SYK: A Medical Equipment Maker Benefiting From M&A, New Products

Image Source: Pexels

Stryker Corp. (SYK) reported strong financial results for the third quarter, driven by robust top-line performance. The company achieved $6.1 billion in reported sales, a significant 10.3% increase year-over-year. Net income and earnings per share also increased.

Reported net income rose 3% to $859 million and diluted earnings per share (EPS) climbed 2.8% to $2.22. Despite the strong sales, net income growth was moderate because costs — including a higher cost of sales, non-recurring operating impairments, and increased interest expense — grew faster than revenue. Ultimately, a reduction in income taxes supported the final gain.

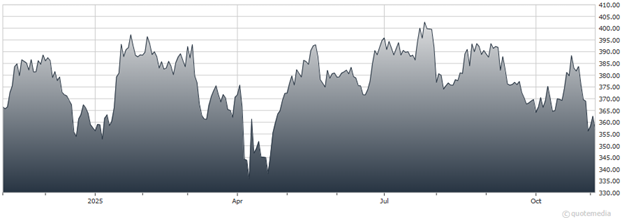

Stryker Corp. (SYK)

Stryker's strong 9.5% organic net sales growth was powered by several key operational drivers. Healthy procedural volumes and robust hospital capital expenditure demand were foundational. Technologically, the momentum in the Mako robotic platform continued, driving an 11.4% organic growth in the Orthopedics segment.

Other segments also performed well, including Neurotechnology, fueled by recent launches like the Surpass Elite flow-diverting stent. The company also successfully advanced the Inari acquisition integration and continued its commitment to active M&A efforts – all while managing persistent supply chain disruptions and increasing tariff impacts.

In a sign of excellent financial health and operational efficiency, Stryker’s cash flow saw a significant 32.2% year-over-year increase, primarily driven by working capital improvements. This impressive cash generation underscores the company’s ability to return substantial capital to shareholders. For the first nine months of the year, Stryker returned $2.3 billion to shareholders via dividends, demonstrating a strong commitment to shareholder value.

Management also anticipates delivering a second consecutive year of 100 basis points of adjusted operating margin expansion, anticipating continued strength in procedural volumes and the hospital capital expenditure environment through the end of the year.

More By This Author:

MGK: Rotate To This Growth Fund As Economy Remains ResilientBIZD And PBDC: Should You Buy BDC Funds Despite Credit Worries?

Cloudflare: A Tech Name To Trade After Recent Breakout