Stone Energy: Undervalued, But Watch The Price Of Crude

Stone Energy Corporation (NYSE:SGY) (hereinafter called “SGY” or the “Company”) is an independent exploration and development (E&P) oil and natural gas company with corporate headquarters located in Lafayette, Louisiana. SGY’s line of business is the acquisition and subsequent exploration, development, operation, and production of oil and gas properties located primarily in the Gulf of Mexico (“GOM”).

The company also had significant operations in the Rocky Mountain Basins and the Williston Basin (Rocky Mountain Region). Almost all these Rocky Mountain Region properties were sold to Newfield Exploration Company (NYSE:NFX) on June 29, 2007. The properties SGY maintained in the Rocky Mountain Region include working interests in several undeveloped plays which totaled approximately 96,000 net acres as of February 11, 2008.

Currently, the company’s strategic focus is on the Gulf of Mexico conventional shelf properties. The company is also pursuing exploration opportunities in the deepwater and in the deep shelf of the GOM. During 2007, SGY began securing leasehold interests in Pennsylvania (Appalachia). As of February 11, 2008, the company had secured leasehold interests in approximately 20,000 net acres. Additionally, SGY is also engaged in an exploratory joint venture in Bohai Bay, China.

On August 28, 2008, SGY completed acquisition of Bois d'Arc Energy, Inc., paying approximately $935 million in cash and issuing approximately 11.3 million shares. BDX properties are located in the outer continental shelf of the Gulf of Mexico, with estimated oil and natural gas proved reserves of 398 Bcfe as of December 31, 2007. According to SGY’s December 17 press release with the acquisition of BDX the Company estimates its year end 2008 proved reserves to be slightly under 600 Bcfe, up from 402.6 Bcfe as of December 31, 2007.

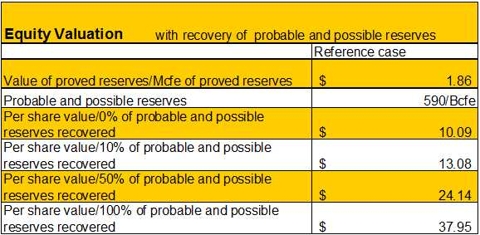

According to the Company’s October 8, 2008 corporate presentation, SGY also has 590 Bcfe of probable and possible reserves. The estimate was provided by Netherland Sewell and Associates as of December 31, 2007 and not available for post BDX acquisition.

SGY is a profitable oil and gas E&P company. For the nine months ended September 30, 2008, the company generated $634.9 million revenues and reported $6.08 earning per basic share. However, due to the severe drop in the price of oil and gas in the fourth quarter 2008 the company might be required to report significant non-cash ceiling test write-down to its full cost pool in its year end 2008 financials. If the size of the write-down would be too large, the company might be reporting a net loss for the year 2008; but even if this be the case we think the company will resume profitability in the first quarter 2009.

SGY has a sound liquidity base. As of September 30, 2008 the company had $172.6 million in cash and cash equivalents and $109.2 million in net working capital. Moreover, SGY has secured a revolving bank credit facility of $700 million maturing on July 1, 2011. However, in early December 2008 the bank group reduced the credit facility to $625 million, leaving $153.9 million of borrowings available under the credit facility as of December 17, 2008.

SGY has low debt leverage. As of September 30, 2008, the company’s total long-term debt was $825 million; which was 20.3% of its total assets.

The company’s common shares trade on the New York Stock Exchange under the symbol SGY. The company does not pay dividends.

Valuation Summary

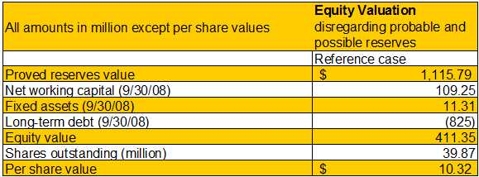

Using our estimate of 12.2% for the weighted average cost of capital of the Company as the discount rate and our projected net cash flows over the life of the Company’s proved reserves, based on EIA ‘s December 17 reference case price projections, we estimated SGY’s , proved reserves, equity, and per share values as per the following table:

The above does not consider the value of the company’s probable and possible reserves. The following table shows our estimates of SGY’s share value under different assumptions regarding recovery of the company’s probable and possible reserves.

Based on the above valuation analysis and the current price of the stock, we think SGY is undervalued. However, we like to emphasize this is not a buy recommendation or rating. If the price of crude oil continues going down further, SGY will also go down further. Investors should decide on an entry point based on their own analysis of the market trends.

Disclaimer: No positions in the stock or relationships with the company by the analysts or Alpha Beta Investment Research LLC.

Any updates on $SGY? The company has faired rather poorly over the last year.