Stocks Sink Ahead Of Crucial Inflation Data

Image Source: Unsplash

US equity indices are struggling to make gains this week after another volatile session saw Wall Street go red after a further sell-off in the crypto space sparked some fears of contagion.

Investors also digested the results of tighter-than-expected midterm elections. A “red wave” of Republican victories has failed to materialize with Democrats performing better than anticipated with control of Congress still hanging in the balance. A divided government is actually often seen as positive for stocks as gridlock reduces the chances of passing disruptive new tax increases or regulations.

Hopes that China may ease back on its zero-covid policy had given risk markets a lift to kick off the week. But rising daily infection rates and lockdowns in some parts of the country have seen the indices struggle to maintain any bullish momentum.

Focus now turns to the all-important US inflation release out later today.

US CPI may fall, but is still high

The headline figure is expected to fall further from the summer peak at 9.1% and below the psychological 8% mark, though the monthly number is seen ticking up two-tenths to 0.6%.

Core measures are also forecast to ease a tick to 6.5% y/y and 0.5% m/m. This would be the eleventh time in thirteen months that core CPI has printed gains of 0.5% or more, while the September number of 6.6% was a 40-year high.

Is it clear the data remains elevated compared to historical levels, even as energy and vehicle prices fell in the previous three months.

But the Ukraine conflict and looming winter still present risks related to energy costs into the new year.

The focus will be on the gains around the “stickier” categories like housing and rents which account for over 30% of the CPI basket. Economists reckon these costs are not expected to slow until spring next year.

The hot figures are unlikely to bring much relief to hopes for a Fed pivot with the annualized number still way above the Fed’s 2% headline target.

This will mean policymakers continue on their rate hiking path.

After four successive 75bp rate hikes, it’s just less than a coin toss currently for another jumbo-sized hike according to money markets.

Indices hoping for softer data

A downside surprise would bring the peak Fed funds rate back towards 5% and give stocks a much-needed boost, with the tech sector getting some breathing space after a few torrid months.

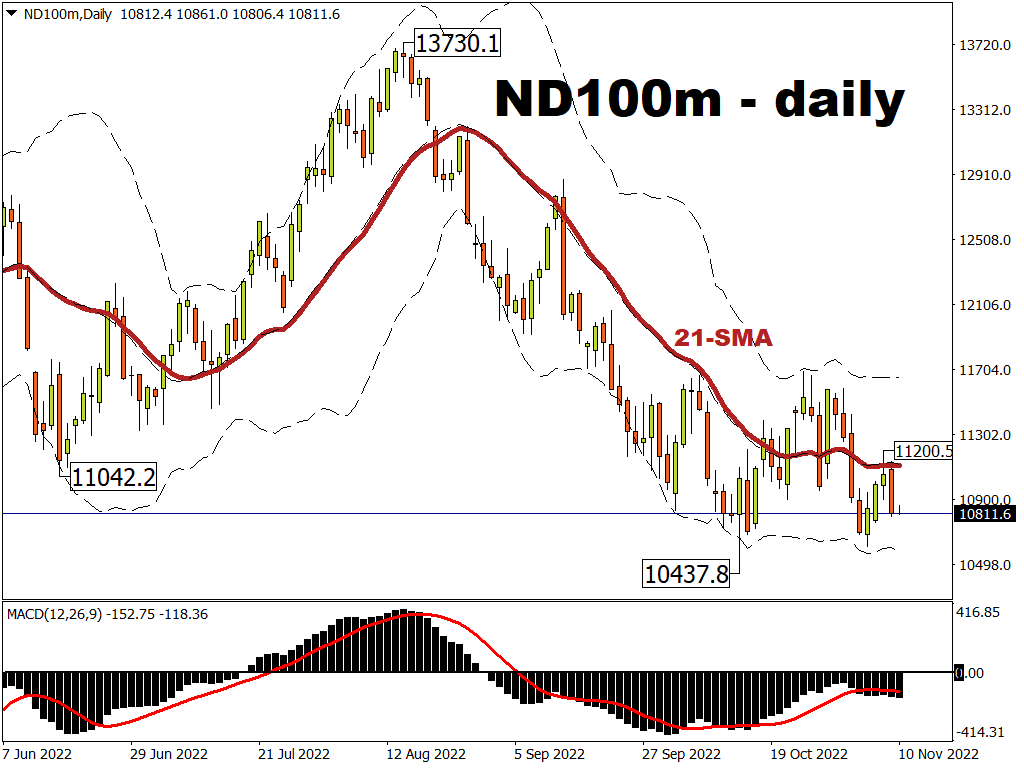

Growth stocks have underperformed value recently, as seen in the divergent performance between the struggling tech-laden Nasdaq and the Dow which has a more old-economy, value-based companies.

The former suffered its biggest decline since late January last week with the mid-June low at 11,042.2 capping upside earlier in the week. The October cycle low is at 10,437.8.

Meanwhile, the Dow pushed above its 200-day simple moving average at 32,478 before the sell-off yesterday saw the index finish just above this widely watched indicator.

More By This Author:

Dollar Subdued After Midterms And Into CPI

FOMC Meeting Looms Over FX Markets

Quiet October For Bitcoin

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more