company With Solid Growth

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more