Swing Low For Indices?

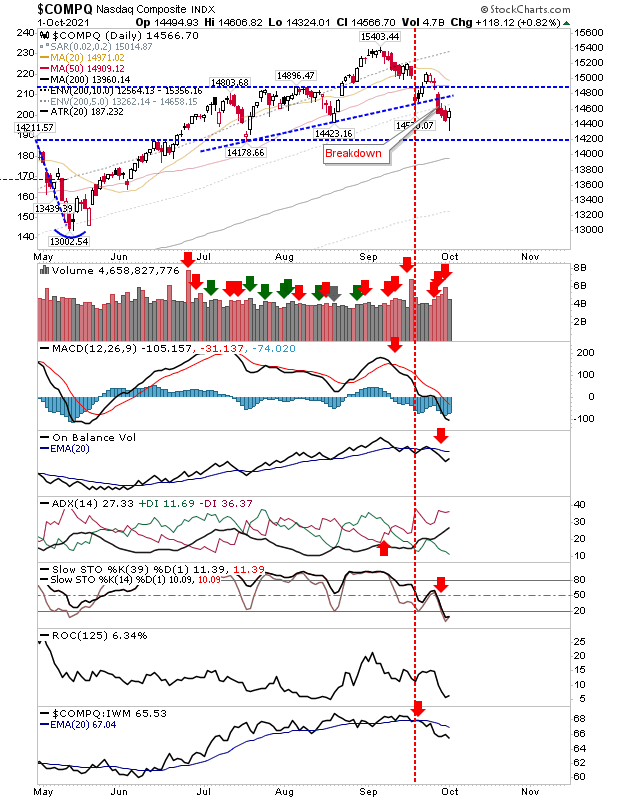

Friday was a first attempt by bulls to build a swing low since peaking in early September. Lead indices finished with bullish candlesticks on oversold momentum indicators. Volume was down on previous selling, so any follow through will need some confirmed accumulation - but Friday was a good start.

The Nasdaq finished with a bullish hammer and is well placed for a follow through higher on Monday. The key negative is the relative performance weakness of the index to the Russell 2000 and the fact this index is a long way from testing its 200-day MA.

The S&P closed with a bullish piercing pattern with stronger relative volume than the Nasdaq, although not net accumulation. Other technicals are negative, but given the oversold state of momentum it offers an opportunity for a 'buy' signal.

The Dow Jones Index is caught in a trading range similar to that of the Russell 2000. The index is outperforming the Nasdaq 100, although other technicals are net bearish. The next rally will likely kick off on a test of the 200-day MA, although this test will also coincide with a test of Dow Jones Index trading range support near 32,300.

The Russell 2000 did manage to rally off its 200-day MA, although it's stuck smack bang in the middle of its trading range. The Russell 2000 is enjoying a relative performance advantage against the Nasdaq and S&P and is well placed to lead out the next phase of the rally. However, for this to happen, it needs to clear this trading range to the upside.

Indices are ready to rally, the question is whether they will. A bounce can be expected at minimum, but getting to new highs is of a higher order. Tomorrow may see the start of the bounce, by the end of the week we might know more about how sustainable such a bounce may be.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more

This is amazing. you have discussed it very well. But Don't you think swing trading is beneficial to the day traders?

I think it does.