Stocks Struggle For Direction Amid Earnings, Housing Data

Major indexes are quietly sinking this afternoon, as investors weigh disappointing April housing data against an upbeat batch of corporate earnings. Specifically, housing starts fell 9.5% last month, coming in at a seasonally adjusted rate of 1.569 million units -- lower than the 1.7 million units expected by analysts. Meanwhile, both Home Depot (HD) and Walmart (WMT) both posted impressive quarterly earnings reports.

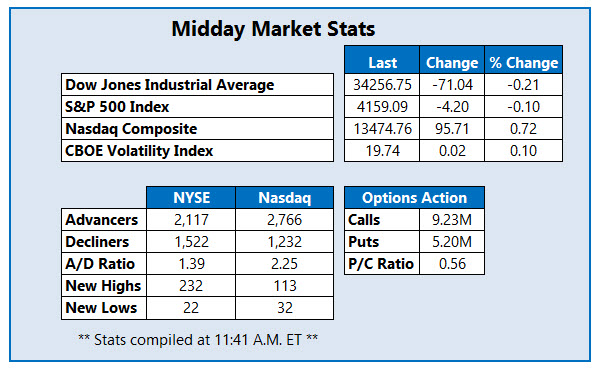

Despite this, the Dow Jones Industrial Average (DJI) erased its earlier gains, and was last seen off 71 points. The S&P 500 Index (SPX) also turned lower, after a morning of clinging to weak gains. The Nasdaq Composite (IXIC), on the other hand, is trading comfortably in the black, as most Big Tech members slowly start to rebound.

Big box retailer Walmart Inc (NYSE: WMT) is seeing a pop in options activity today. The equity is up 1.9% at $141.54 after the firm posted first-quarter earnings and revenue that beat analysts' estimates. Walmart also hiked its full-year profit forecast. So far today, 102,000 calls and 51,000 puts have exchanged hands, five times the intraday average. The most popular contract by far is the May 147 call, followed by the 145 call in the same series, with positions being opened at the former. This suggests these traders are eyeing even more upside for the underlying stock by the time these contracts expire on Friday, May 21.

IQIYI Inc (Nasdaq: IQ) is one of the best performing stocks on the Nasdaq today. The equity was last seen up 10.7% at $14.00, enjoying a bounce after the company's first-quarter losses were narrower than expected and revenue topped analysts' expectations. The China-based tech name just bottomed out at a record low of $12.14 late last week, and though the stock looks to be reversing its course, it will have to square up with its 20-day moving average, which rejected the security's April rally.

One of the worst stocks on the New York Stock Exchange (NYSE) today is Peabody EnergyCorporation (NYSE: BTU). While the reason behind the dip is unclear, Peabody Energy stock was last seen down 17.2% to trade at $7.14, cooling a bit from its impressive surge to an annual high of $8.70, staged during yesterday's trading. Despite today's dip, BTU is still up 201.8% for the year.