Tech, Energy Stocks Boost Broader Market Midday

Wall Street boasts a solid midday lead, reversing a quiet start to the holiday-shortened week as tech and energy stocks boost the broader market. At last check, the Dow Jones Industrial Average (DJIA) is well in the black, while the Nasdaq Composite (IXIC) sports a triple-digit lead and, along with the S&P 500 Index (SPX), heads for its fourth-straight daily win.

Microsoft Corp (Nasdaq: MSFT) tapped former OpenAI CEO Sam Altman as the head of its new artificial intelligence (AI) team, and the news has options traders in a frenzy. So far, 270,000 calls and 158,000 puts have been exchanged, or double the average intraday volume. New positions are being sold-to-open at the top four most popular contracts, led by the weekly 11/24 380-strike call. Microsoft stock was last seen 1.3% higher at $374.52 and is now up 56.6% in 2023.

U.S.-listed shares of Argentinean companies are moving higher today after far-right Libertarian Javier Milei won the country's presidential election. Argentine energy firm YPF SA ( NYSE: YPF) stock is up 39.6% at $14.98 this afternoon and standing at the top of the New York Stock Exchange (NYSE) following the news that Milei wants to privatize the company. Today's pop has helped YPF moved nearly 60% higher on the year.

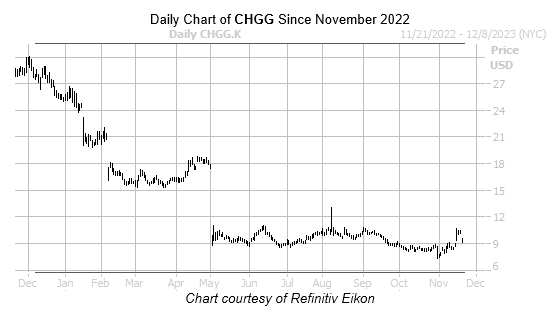

Morgan Stanley just downgraded Chegg Inc (NYSE: CHGG) to "underweight" from "equal weight" and cut its price target to $9, pushing the equity towards the bottom of the NYSE. The analyst said the stock's recent outperformance is in contrast with its fundamentals. Last seen down 11.6% at $9.25, CHGG has suffered multiple bear gaps in 2023 and is now down more than 67% over the last 12 months.

More By This Author:

S&P 500, Dow Log Longest Weekly Win Streak Since JulyStocks Still Eyeing Weekly Wins Despite Midday Slide

Dow Snaps Win Streak With Modest Loss