Stocks Pick Of The Week - Tech Giants' Stocks Resilient Amid Bank Crisis: Is It Time To Invest In Them?

The recent crisis in the banking sector, from SVB to Credit Suisse, has raised concerns and highlighted the need for central banks to be cautious about hiking rates. If the Fed takes a more cautious stance, bond yields may drop further, which could be good news for big tech stocks.

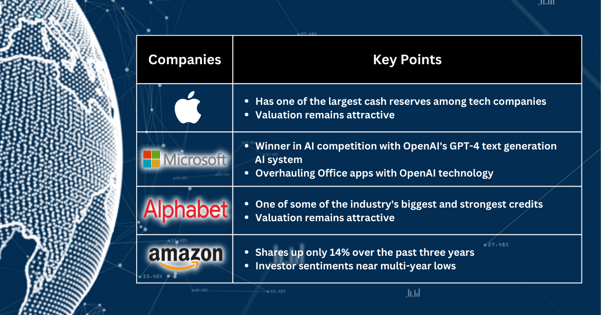

Despite a decline in tech shares from their peaks, they remain extremely resilient, with most issuers having ample cash to fund themselves without requiring significant additional capital. The 12 biggest tech companies have a total cash reserve of almost $700 billion, led by Apple and Alphabet.

Microsoft – A absolute winner in AI competition so far

Microsoft could benefit after ChatGPT maker OpenAI said it has introduced its new GPT-4 text generation AI system.

Its effort to overhaul its entire lineup with OpenAI technology has spread to one of the company’s oldest and best-known products: its Office apps.

The software, including Excel, PowerPoint, Outlook, and Word, will begin using OpenAI’s new GPT-4 artificial intelligence platform, Microsoft said on Thursday. AI-powered assistants called Copilots will be able to generate whole documents, emails, and slide decks from knowledge the software has gained scanning corporate files and listening to conference calls. The technology will debut in the coming months, and Microsoft is already testing it with some companies.

Apple, Alphabet’s valuation attractive

The vast majority of technology stocks’ valuation remains attractive, even after bouncing sharply off their lows, with Apple, Microsoft, and Alphabet among some of the industry's biggest and strongest credits on that list.

As fundamentals get worse before they get better and begin to trough in 2023, the safer-haven traits of technology debt, including cash-rich balance sheets and limited rating risk, may lead to improved excess returns vs. broader index peers for the remainder of the year, even as recessionary fears persist.

Amazon lags behind its peers, time to catch up?

Amazon shares are up only 14% over the past 3 years vs. the SPX up 63%, and we continue to believe investor sentiment on Amazon is near multi-year lows.

More By This Author:

US Regulators Step In To Save Banks: Here's How It Affects Stocks And Gold

Stocks Pick Of The Week - AI Stocks Show Strong Growth Potential In Early Stages Of Development

Market Turmoil Continues As Key Buying Signal Remains Elusive

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more