Tech Stocks As A "Safe Haven"?

One of the last things to be tossed overboard in the late innings of a bull market is discrimination. Instead of comparing the valuations of different assets and buying relative bargains, investors (known in retrospect as “dumb money”) just pour cash into the things that have been going up. This gives those favored assets one last parabolic spike before the inevitable end-of-cycle crash.

It, of course, has to be noted that critics of the current financial bubble have been predicting its end for a while and anyone who listened passed up what turned out to be easy money.

Still, what’s happening now is ridiculous. From today’s Wall Street Journal:

"Why Mess With a Winning Strategy? Investors Bet on Tech

Investors have given up bargain hunting so far this year.

Instead, they are piling into shares of some of the market’s biggest winners: so-called growth stocks, shares of companies that promise rapidly increasing profits and revenue.

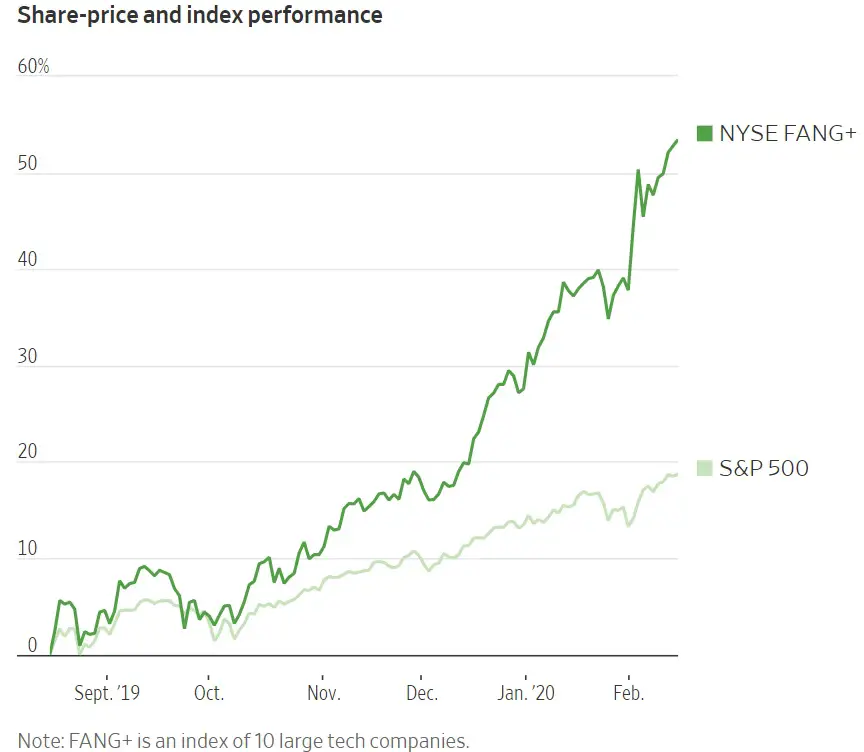

They remain as hungry as ever for shares of software providers and cloud-computing companies, flocking to heavyweights like Microsoft (MSFT), Apple (AAPL), Amazon (AMZN) and Google parent Alphabet (GOOGL). These stocks are sitting on double-digit gains in 2020 and have powered 45% of the S&P 500’s total return.

“Investors believe they’re better positioned to weather any economic storm,” said Brent Schutte, chief investment strategist at Northwestern Mutual Wealth Management Co., speaking of growth stocks. “Even if there’s a recession, people will keep using Facebook (FB).”

It is a shift from the Fall when value stocks—those that tend to trade at low prices relative to their earnings or net assets—outperformed growth shares and pundits predicted their long-awaited rebound had arrived after years of disappointing returns. Those hopes were buoyed by three interest rate cuts by the Federal Reserve that were expected to spur a rally in bank stocks and other traditional value plays.

Since then, markets have been rattled by tensions between the U.S. and Iran and the coronavirus outbreak in China, which has sickened tens of thousands of people around the world and crimped business activity. Oil prices tumbled into a bear market and investors have flocked to traditionally safer bets like U.S. Treasurys (IEF).

But through the turbulence, investors kept snapping up shares of companies promising high growth, confident they can survive these challenges. Many are eager to hold on to stocks they view as enduring winners of a period of technology disruption.

As other sectors have muddled through, big tech companies, which have become nearly synonymous with growth in recent years, have continued to stand out. Overall corporate earnings have been roughly flat for the fourth quarter, but 84% of companies in the tech sector have reported profits that beat expectations, according to FactSet. Apple posted record revenue, while Microsoft’s cloud business continued to shine. Shares of both companies are near highs.

The S&P 500’s tech sector is up 11% this year, leading the way as it has for much of the decadelong bull run. The enthusiasm has even extended to initial public offerings like Uber Technologies Inc. (UBER) and Pinterest Inc. (PINS) that made a big splash last year. Though they initially floundered, the stocks have raced past the broader market, rising 33% and 25%, respectively, in 2020.

“The market is going to continue to reward these companies,” said Daniel Morgan, senior portfolio manager at Synovus Trust Co. “There’s still a large appetite for growth.”

To sum this up, high-growth tech stocks have become this cycle’s safe-haven assets. Like houses in the previous bubble and dot-coms in the one before that, “they always go up,” so they’re positioned to weather any storm.

History teaches that this kind of thinking fails for at least two reasons. First, in hard times many people need to raise cash. And that cash resides in the things that went up most in the preceding bull market. So even assuming that Amazon, Apple, et al continue to grow (a very big assumption in an uncertain world), they’ll still be sold to plug the suddenly gaping holes in investors’ balance sheets. Which means they can’t be both safe havens and sources of cash for worried investors. The two roles are mutually exclusive.

Second, when most of the market is down, investors tend to harvest tax losses by selling their losers. Then they sell some of their winners to match capital gains to capital losses. This kind of tax management puts downward pressure on the (previously) best-performing stocks. So in the next recession/financial crisis/bear market, today’s winners will necessarily be among the big losers.

At least that’s what history says. Soon we’ll find out if the past is still prologued.

I would think you would need to differentiate between purely digital tech companies - for example software companies like $FB and $CRM, and product based tech companies like $AAPL. The latter is going to take a major hit due to disruptions in supply from the #coronavirus outbreak.