Stocks Will Hit New All Time Highs Before February 1, 2024

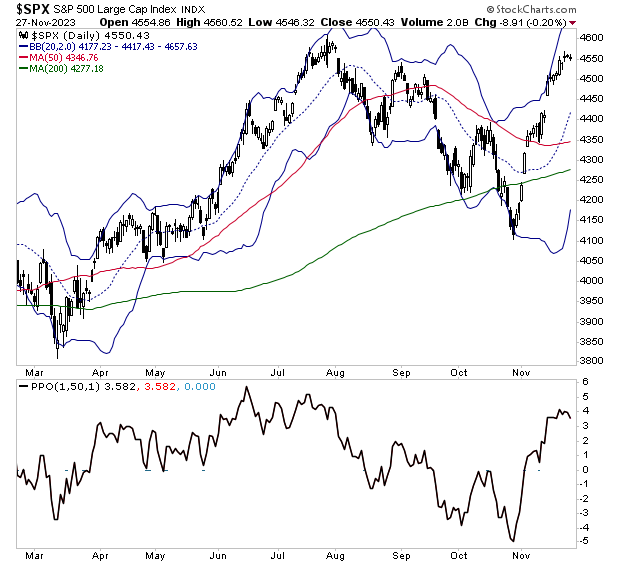

The S&P 500 is consolidating after one of its best monthly performances in the last 30 years.

Thus far in November, the S&P 500 is up 8.5%. If the month ended today, it would be one of the top 10 monthly returns for the S&P 500 in the last 30 years. We rode this rally the entire way up, having told our clients to buy stocks aggressively when the S&P 500 was down at 4,200. Suffice to say, they’re quite happy.

And their #1 question today is: so what’s next for stocks?

The S&P 500 is quite overextended, having rallied to a level that is 4% above its 50-day moving average (DMA). Throughout the last 12 months, an extension of this magnitude above the 50-DMA has marked a temporary top for stocks.

(Click on image to enlarge)

The big question now is if stocks correct… or if they simply consolidate here, thereby allowing the 50-DMA to catch up to price, before the market make its next push higher.

Thus far the market is opting for #2: consolidating.

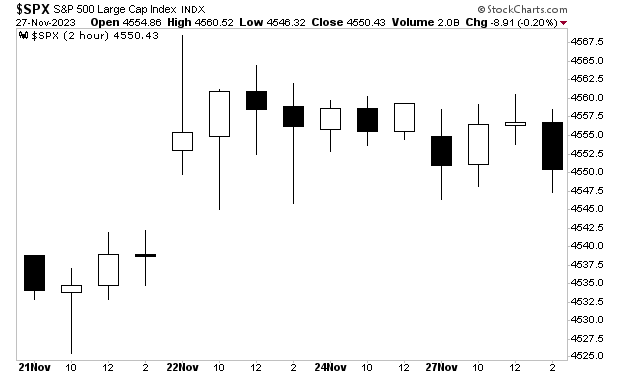

The S&P 500 has traded within a 20 point range since November 22nd. The key issue here as far as I’m concerned is that the bears have failed to push stocks down in any significant way, even though there was very low trading volume due to the Thanksgiving holiday.

(Click on image to enlarge)

Think of it this way… stocks are finalizing one of their most aggressive single month rallies in 30 years, and the bears can’t even generate enough selling pressure to push the S&P 500 down 1%.

This suggests that the next move for stocks will be up once this consolidation is over. And given that the market is less than 5% from its all-time highs, I believe we’ll see the S&P 500 hit NEW all-time highs some time in the first quarter of 2025, likely before February 1st, 2024.

For more market insights and analysis, join our free daily market commentary Gains Pains & Capital. You’ll immediately start receiving our Chief Market Strategist Graham Summers, MBA’s briefings to your inbox every morning before the market’s open.

And if you sign up today, you’ll also receive a special investment report How to Time a Market Bottom that the market set-up that has caught the bottoms after the Tech Crash, Housing Bust, and even the 2020 pandemic lows.

Even more importantly, you’ll find out what this trigger says about the market today!

More By This Author:

Yes, You CAN Time the Market - And I’ll Show You HowEnjoy The Santa Rally… What Comes Afterwards Won’t Be Pretty

Japan’s Currency Hasn’t Traded Here Since The Late 1980s