Strong IPhone 16 Sales Boost Apple Amid Competitive Chinese Market

Apple’s iPhone 16 has seen a strong start in China, with sales up 20% in the first three weeks compared to the previous year’s iPhone 15, according to Counterpoint Research. This marks a positive signal for Apple in a market where it has faced stiff competition from local rivals such as Huawei, Vivo, and Xiaomi. Sales of the high-end iPhone 16 Pro and Pro Max models grew by 44%, driven by consumer preference for the premium models.

This uptick in sales comes at a critical moment for Apple, as the Chinese market remains one of the most competitive globally. Despite these gains, Apple still faces challenges, including Huawei’s strong performance with the Mate 60 series and upcoming product launches from competitors.

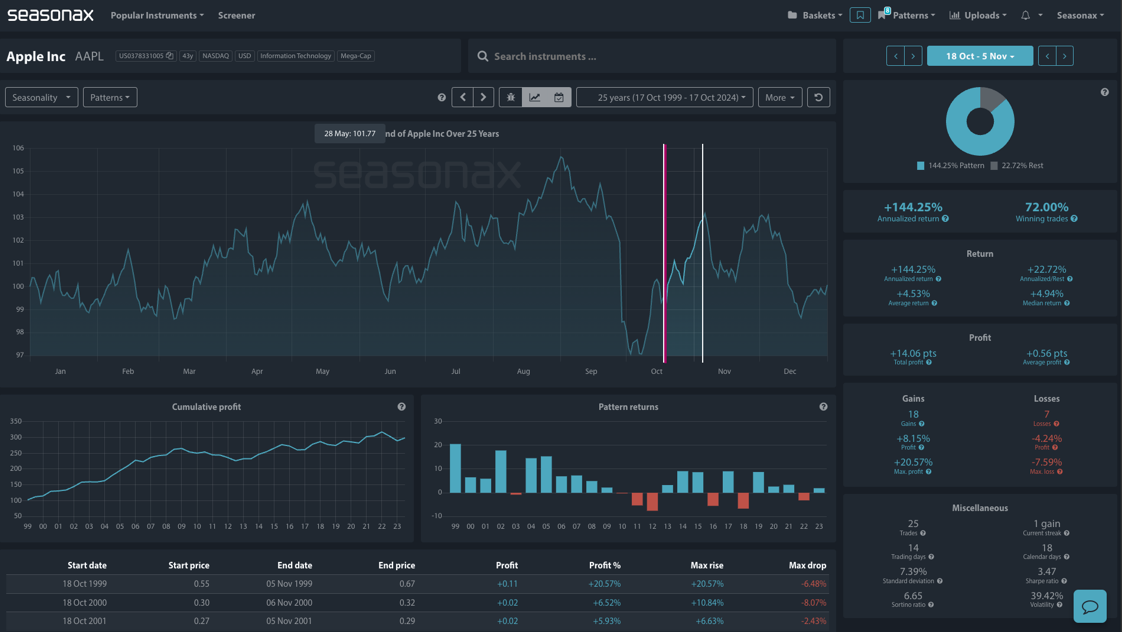

Looking at Apple’s seasonal trend, the stock typically performs well between mid-October and early November, with a robust 144.25% annualized return and a win rate of 72%. This seasonal strength aligns with the recent surge in iPhone sales, providing a potential buying opportunity for investors looking to capitalize on Apple’s bullish momentum as it navigates the Chinese market.

(Click on image to enlarge)

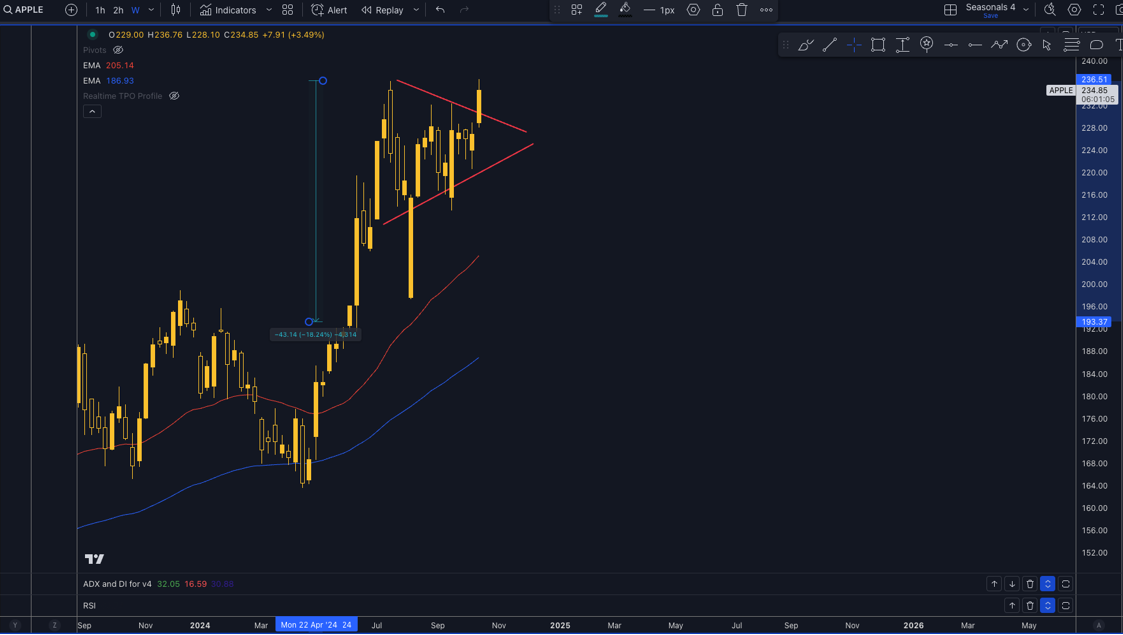

Technically, Apple is breaking above a key weekly trend line and breaking out of an imperfect flag structure indicating that a measured move of the flag pole higher could be targeted.

(Click on image to enlarge)

With the iPhone contributing around half of Apple’s annual revenue, its strong performance in China bodes well for the tech giant. Coupled with Apple’s historically strong seasonality pattern during this period, the stock could see further gains, making this a potential dip-buying opportunity for investors.

Trade risks

One major risk is the US election. If Donald Trump returns to the Whitehouse we could see some significant tariffs return and that could slow global trade and growth.

Video Length: 00:02:08

More By This Author:

Boeing’s Seasonal Opportunity Amid Financial Struggles: Is This The Dip To Buy?

Rio Tinto Seasonal Surge Aligns With $6 7 Billion Bet On Lithium

Will Crude Oil Recover After Seasonal Weakness And Short Squeeze?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more