Tech Stocks In Focus After Nvidia’s Blowout Numbers

Image Source: Unsplash

Wall Street futures surged higher overnight as shares in Nvidia surged in after hours. Most of the stocks in the sector also climbed on speculation that Nvidia’s blockbuster outlook will reignite a tech-driven surge. Until the recent stock market rout, chipmakers and other tech companies had been fuelling near-regular records for major US indices. While the Nvidia stock can single handedly lift markets on any particular day, it remains to be seen whether the stock will have enough momentum to fuel a recovery in the wider markets that have many other concerns ranging from tech valuation fears, bubble in the AI technology, to stagflation and government debt worries. I remain sceptical for what it is worth. Meanwhile, today’s US jobs report for September was mixed, with the headline jobs number rising more than expected but the unemployment rate also ticking higher.

Keep an eye on Nvidia performance today

While the Nasdaq 100 futures are still down in November, Nvidia’s strong earnings are offering a bit of relief to global risk sentiment. Nvidia shares spiked more than 5% after the giant chipmaker gave a strong revenue forecast for the current period.

Nvidia is as a barometer for AI technology, so its results will help to counter at least some of the concerns that a global rise in AI spending is poised to pop. Markets will probably need more conviction from the other companies but with the earnings season practically over now, investors’ scepticism about tech spending outside of Nvidia will probably remain to some degree. That may keep the upside limited for major tech indices like the Nasdaq 100 and S&P 500, especially with other macro concerns also on the forefront.

Rising bond yields spell trouble

Chief among market’s worries is the sharp rise we have seen in bond yields of countries with high levels to debt, most notably Japan, and now the UK, too. Fiscal worries are pushing yields higher as investors demand higher reward for holding onto government debt. With bond yields on the rise, this is not something positive for low- and zero-yielding assets, as well as, one would argue, growth stocks. But it is not just rising yields that matter, it is the unwinding of leveraged bets as the yen and cryptocurrencies continue to tumble.

In Japan, the debt problem is fast turning into a currency crisis. The yen has continued to plunge lifting the USD/JPY to near 158.00 handle. It could climb even higher if today’s US jobs report doesn’t disappoint expectations. Markets fear the government is mismanaging the economy and are therefore demanding a higher yield for holding Japanese debt. The moves in Japanese assets have already ignited a so-called carry trade unwind. The carry trade is where you borrow money from a country with interest rates low, and you use the funds to buy stocks and other financial assets. With Japanese yields now surging, the cost of the carry is increasing. Yields are starting to get uncomfortably high, and this is increasing the pressure on leveraged bets, causing traders to unwind their trades in all sorts of financial assets. That has been the trend in recent days; let’s see if investors will take advantage of the Nvidia-led rally to unwinding positions in technology today.

