Stronger Bullish Action For The Nasdaq And S&P As Russell 2000 Suffers Again

Sellers tried to put the squeeze on the indices with a large intraday swing lower, but by the close of business, those losses were recovered for some of the indices.

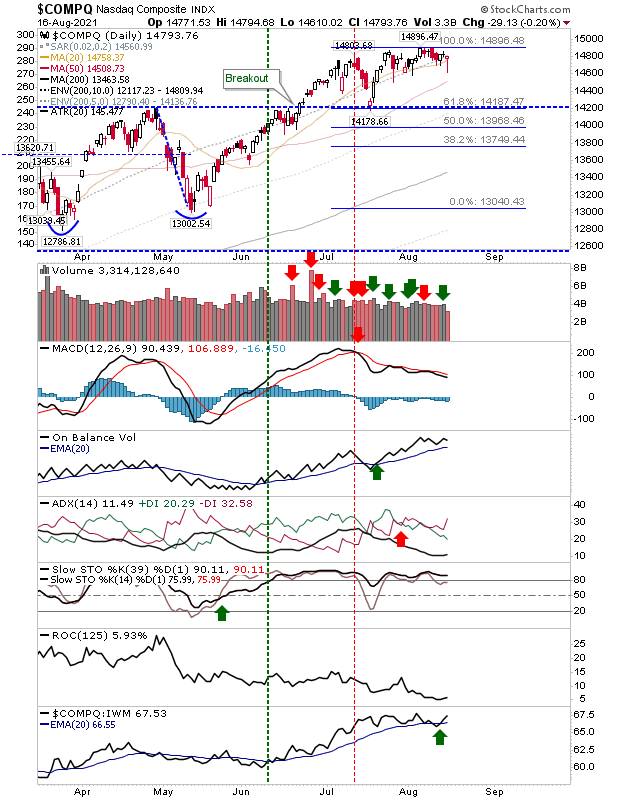

The Nasdaq had undercut its 20-day MA with a quick loss, but it recovered to finish with a 'bullish' hammer. However, as the index is not oversold in momentum it's not a strong bullish candlestick. Technicals are mixed with a 'sell' trigger in the MACD and ADX, but bullish On-Balance-Volume and Stochastics. The selling volume was lighter, so there is no distribution.

The S&P had flashed a sequence of narrow, tight-range candlesticks up until today, but today offered a wide range hammer that saw buyers step in to claw back intraday losses. It was enough to leave the index at a new all-time high after looking like it was going to be a confirmed day of selling. Ultimately, it proved to be an accumulation day but overall trading volume was light - in line with vacation trading.

The Russell 2000 gapped below its rising wedge and it remains to be seen if there is a measured move lower down to - and below - trading range support. However, there is a 'sell' trigger in On-Balance-Volume, ADX, and relative performance loss to the Nasdaq.

Markets continue to diverge with gains in the Nasdaq and S&P countered by losses in the Russell 2000. The latter is more worrying as a move to trading range support would look to be a minium target and this will have an obvious (negative) knock-on effect on the S&P and Nasdaq.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more