Tap Into Large-Cap Tech Strength With These 3 Stocks

Image: Bigstock

Large-cap technology has recently come back into style, with many buyers stepping up. For example, three stocks – Cadence Design Systems (CDNS - Free Report), Salesforce (CRM - Free Report), and Palo Alto Networks (PANW - Free Report) – have all widely outperformed the S&P 500 in 2023 so far, as we can see in the chart below.

Image Source: Zacks Investment Research

In addition, all three have witnessed positive earnings estimate revisions, indicating favorable near-term business outlooks. For those interested in large-cap technology stocks with solid momentum and outlooks, here is a deeper dive into all three.

Palo Alto Networks

Palo Alto Networks offers network security solutions to enterprises, service providers, and government entities worldwide. Presently, the stock sports a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

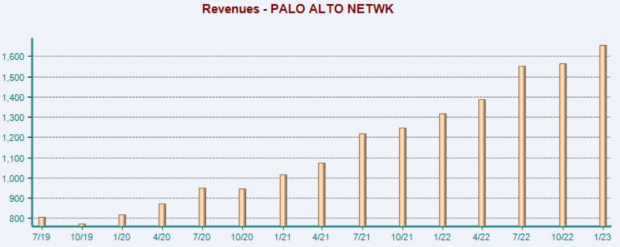

Palo Alto posted a notably strong quarter in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 34% and delivering a modest revenue surprise. As we can see in the chart below, the company’s revenue growth has been rock-solid.

Image Source: Zacks Investment Research

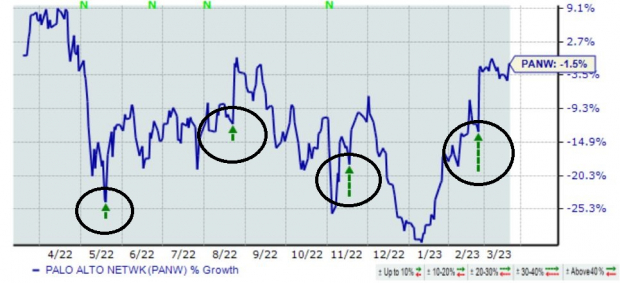

The market took the better-than-expected results in stride, sending shares soaring post-earnings. In fact, the company’s quarterly results have consistently pumped life into shares, illustrated below by the green arrows.

Image Source: Zacks Investment Research

Cadence Design Systems

Cadence Design Systems offers products and tools that help customers to design electronic products. Analysts have taken their earnings estimates higher across all timeframes, helping land the stock a Zacks Rank #1 (Strong Buy) rating.

Image Source: Zacks Investment Research

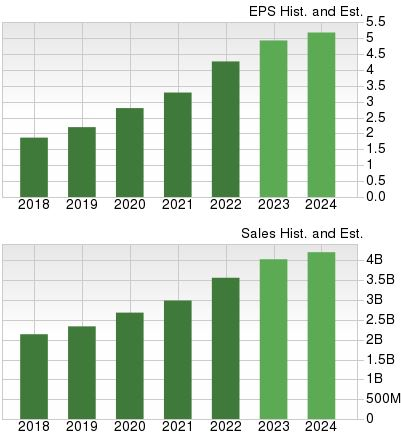

The company sports a solid growth profile, with the $4.97 Zacks Consensus EPS Estimate for its current fiscal year (FY23) indicating a 16% year-over-year climb in earnings.

And in FY24, earnings are forecasted to climb a further 8%. Top line growth is also apparent, with estimates calling for 13% year-over-year revenue growth in FY23 and 8.4% in FY24.

Image Source: Zacks Investment Research

Salesforce

Salesforce is the leading provider of on-demand Customer Relationship Management software, enabling organizations to better manage critical operations. CRM presently sports a rating of Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

CRM shares may steer value-conscious investors away, with the company’s current 5.3X forward 12-month price-to-sales ratio residing on the higher end of the spectrum. Still, the value is well below the 7.1X five-year median, making CRM shares appear cheap on a historical basis.

Image Source: Zacks Investment Research

Bottom Line

Focusing on stocks displaying relative strength is an excellent way for investors to find themselves in positive trends.

And in 2023, all three large-cap tech stocks above – Cadence Design Systems (CDNS - Free Report), Salesforce (CRM - Free Report), and Palo Alto Networks (PANW - Free Report) – have displayed immense relative strength, outperforming the general market by notable margins. And for the cherry on top, all three sport favorable Zacks Rank ratings, indicating favorable near-term business outlooks.

More By This Author:

3 Big Tech Stocks Are Holding Up The Entire MarketBear Of The Day: MicroStrategy

Bull Of The Day: Baidu

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more