Stocks Stumble As Bond Yields Rise

Another jump in bond yields is weighing on markets midday, with the Dow Jones Industrial Average (DJI) last seen down 97 points, while the S&P 500 Index (SPX) has headed lower as well. Meanwhile, the Nasdaq Composite (IXIC) is eyeing a quiet gain as China-based tech stocks bounce.

The 10-year Treasury yield is on the rise, hovering around 3%, as investors fret over the slowing pace of the economy and the chance of another recession. This fear is undoubtedly being stoked by the Atlanta Federal Reserve's GDPNow tracker, which showed a second-quarter growth rate of just 0.9%, falling from 1.3% last week.

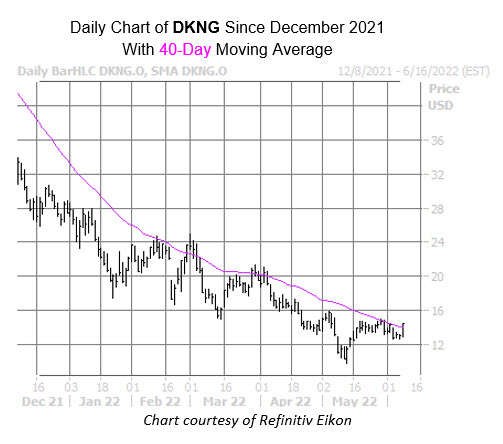

There is an unusual amount of bullish options activity surrounding DraftKings Inc (Nasdaq: DKNG) today, with 46,000 calls across the tape at last check, which is double the intraday average and almost triple the number of puts traded. The weekly 6/10 14.50-strike call is the most popular, followed distantly by the 15-strike call in the same weekly series. Positions are being bought to open at the former. DKNG was last seen up 10.9% to trade at $14.34. Should these gains hold, the security could notch its first close above the 40-day moving average since early April.

Software stock Cyren Ltd (Nasdaq: CYRN) is one of the best performing stocks on the Nasdaq today. The equity was last seen up 27.7% to trade at $2.26, following news that the company has entered into an all-cash deal to sell its legacy Secure Email Gateway unit to Content Services Group GmbH for 10 million euros (or $10.70 million). CYRN still suffers a near 60% year-to-date deficit, though today's pop has it well above recent pressure at the 30-day moving average for the first time in two months.

One of the worst performers on the Nasdaq, on the other hand, is Loyalty Ventures Inc (Nasdaq: LYLT). The equity was last seen down 56.4% to trade at $4.81. The company said earlier during an update from its air miles rewards program that it's re-evaluating its 2022 revenue and EBITDA guidance amid trouble agreeing on extension turns with its sponsor Sobey. LYLT is trading at record lows, and is now down 82% in 2022.