Stocks Swimming In Red Ink As Earnings, Yields Weigh

The Dow Jones Industrial Average (DJI) is down a brutal 481 points at midday, extending this morning's losses as Goldman Sachs's (GS) dismal earnings report and Microsoft's (MSFT) plans to acquire Activision Blizzard (ATVI) weigh on the blue-chip index. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are swimming in red ink as well, as the 10-year Treasury yield climbs to its highest level since January 2020.

Elsewhere, investors are digesting the news that the Covid-19 omicron variant may have peaked, as New York's seven-day average of daily new cases falls, according to Johns Hopkins University data.

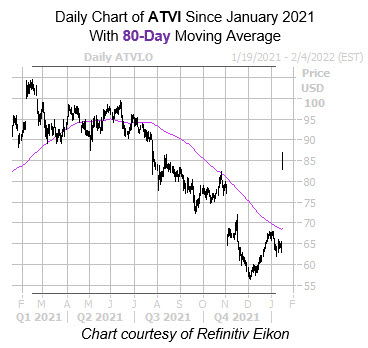

Activision Blizzard, Inc. (Nasdaq: ATVI) is seeing a surge in options activity today after Microsoft (MSFT) said it would acquire the gaming concern in a $68.7 billion cash deal. So far, 184,000 calls and 164,000 puts have exchanged hands, volume that is 29 times what is typically seen at this point. Most popular is the January 82.50 put, followed by the 80-strike put in the same series, with new positions being opened at both. The shares were last seen up 29.9% at $83.63 -- their highest trading level since August. ATVI is clearing long-time overhead pressure at the 80-day moving average, though remains down 8% year-over-year.

Brickell Biotech Inc(Nasdaq: BBI) is one of the best stocks on the Nasdaq today, last seen up 57.8% at 33 cents. Today's bull gap came after H.C. Wainwright initiated coverage with a "buy" rating and $2 price target. The firm said Brickell Biotech's late-stage asset, sofpironium bromide, may soon be submitted for regulatory approval in the U.S. BBI is bouncing off yesterday's all-time low of 20 cents and pacing for its highest close since November, but still sports a 70.9% year-over-year deficit.

Among the worst stocks on the Nasdaq --and there are a lot of them -- is Guardforce AI Co Ltd (Nasdaq: GFAI). GFAI is down 23.5% at $1.24 at last check, after the company priced its $10.3 million private placement at $1.30 per share. Over the last three months, the shares have shed 55.7%.

Disclaimer: Schaeffer's Investment Research ("SIR" or "we" or "us") is not registered as an investment adviser. SIR relies upon the "publishers' ...

more