Stocks Surging As Fed Pauses, But Uncertainty Remains With Monetary Policy Lag

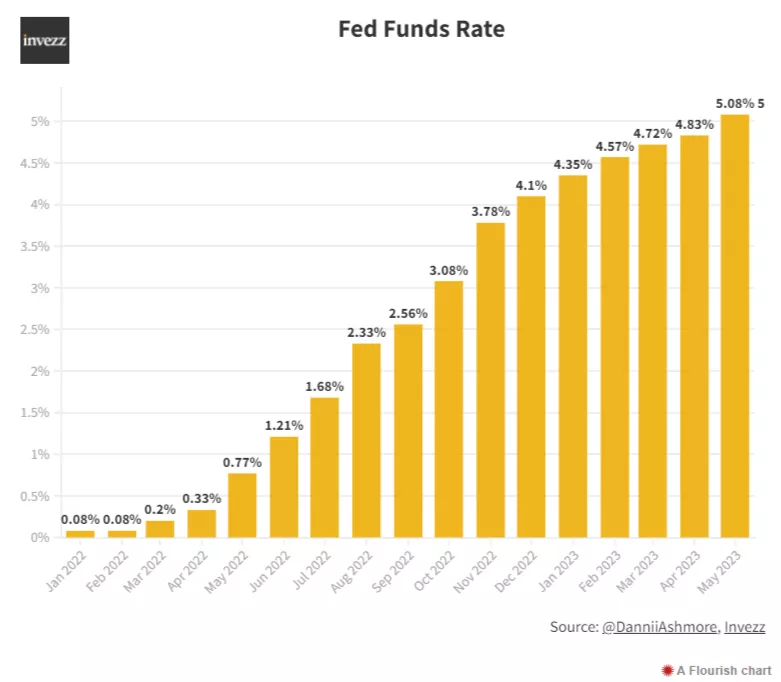

For the first time since March 2022, the Federal Reserve is not hiking interest rates. After ten consecutive rate hikes – a pace which has not been seen since the 1980s – the Fed is pausing. Rates will sit between 5% and 5.25% at least until July 25th, when the next FOMC meeting is scheduled.

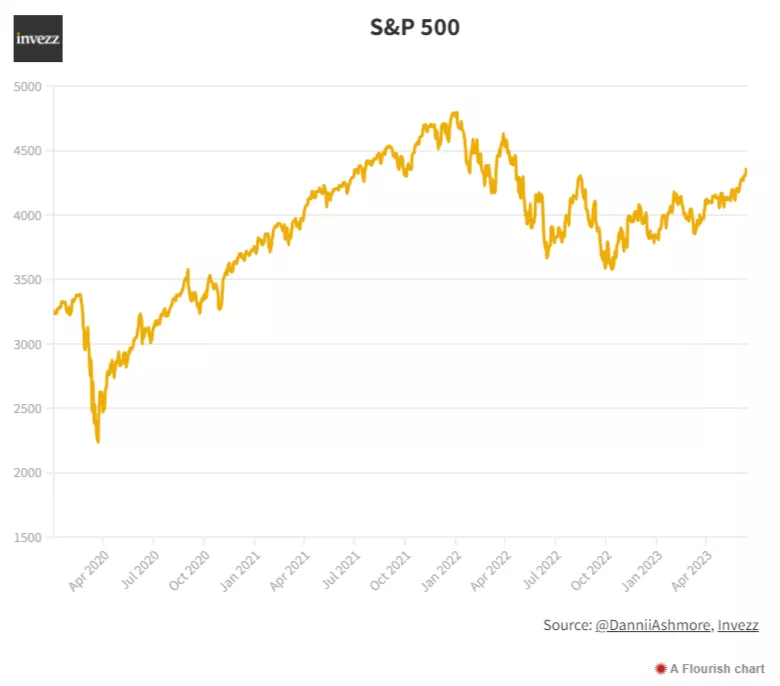

This move was widely anticipated and hence there was minimal movement after the announcement. However, markets have been red hot lately as this pause came to be priced in. The Nasdaq is up 10% in the last month, now up 31% on the year. If that return were annual, it would be the third highest return in 20 years (after 2009, 2020 and 2013).

Will there be a recession?

