Stocks Struggle For Direction As Choppy Q3 Comes To An End

Markets are having a hard time deciding how to end a dismal week (and month, and quarter) with the Dow Jones Industrial Average (DJI) last seen with a slight gain as it struggles to brush off Nike's (NKE) post-earnings plummet. The S&P 500 Index (SPX) and the Nasdaq Composite (IXIC), meanwhile, are clinging to more substantial gains, as investors continue to digest this morning's hotter-than-expected inflation reading.

It's possible that stocks could see dramatic pullbacks from these midday gains by the close as we've seen over the past few sessions, but regardless, stocks are looking to turn in some serious losses for both September and the third quarter. The Dow is off more than 7% this month, set for its biggest drop since March 2020, while all three indexes are on track to string on a third-straight quarterly drop, marking the longest streak for the S&P 500 and Nasdaq since 2009.

Carvana Co (NYSE: CVNA) is seeing a pop in bearish options activity today, with 8,278 puts exchanged so far, which is double the intraday average, compared to 5,689 calls. The most popular position is the weekly 9/30 21.50-strike call, followed by the October 15 put, with positions being opened at the former. While CVNA is up 2.5% at $22.10 this afternoon, the stock shed over 19% yesterday after the company's competitor CarMax (KMX) shared a drop in vehicle sales during its last quarter. Carvana stock was able to find footing at a familiar floor near the $20 region, however, though it's lost 90% this year.

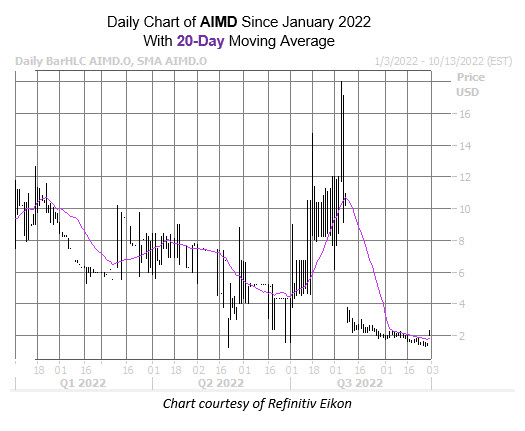

One of the best-performing stocks on the Nasdaq is Ainos (Nasdaq: AIMD). The equity was last seen up 60% at $2.21 after it announced upbeat results from its preclinical trial of its low-dose oral interferon alpha formulation VELDONA in hamsters infected with the Omicron variant SARS-CoV-2. AIMD is no stranger to outsized swings on the charts, as it surged to the $18 level in late-July before immediately gapping lower. The stock still suffers an 83.5% year-to-date deficit, though its set to topple the 20-day moving average for the first time since that bear gap.

Intercept Pharmaceuticals Inc (Nasdaq: ICPT), meanwhile, is sitting near the bottom of the Nasdaq, of 18.2% to trade at $13.42 at the last check. The drug maker said that its liver disease treatment failed to meet the main goal of its phase 3 study. ICPT is trading at two-month lows in response, dropping back below its formerly supportive year-to-date breakeven level as well.

More By This Author:

Dow Drops 458 Points As Stocks Resume Selloff

Dow Deepens Morning Losses With Almost 400-Point Drop

Dow, S&P 500 Snap Losing Streaks As Treasury Yield Retreats