Tech Stocks Are Not Always The Answer To Big Gains

Image Source: Pixabay

If there’s one thing that’s undoubtedly true over the past decade, it’s that technology stocks have been blistering hot.

And it’s been for very understandable reasons.

Many of these companies’ products have entirely changed the way the world behaves. People stay solely connected through digital channels such as social media, students are now taking their exams online, and consumers are even utilizing digital apps that allow for grocery delivery.

But while all that sounds fun and exciting, many have overlooked simple businesses that aren’t overly flashy. This includes companies that take care of waste management, provide staffing uniforms, and even energy drink providers, to give a few examples.

Many of these companies fall into the Consumer Staples sector, whose businesses face steady demand across many economic conditions. In other words, people will want their trash picked up no matter the state of the economy, and we all obviously enjoy our caffeine buzz.

And perhaps to the surprise of some, these non-technology companies have seen wildly strong performance, with their predictable nature able to provide nice shields against volatility.

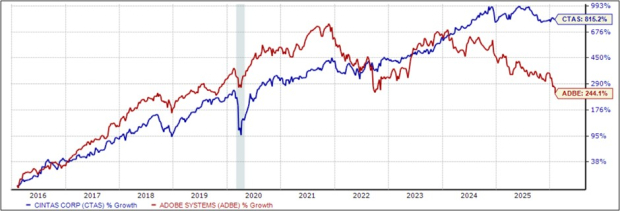

Cintas Outperforms Adobe

For example, Cintas (CTAS - Free Report), the company that provides uniforms and other workplace supplies to employers, has gained +815% over the last decade, compared with a +244% gain from Adobe (ADBE - Free Report).

Cintas’ +24.6% annualized return over the period has undoubtedly excited investors. As shown below, shares have also been considerably less volatile over the last decade, largely weathering 2022 volatility with ease.

Image Source: Zacks Investment Research

Bottom Line

Simply put, you don’t have to buy tech stocks to see great returns. Lesser-discussed companies like Cintas have built consistent, dependable growth by doing the ‘simple’ things exceptionally well. Of course, they’re likely not to impress investors given their less-flashy nature, but sometimes boring is better.

More By This Author:

Meta Pops And Microsoft Drops: A Closer LookKey Factors Of Outperforming Stocks

Can Apple Shake Off AI Struggles?