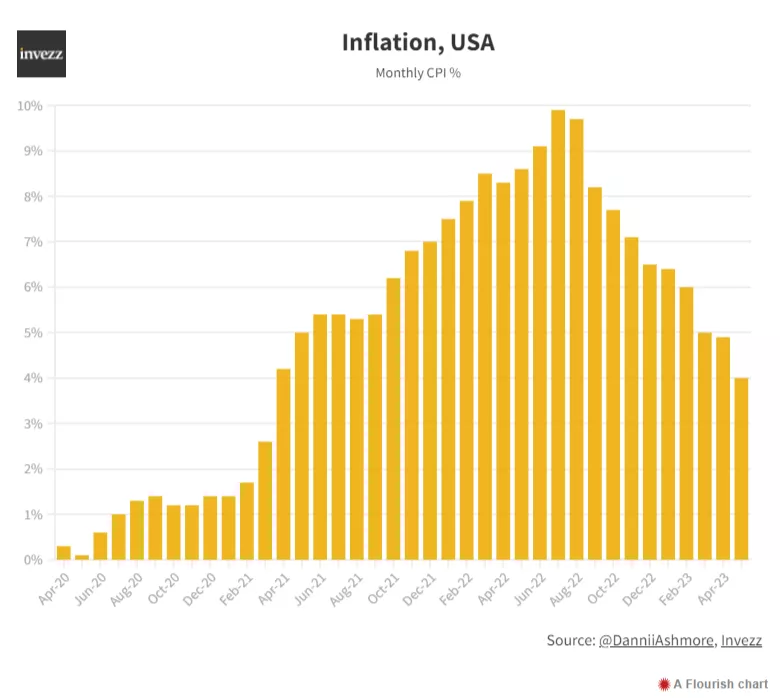

In one sense, this all makes perfect sense. Things looked far more worrisome six months ago, and while uncertainty and concern still abounds, the picture does look far brighter. The economy has thus far avoided a recession (despite one feeling like it has been looming for a year now) and last month’s inflation numbers show a fall to 4%. That is a long way north of 2%, but also far below the near-double digit readings that were coming out last year.

On the flip side, there is reason to be concerned and question the extent of the price rises. Sure, the labour market remains tight and that is a good thing, but is it all good? If the Fed does remain determined to pull inflation down to 2%, there must be at least some give with employment. Last month, unemployment came in at 3.4%, the lowest since 1969. Hmm.

There is also an elephant in the room: the lagged effect of monetary policy. Changes to interest rates take a while to filter through all layers of the economy. As time goes by, all sorts of levers are pulled by the syphoning of liquidity out of the system – more fixed rate mortgages require refinancing, a lower undertaking of new investment projects will become clearer as projects already ongoing finish, etc.

And again, inflation remains elevated compared to the target. The Fed also made it very clear that future interest rate hikes were far from off the agenda.

“Looking ahead, nearly all committee participants view it as likely that some further rate increases will be appropriate this year to bring inflation down to 2% over time”

That is as explicit as it gets, and sums up what can only be viewed as a wait-and-see approach.

“Inflation has moderated somewhat since the middle of last year, nonetheless, inflation pressures continue to run high and the process of getting inflation down to 2% has a long way to go”, Powell added.

Are valuations too high?

Despite these fears, it is hard to say that valuations are too high. Without sitting on the fence too much, this is quite simply a highly unusual macro climate. We have elevated inflation despite one of the fastest rate hiking cycles ever. We have record low unemployment and yet sentiment feels like it is on the floor. And through all this, the S&P 500 is cautiously ticking along, slowly eating back the losses of 2022, when it shed 20% for its worst year since 2008.

Further remarks from Powell sum up the situation well. Nobody really knows, least of all the Fed themselves. It’s a case of pause for now, and see what happens. There is not much precedent for this state of the economy.

“Holding the target range steady at this meeting allows the committee to assess additional information and its implications for monetary policy … In assessing the appropriate stance of monetary policy, the committee will continue to monitor the implications of incoming information for the economic outlook.”

The “soft landing” that so much of the market fantasises about is far from secured. Sentiment remains low and uncertainty high. But it is a hell of a lot more likely now than it was six months ago, and things are looking just a little bit rosier. But again, things can move quickly, and it is economics 101 that monetary policy operates with a lag.

And not only have we had a tight monetary policy, but rates have jumped all the way from zero to north of 5%. That is a massive leap and one that will take its toll. It is far from over yet.

More By This Author:

Should You Buy Gold After The Federal Reserve Decision?

Bitcoin Outlook As Exchange Supply Hits 5-Year Low

AMD Unveils New A.I. Chip To Rival Nvidia