Tech Stocks Leadership Reaches Important Trend Line Support

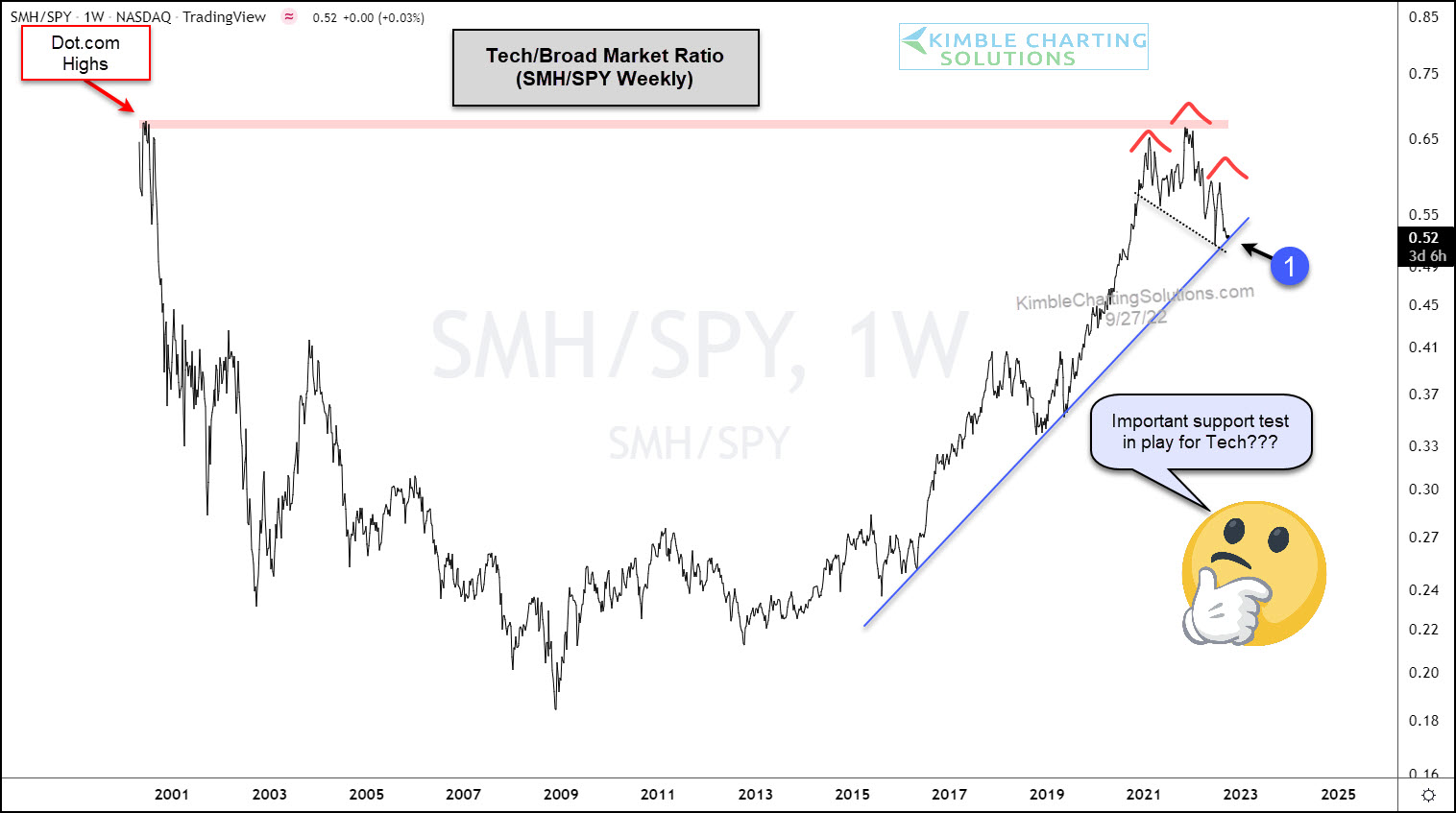

Today we revisit an incredibly important stock market ratio: The Semiconductors Sector SMH versus the S&P 500 SPY.

This ratio highlights how an important tech leadership group is performing versus the broad market. And considering that tech stocks lead the market higher over the past 13 years, well, it’s important.

We’ve highlighted this ratio several times this year, following its breakdown through price support, and its latest test of resistance (before falling again!).

Below is a “weekly” chart that highlights a bearish head and shoulders pattern breakdown that formed as a double top at the Dot.com highs. Yikes!!

The chart has a heavy feel to it so bulls are going to need some super strength for the save. Their opportunity is now and they must begin to see buying. The $SMH to $SPY ratio is testing its long-term trend line support at (1).

This humbly looks to be quite an important test for investors and the broader market!

(Click on image to enlarge)

More By This Author:

NYSE Composite Breakdown, Taking Out June Lows, Another Warning To Bulls

Fed Funds Could Rise 2% More, Says 2-Year Yields And Joe Friday

Gold Bulls Don’t Want To See A Breakdown Here

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.