Nasdaq 100 technical analysis

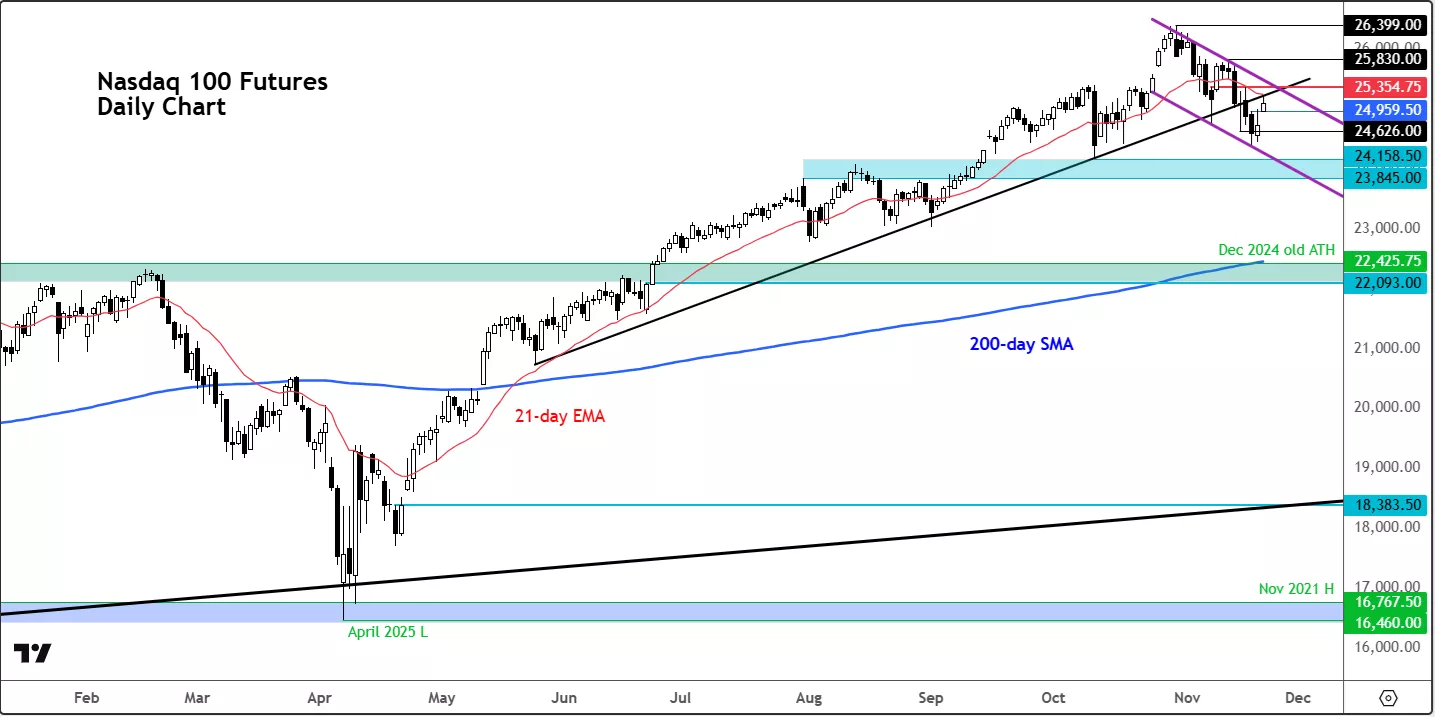

From a technical standpoint, the Nasdaq still looks broadly bearish to neutral after snapping the bullish trend line that had held firm since before the summer. That break occurred on Monday, and we’ve remained beneath the line ever since. As long as price continues to trade below that broken trend line, buying the dips becomes a far more questionable strategy. The recent pattern of lower lows and lower highs suggests the market’s tone has shifted, and we need to respect that.

At the time of writing, the Nasdaq was testing the underside of that old trend line, an area that now coincides with the 21-day exponential moving average. This zone sits roughly around 25,200. A move above there would bring horizontal resistance at 25,350 into focus, which also aligns with the upper boundary of the current bearish channel. In other words, the bulls still have a fair bit of work to do; we’re certainly not out of the woods yet. Until the short-term structure of lower lows and lower highs is broken, it’s difficult to argue that a meaningful bottom is in place.

On the downside, 24,960 stands out as a key support level, marked by the recent cluster of prior highs. A break beneath that would shift attention towards the 24,600 region, followed by this week’s low at 24,375. Technically, it remains unclear whether the broader bullish trend is genuinely re-establishing itself or whether this latest rebound is simply a dead-cat bounce. The sharp declines across global markets—and the 30% slide in Bitcoin from its record peak in just a few weeks—add to the case for caution.

For now, I’d treat the bounce with a healthy degree of scepticism. It may yet prove to be another trap for the optimistic. Until we see cleaner signals, proceed carefully from a technical perspective.

More By This Author:

GBP/USD Eases Lower On Soft UK CPI Ahead And US NFPNasdaq 100 Analysis: Futures Ease Amid Valuation Concerns

EUR/USD Downside Should Be Limited