Target Soars Despite Full-Year Forecast Slashed; CEO Comments On "Unacceptable" Shrink And Pride Month

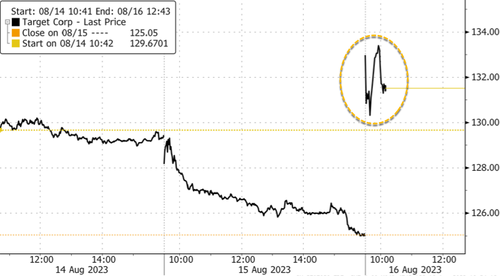

At the start of the cash session Wednesday, Target (TGT) shares jumped the most in a year, following the retailer beating profit estimates for the second quarter, offsetting negative sentiment around lower guidance for the year and a revenue miss.

Responding to earnings, JPMorgan analyst Christopher Horvers wrote in a note to clients:

TGT's 2Q GM-driven upside (offsetting the sales miss that was in line with our below-Street forecast) enabled the company to guide better-than-bearish expectations for the year. Indeed, the estimated $0.40-0.50 of outperformance in 2Q relative to our view of market expectations, and our estimate is the differential between where guidance landed ($7.00-8.00) and our previewed expectations ($7.00-$7.50; we were at $7.41). Elevating above the pre-market short squeeze, we note that this was the easiest gross margin compare of the year, though, at least for now, TGT looks clean on inventory.

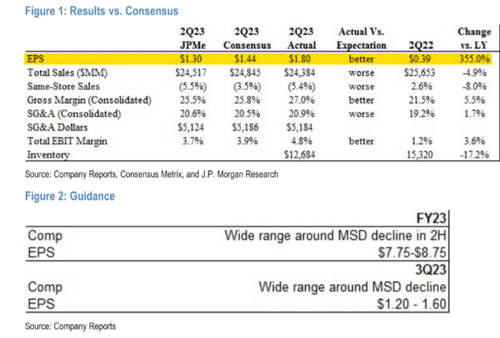

Target reported a net income of $835 million, or $1.80 a share, up from $183 million, or 39 cents a share, in the year-earlier period. This was well ahead of the Wall Street consensus of $1.44 and JPM's $1.30 estimates :

(Click on image to enlarge)

Horvers noted estimates for 2024 are "way too high":

More importantly, the midpoint of the guidance suggests a 4.6% op marginas the starting point for 2024 vs. 5.5% per Consensus Metrix. Indeed, as wenoted, next year needs to come down substantially before having the all clear.If we assume TGT does an "algo year" in 2024 (MSD revenue growth and HSDEPS growth) off the $7.50, this suggests ~$8.00 in EPS vs. the Street's $9.72. Using16x (its average FY1 PE in 2019 and typically where investors center valuation forTGT with bears at 15x), this suggests fair value is $130 at the end of this year (whichsuggests it settles back down below as the dust clears).

More importantly, the midpoint of the guidance suggests aComp in line with our lowered forecasts, EPS +25% ahead of consensus on strong GM performance. Comps were down 5.4%, below the Street's down 3.5%, but in line with our down 5.5% forecast (and the previewed down 5% bar, per our conversations), with traffic down 4.8% and ticket down 0.7%. Retail gross margin rose 550 bps YOY to 27.0 % (vs. 25.8% per Consensus Metrix and our 25.5%) reflecting lower markdowns and other inventory- related costs, lower freight costs, retail price increases, and lower supply chain and digital fulfillment costs, partially offset by higher shrink. SG&A was 20.9% of sales, ahead of our and the Street's estimates reflecting sales deleverage and higher costs, including continued investments in pay and benefits and inflationary pressures throughout the business, partially offset by disciplined cost management4.6% op marginas the starting point for 2024 vs. 5.5% per Consensus Metrix. Indeed, as wenoted, next year needs to come down substantially before having the all clear.If we assume TGT does an "algo year" in 2024 (MSD revenue growth and HSDEPS growth) off the $7.50, this suggests ~$8.00 in EPS vs. the Street's $9.72. Using16x (its average FY1 PE in 2019 and typically where investors center valuation forTGT with bears at 15x), this suggests fair value is $130 at the end of this year (whichsuggests it settles back down below as the dust clears).

FY23 guidance lowered ; 3Q cut 26% below Street at the midpoint with 2H implied 16% below. For FY23, TGT its lowering its guidance to comps in a wide range around a MSD decline for the remainder of the year vs. the Street's -1.5% in 2023 and down 1-2% in 2H, with EPS of $7.00-8.00 vs. the Street's $7.86 and $7.75-8.75 prior, reflecting mgmt's caution given top-line challenges persist in the near term. For 3Q, the company expects comparable sales in a wide range around a MSD decline vs. the Street's -1.9% and our - 3.4%, and EPS of $1.20-1.60, 26% below the Street's $1.90 at the midpoint (and our $2.00)

Shares of Target surged as much as 8.2% at the opening bell in New York but have faded from the initial highs.

(Click on image to enlarge)

What stood out in the earnings call were comments from Target's CEO, Brian Cornell. He expressed concerns about escalating thefts and violence in stores, labeling them "unacceptable," and addressed the Pride Month controversy.

"As you'll hear in more detail from Michael, shrink and the second quarter remain consistent with our expectations. expectations, but well above the sustainable level where we expect to operate over time. And unfortunately, safety incidents associated with theft are moving in the wrong direction. During the first five months of this year, our store saw a 120% increase in theft incidents involving violence or threats of violence," Cornell said.

He said, "In addition to these more recent challenges, our team continues to face an unacceptable amount of retail theft and organized retail crime."

Meanwhile, CFO Michael Fiddelke believes:

And our long-run expectation is that shrink rates will moderate from today's unsustainable levels. But, so far, we've only seen indications that loss rates might soon be reaching a plateau, but have not yet seen evidence that loss rates will begin to come down. So, the only reason for the expected change in year-over-year comparisons is the cadence of how shrink was recognized by quarter in the back half of last year, year, a period when loss rates increased rapidly, resulting in higher shrink accruals at year-end.

... and how does Fiddelke have a crystal ball about what thieves will be doing in the future? Unless Target is now pressuring DAs in progressive metros to enforce laws and order...

Last but not least, Cornell updated investors about Pride Month:

In the second quarter, many of our (Inaudible) team members faced a negative guest reaction to our Pride assortment.

As you know we have featured a Pride assortment for more than a decade. However, after the launch of the assortment this year, members of our team began experiencing threats and aggressive actions that affected their sense of safety and well-being while at work. I want to make it clear, we denounce violence and hate of all kinds, and the safety of our team and our guests is our top priority. So, to protect the team in the face of these threatening circumstances, we quickly made changes, including the removal of items that are at the center of the most significant confrontational behavior.

Pride is one of many heritage moments that are important to our guests and our team, and we'll continue to support these moments in the future. They are just one part of our commitment to support a diverse team, which helps us serve a diverse set of guests. As we talk to these guests, they consistently tell us that target is their happy place. happy place.

Even though Target had a big profit beat, the overhanging issue is a softening of sales, forcing the retailer to the lower full-year forecast. Just wait until student debt payments restart next month.

More By This Author:

US Building Permits Stagnant In July As Mortgage Rates Topped 7%WTI Holds Losses Despite Bigger Than Expected Crude Draw

Futures, World Markets Tumble After China Surprise Rate Cut Sparks Growth Fears

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more